Embarking on the journey of understanding your financial health begins with a crucial step: obtaining your annual credit report. This document is more than just a collection of numbers; it’s a comprehensive snapshot of your credit history, a vital tool for navigating the world of loans, credit cards, and even certain rental applications. Knowing how to access and interpret this report empowers you to make informed financial decisions and safeguard your financial future.

Your annual credit report is compiled by the three major credit bureaus in the United States: Equifax, Experian, and TransUnion. It details your borrowing history, including credit accounts, payment history, outstanding debts, and any public records or inquiries related to your credit. Regularly reviewing this report is not just a good practice; it’s an essential habit for identifying potential errors, monitoring for identity theft, and understanding the factors that influence your creditworthiness.

Understanding Your Annual Credit Report

Your annual credit report is a comprehensive document that serves as a detailed record of your credit history. It is essential for understanding your financial standing and ensuring its accuracy. By reviewing this report, you can identify any errors that might negatively impact your ability to obtain credit, such as loans or credit cards, and protect yourself from potential identity theft.This report is compiled by major credit bureaus and contains vital information about how you manage credit.

Understanding its contents is the first step towards effectively managing your credit health and achieving your financial goals.

Purpose and Importance of an Annual Credit Report

The fundamental purpose of your annual credit report is to provide lenders with a clear picture of your creditworthiness. When you apply for credit, lenders use this report, along with your credit score, to assess the risk associated with lending you money. A well-maintained credit history, reflected in an accurate report, can lead to better interest rates and more favorable loan terms.

Conversely, inaccuracies or negative information can hinder your access to credit or result in higher costs. Regularly reviewing your report is crucial for maintaining financial health and security.

Information Found Within an Annual Credit Report

Your annual credit report is a detailed compilation of your credit activities. It typically includes several key sections, each providing specific insights into your financial behavior. Understanding these sections allows you to interpret the information accurately and identify any discrepancies.The primary categories of information found in your credit report are:

- Personal Information: This section contains your identifying details, such as your name, current and previous addresses, Social Security number, and employment history. It’s important to ensure this information is accurate to prevent identity theft.

- Credit Accounts: This is the core of your report, detailing all your credit accounts, including credit cards, mortgages, auto loans, and student loans. For each account, you’ll find information about the lender, account number, date opened, credit limit or loan amount, current balance, and payment history.

- Public Records: This section includes information from public sources, such as bankruptcies, liens, and judgments. These items can significantly impact your creditworthiness.

- Credit Inquiries: This part lists who has requested access to your credit report. “Hard inquiries,” which occur when you apply for new credit, can slightly lower your credit score. “Soft inquiries,” such as those for background checks or when you check your own credit, do not affect your score.

Key Credit Bureaus in the United States

In the United States, three major credit bureaus are responsible for compiling and maintaining consumer credit reports. These organizations collect data from lenders and other sources to create the reports that lenders use to assess credit risk.The three primary credit bureaus are:

- Equifax: One of the largest consumer credit reporting agencies, providing credit information and analytics.

- Experian: A global information services company that provides data and analytical tools to help clients manage credit risk.

- TransUnion: Another leading global information and risk management services company.

Each of these bureaus may have slightly different information in your report, as they receive data from various sources. Therefore, it is recommended to review your report from all three.

Benefits of Regularly Reviewing Your Credit Report

Regularly reviewing your credit report is a proactive and beneficial practice for maintaining your financial well-being. It empowers you to take control of your credit history and detect potential issues before they escalate.The advantages of this regular review include:

- Detecting Errors: Credit reports can contain mistakes, such as incorrect balances, wrongly reported late payments, or accounts that do not belong to you. Identifying and correcting these errors promptly is crucial, as they can unfairly lower your credit score and affect your ability to secure credit.

- Preventing Identity Theft: An unauthorized account or unfamiliar inquiry on your report could be a sign of identity theft. Early detection allows you to take immediate action to secure your identity and finances.

- Monitoring Credit Health: Understanding the information on your report helps you gauge your creditworthiness. You can see how your payment history, credit utilization, and other factors are influencing your credit profile, enabling you to make informed decisions to improve it.

- Ensuring Accuracy for Loan Applications: When you apply for a mortgage, car loan, or credit card, lenders rely on the accuracy of your credit report. A clean and accurate report increases your chances of approval and can lead to better interest rates, saving you money over time.

By making it a habit to review your credit report at least once a year, you are taking a significant step towards safeguarding your financial future and achieving your financial objectives.

Eligibility and Frequency for Obtaining Your Report

Understanding your eligibility and the frequency with which you can obtain your annual credit report is crucial for proactive financial management. Federal law ensures that all consumers have a right to access their credit information regularly, allowing them to monitor their financial health and identify any inaccuracies. This entitlement is a cornerstone of consumer protection in the United States.The Fair Credit Reporting Act (FCRA) is the primary legislation that governs access to credit reports.

This act was established to promote the accuracy, fairness, and privacy of consumer information collected by credit reporting agencies. It provides consumers with specific rights, including the right to a free annual credit report from each of the major credit reporting agencies.

Legal Entitlement to a Free Annual Credit Report

The FCRA mandates that consumers are legally entitled to receive one free copy of their credit report from each of the three nationwide credit reporting agencies (Equifax, Experian, and TransUnion) every twelve months. This right is designed to empower individuals to review their credit history and ensure its accuracy without incurring any cost.

Mandating Regulations for Free Reports

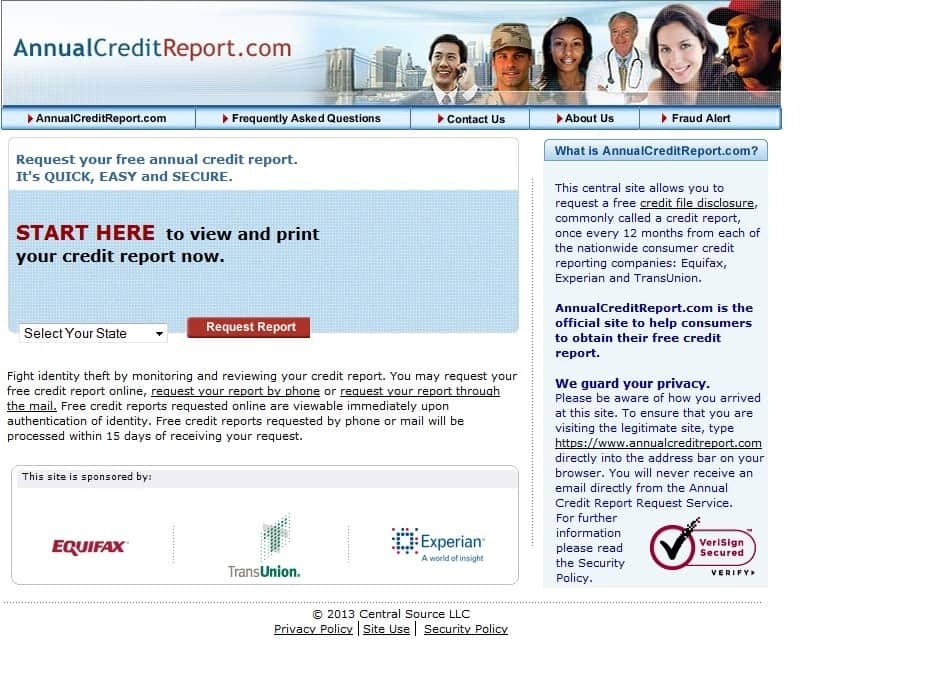

The availability of free annual credit reports is specifically mandated by the Credit Reporting Responsibility Act of 2003, which amended the FCRA. This act established the centralized online portal, AnnualCreditReport.com, as the sole, authorized source for consumers to request their free annual credit reports. This website was created to simplify the process and ensure consumers receive their reports directly from the reporting agencies.

Circumstances for More Frequent Report Access

While the general entitlement is for one free report per year from each agency, there are specific circumstances that allow for more frequent access without charge. These situations are designed to address potential issues or changes in your credit profile that warrant closer monitoring.

- Identity Theft or Fraud: If you have been a victim of identity theft or suspect fraudulent activity on your credit accounts, you are entitled to additional free reports. This allows you to monitor your credit for any unauthorized accounts or inquiries.

- Adverse Action: If you have been denied credit, insurance, employment, or housing based on information in your credit report, you have the right to receive a free copy of your report within 60 days of receiving the adverse action notice. This enables you to review the information that led to the decision.

- Unemployment: If you are unemployed and intend to seek employment within 60 days, you are eligible for an additional free report.

- Public Assistance: Individuals receiving public assistance are also entitled to an additional free report.

- Dispute Resolution: If you are disputing information on your credit report with a credit reporting agency, you may be granted access to your report to review the contested items.

The “12-Month Rule” for Free Report Acquisition

The “12-month rule” refers to the standard frequency at which you can request a free credit report from each of the three major credit bureaus. This means that after you have obtained your free report from Equifax, for instance, you must wait a full twelve months before you are entitled to another free report from Equifax. This rule applies independently to each of the three credit reporting agencies.

“Consumers are entitled to one free credit report annually from each of the three nationwide credit reporting companies.”

It is important to note that you can request your reports at different times throughout the year. For example, you could request your Equifax report in January, your Experian report in July, and your TransUnion report in December, thereby accessing your credit information more frequently than once a year from a single source. However, you still must adhere to the 12-month waiting period from each specific agency before receiving another free report from that same agency.

Primary Methods for Requesting Your Free Annual Report

Understanding how to access your free annual credit report is crucial for maintaining financial health. Fortunately, there are several convenient and official avenues available to you. These methods are designed to be straightforward, ensuring that obtaining your report is an accessible process for everyone.The three primary methods for requesting your free annual credit report are through the official online portal, by telephone, and via postal mail.

Each method requires specific information and has its own procedural steps.

Requesting Your Report via the Official Online Portal

The most efficient and widely used method for obtaining your free annual credit report is through the official website authorized by the federal government. This portal provides a secure and user-friendly interface for requesting your reports from all three major credit bureaus simultaneously.The official online portal is AnnualCreditReport.com . This website is the sole federally authorized source for consumers to access their free annual credit reports.

It is important to use this specific URL to avoid fraudulent websites.The process typically involves the following steps:

- Visiting the official website: Navigate to AnnualCreditReport.com.

- Verification of identity: You will be asked to provide personal information to verify your identity. This may include your name, address, date of birth, and Social Security number.

- Selection of credit bureaus: You can choose to receive your report from one, two, or all three of the major credit bureaus: Equifax, Experian, and TransUnion.

- Review and download: Once your identity is verified and your request is processed, you will be able to view and download your credit reports.

The essential information required for this method includes:

- Full legal name

- Current address

- Previous addresses (if you have moved in the last two years)

- Date of birth

- Social Security number

- Email address (optional, but recommended for communication)

Navigating the AnnualCreditReport.com Portal

AnnualCreditReport.com serves as the official, government-mandated channel for obtaining your free annual credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Navigating this portal is a straightforward process designed to be user-friendly. This section will guide you through the steps of creating an account, verifying your identity, selecting your desired credit reports, and addressing any potential issues you might encounter.The online portal streamlines the request process, offering convenience and immediate access to your credit information.

By following these steps, you can efficiently secure your reports and begin the important task of reviewing them.

Creating an Account on AnnualCreditReport.com

To access your credit reports online, you will first need to establish an account on the AnnualCreditReport.com website. This account creation process is designed to protect your personal information and ensure that only you can access your credit data.The steps to create an account are as follows:

- Visit the official website at www.annualcreditreport.com.

- Locate and click on the “Request Your Reports” button, which is typically prominently displayed on the homepage.

- You will be prompted to choose between requesting your reports online or by mail. Select the “Online” option.

- Begin by entering your personal information, including your full name, address, date of birth, and Social Security number. This information is crucial for verifying your identity.

- You will then be asked to create a username and password for your account. Choose a strong, unique password that you can remember.

- You may also be asked to set up security questions to aid in account recovery if you forget your password.

- Review all the information you have entered for accuracy before proceeding.

Verifying Your Identity During the Online Request Process

Identity verification is a critical step in the online credit report request process. This measure is in place to prevent identity theft and to ensure that your sensitive financial information is protected. AnnualCreditReport.com utilizes several methods to confirm that you are indeed the person requesting the report.During the online request, you will typically be asked a series of questions based on your credit history.

These questions are designed to be challenging for someone who does not have access to your personal credit information. Examples of these questions might include:

- Previous addresses you have lived at.

- Names of past creditors or lenders.

- Details about past loan or credit account types.

- Information related to your credit history that is not publicly available.

It is important to answer these questions accurately and to the best of your ability. If you are unable to answer a sufficient number of questions correctly, you may be directed to an alternative verification method, such as requesting your reports by mail or phone, or you may be asked to provide additional documentation.

Selecting Which Credit Bureau’s Report You Wish to Receive

Once your identity has been successfully verified, you will be presented with the option to choose which credit bureau’s report(s) you would like to obtain. While you are entitled to one free report from each of the three major credit bureaus every 12 months, you can choose to request them all at once or stagger your requests throughout the year.You will typically see a list of the three credit bureaus:

- Equifax

- Experian

- TransUnion

You can select one, two, or all three reports. Many individuals opt to request all three reports simultaneously to get a comprehensive overview of their credit standing. Alternatively, some prefer to request reports from different bureaus at different times of the year to monitor their credit more frequently.

Addressing Issues During the Online Request

Encountering issues during the online request process for your annual credit report is not uncommon. The portal is designed to be robust, but various factors can sometimes lead to difficulties. Fortunately, AnnualCreditReport.com provides alternative methods and support to help you resolve these problems.If you face challenges, consider the following steps:

- Technical Glitches: If the website is not loading correctly or you are experiencing error messages, try refreshing the page or clearing your browser’s cache and cookies. Sometimes, a simple restart of your browser or device can resolve temporary technical issues.

- Identity Verification Failures: If you are unable to verify your identity through the online questions, it is likely due to discrepancies in the information held by the credit bureaus or because the questions are based on information that is not readily available in your credit file. In such cases, the portal will usually direct you to an alternative method.

- Alternative Request Methods: If the online process proves too difficult, AnnualCreditReport.com offers other ways to request your reports. You can typically choose to request your reports by phone or by mail. The website will provide instructions and necessary forms for these methods.

- Contacting Customer Support: For persistent issues or if you require further assistance, look for a “Contact Us” or “Help” section on the AnnualCreditReport.com website. This will usually provide a phone number or email address for customer support. They can help troubleshoot specific problems or guide you through the process.

It is important to remain patient and persistent if you encounter any difficulties. The ability to access your credit reports is a fundamental right, and the system is designed to accommodate various circumstances.

Alternative Avenues for Report Acquisition

:max_bytes(150000):strip_icc()/ScreenShot2022-04-08at11.16.03AM-50d04fcd9fb140f8aefddf62be832730.png)

While AnnualCreditReport.com is the designated portal for your free annual credit reports, understanding alternative methods can provide flexibility and additional insights. These options may involve direct interactions with the credit bureaus or utilizing third-party services, each with its own set of advantages and considerations.

Direct Acquisition from Major Credit Bureaus

The three major credit bureaus – Equifax, Experian, and TransUnion – are the custodians of your credit information. While they facilitate access through AnnualCreditReport.com, they also offer direct channels for obtaining your credit reports. It is important to note that accessing your report directly from a bureau outside of the federally mandated free annual report may incur a fee. These direct requests are typically for specific, immediate needs rather than the annual review.

- Equifax: Equifax provides options to purchase credit reports and scores directly from their website. While they comply with the Fair Credit Reporting Act (FCRA) requirements for free annual reports via AnnualCreditReport.com, additional reports or services purchased directly may have associated costs.

- Experian: Similar to Equifax, Experian allows consumers to buy credit reports and scores. They also offer various credit monitoring services that include report access. Be mindful of any subscription terms and conditions when opting for these services.

- TransUnion: TransUnion also offers direct purchase of credit reports and scores. It is crucial to differentiate between a free annual report obtained through the official channel and reports purchased directly, which will likely have a price.

The primary condition for direct acquisition is usually a fee, which can vary depending on the bureau and the specific product or service chosen. Some bureaus may offer bundled packages that include credit reports, scores, and monitoring tools.

Credit Monitoring Services with Report Access

Numerous third-party services specialize in credit monitoring, and many of these include access to your credit reports as part of their offerings. These services aim to provide a more proactive approach to managing your credit health by alerting you to changes and offering tools for analysis.

- Service Offerings: Credit monitoring services often provide regular updates on your credit report, alerts for new accounts, inquiries, or changes in credit utilization. Some services may offer access to one or more of your credit reports on a recurring basis (e.g., monthly or quarterly) in addition to the annual report.

- Cost and Subscription Models: These services typically operate on a subscription basis, with monthly or annual fees. The cost can range significantly depending on the provider and the level of features offered. It is essential to review the subscription details carefully, including trial periods and cancellation policies.

Comparison of Third-Party Services vs. Official Portal

Choosing between third-party services and the official AnnualCreditReport.com portal involves weighing different benefits and drawbacks. The official portal is designed for a straightforward, no-cost annual review, whereas third-party services offer ongoing management and potentially more detailed insights.

Benefits of Third-Party Services:

- Proactive Monitoring: Real-time alerts for significant credit changes.

- Convenience: Consolidated view of credit information from multiple sources.

- Additional Tools: May include credit score simulators, identity theft protection, and dispute assistance.

- Regular Report Access: Some services provide more frequent access to credit reports than the annual entitlement.

Drawbacks of Third-Party Services:

- Cost: Most services require a subscription fee.

- Potential for Upselling: Services may push additional products or insurance.

- Information Overload: The volume of alerts and data can be overwhelming for some users.

- Data Accuracy: While generally reliable, occasional discrepancies can occur, requiring verification.

Benefits of the Official Portal (AnnualCreditReport.com):

- Free: Provides one free credit report from each of the three major bureaus annually.

- Direct from Source: Reports are directly from Equifax, Experian, and TransUnion, ensuring accuracy.

- Unbiased: No marketing or upselling of additional services.

Drawbacks of the Official Portal:

- Limited Frequency: Access is typically limited to one free report per bureau per year.

- No Real-Time Monitoring: Does not provide ongoing alerts for credit changes.

- Basic Information: Focuses on providing the report itself, without extensive analytical tools.

Potential Pitfalls with Unofficial Sources

When seeking credit reports, it is paramount to exercise caution and avoid unofficial or misleading sources. These can lead to financial loss, identity theft, or the acquisition of inaccurate information.

- Phishing Scams: Malicious websites may mimic legitimate credit reporting agencies to trick individuals into revealing personal information, such as Social Security numbers, dates of birth, and financial account details. These scams are often designed to look very similar to official sites.

- Misleading “Free” Offers: Some services may advertise “free” credit reports but require a credit card for “verification” or enroll you in a costly subscription without clear disclosure. The free annual reports are mandated by law and should not require payment.

- Outdated or Inaccurate Information: Unofficial sources might not have access to the most current or complete credit data, leading to an incomplete or erroneous understanding of your credit standing.

- Data Security Risks: Websites that are not secure or reputable may not adequately protect your sensitive personal and financial information, making it vulnerable to breaches.

- Unauthorized Charges: Signing up for services that are not transparent about their pricing can result in unexpected and recurring charges on your credit card or bank statements.

It is always best practice to rely on AnnualCreditReport.com for your free annual credit reports and to be highly skeptical of any other source that claims to offer them for free or through dubious means. If you choose to use a third-party service for ongoing monitoring, ensure it is a reputable provider with clear terms and conditions.

Understanding and Interpreting Your Report

Your annual credit report is a comprehensive document detailing your credit history. Understanding its various sections is crucial for managing your finances effectively and ensuring the accuracy of the information presented. This section will guide you through reading and interpreting your report, highlighting key elements and how to identify potential discrepancies.The credit report is divided into several distinct sections, each providing specific information about your creditworthiness.

Familiarizing yourself with these components will empower you to make informed decisions and take proactive steps towards a healthier financial future.

Key Sections of Your Credit Report

Your credit report is structured into several primary sections, each serving a specific purpose in painting a complete picture of your credit behavior. Understanding what each section contains is the first step toward effective interpretation.

- Personal Information: This section includes your name, address, Social Security number, date of birth, and employment information. It’s vital to ensure this data is accurate, as errors here can sometimes lead to identity theft issues or affect your ability to obtain credit.

- Credit Accounts: This is arguably the most significant section. It lists all the credit accounts you have opened, including credit cards, loans (mortgage, auto, student), and other lines of credit. For each account, you’ll find details such as the creditor’s name, account number (often partially masked), the date the account was opened, the credit limit or loan amount, the current balance, and your payment history.

- Payment History: A detailed record of how you have paid your accounts. This includes information on whether payments were made on time, late payments (and how late they were), and any accounts that have been charged off or sent to collections. This is a primary factor influencing your credit score.

- Inquiries: This section lists all parties who have recently requested access to your credit report. There are two types of inquiries: “hard inquiries,” which occur when you apply for new credit, and “soft inquiries,” which happen when you check your own credit or when a company reviews your credit for promotional offers. Hard inquiries can slightly lower your credit score, while soft inquiries do not.

- Public Records: This section may include information such as bankruptcies, liens, judgments, and collections. These are serious negative marks on your credit report and can significantly impact your credit score.

Common Elements and Their Significance

Each piece of information within your credit report contributes to the overall assessment of your credit risk. Understanding the significance of these common elements is key to interpreting the report accurately.

Account Information

This subsection details your credit accounts, providing a snapshot of your credit utilization and management.

- Creditor Name: Identifies the lender or company that extended you credit.

- Account Type: Specifies the kind of credit, such as revolving credit (credit cards) or installment loan (mortgage, auto loan).

- Date Opened: Indicates how long you have had the account, which can reflect your experience with credit.

- Credit Limit/Loan Amount: The maximum amount you can borrow on a credit card or the original amount of a loan.

- Current Balance: The amount you currently owe on the account.

- Payment History: A month-by-month record of your payment behavior for that specific account, noting on-time payments, late payments (e.g., 30, 60, 90 days late), and any special conditions like defaults or collections.

Inquiries

The inquiries section provides a timeline of who has accessed your credit report.

- Date of Inquiry: When your credit report was accessed.

- Company Name: The entity that requested the report.

- Type of Inquiry: Differentiates between hard inquiries (resulting from credit applications) and soft inquiries (for checks not related to new credit applications). A high number of hard inquiries in a short period can signal to lenders that you may be taking on a lot of new debt, potentially increasing risk.

Public Records

This section contains significant negative information that can have a lasting impact on your creditworthiness.

- Bankruptcies: Details of Chapter 7, 11, or 13 bankruptcies, including the date filed and discharge date.

- Liens: Claims placed on your property by creditors, such as tax liens or judgment liens.

- Judgments: Court orders that require you to pay a debt.

- Collections: Accounts that have been turned over to a collection agency due to non-payment.

Identifying Potential Errors or Inaccuracies

Errors on your credit report can negatively impact your credit score and your ability to obtain credit. A thorough review is essential.To identify potential errors, systematically examine each section of your report. Pay close attention to:

- Personal Information: Verify your name, address, Social Security number, and date of birth are correct. Incorrect information can lead to mixed files.

- Account Information: Check that all listed accounts are yours and that the balances, credit limits, and dates opened are accurate. Ensure there are no duplicate accounts listed.

- Payment History: Confirm that your payment history accurately reflects your on-time payments. Look for any reported late payments that did not occur or are reported incorrectly (e.g., a 30-day late payment mistakenly reported as 60 days).

- Inquiries: Review the list of inquiries to ensure you recognize each hard inquiry. An inquiry from a company you did not apply for credit with could indicate identity theft.

- Public Records: Verify the accuracy of any public records listed. For instance, ensure a debt reported in collections has indeed been resolved or is not yours.

If you discover an error, it is important to dispute it with the credit bureau that provided the report and with the furnisher of the information (the creditor or collection agency).

Understanding Credit Scores in Relation to Your Report

Your credit score is a three-digit number that summarizes the information in your credit report. It is used by lenders to assess your credit risk. While your credit report provides the raw data, your credit score distills this data into a single, predictive number.Credit scoring models, such as FICO and VantageScore, analyze various aspects of your credit report to generate a score.

The most influential factors typically include:

- Payment History (approximately 35% of score): As mentioned, this is the most critical component. Consistent on-time payments are paramount.

- Amounts Owed (approximately 30% of score): This refers to your credit utilization ratio – the amount of credit you are using compared to your total available credit. Keeping this ratio low (ideally below 30%) is beneficial.

- Length of Credit History (approximately 15% of score): A longer credit history generally has a positive impact.

- Credit Mix (approximately 10% of score): Having a mix of different types of credit (e.g., credit cards, installment loans) can be favorable, demonstrating responsible management of various credit forms.

- New Credit (approximately 10% of score): Opening many new accounts in a short period can negatively affect your score.

Understanding how these elements from your credit report translate into your credit score allows you to prioritize actions that will have the most significant positive impact. For instance, focusing on paying down credit card balances will directly improve your “Amounts Owed” category and likely boost your score. Conversely, disputing and correcting errors on your report can remove negative information that is unfairly lowering your score.

Taking Action on Report Findings

Having obtained and understood your annual credit report, the next crucial step is to take proactive measures based on the information you’ve gathered. This section will guide you through the process of addressing any inaccuracies, managing negative but accurate information, and developing a strategic plan to enhance your creditworthiness.

Disputing Errors on Your Credit Report

It is your right to dispute any information on your credit report that you believe is inaccurate or incomplete. The process involves contacting the credit bureaus directly and providing evidence to support your claim. Each of the three major credit bureaus – Equifax, Experian, and TransUnion – has established procedures for handling disputes.The primary methods for initiating a dispute are typically online, by mail, or sometimes by phone.

When disputing, it is essential to be clear and concise about the specific information you are challenging and why. You will need to provide supporting documentation, which could include copies of bills, statements, identification, or any other relevant records that demonstrate the error.

Procedure for Disputing an Error

To effectively dispute an error, follow these steps:

- Identify the specific inaccurate information on your report. This could be an incorrect account balance, a late payment that was actually on time, an account that does not belong to you, or an incorrect personal detail.

- Gather all supporting documentation. This might include payment receipts, canceled checks, correspondence with creditors, or proof of identity.

- Determine which credit bureau(s) are reporting the error. You may need to dispute the same error with more than one bureau if it appears on multiple reports.

- Initiate the dispute with the relevant credit bureau(s). This is usually done through their official websites, by mail, or by calling their customer service.

- Clearly state the disputed item and the reason for the dispute. Provide copies (never originals) of your supporting documents.

- Keep a record of all correspondence, including dates, names of representatives you speak with, and copies of letters sent.

Timeline for Resolving Credit Report Disputes

The Fair Credit Reporting Act (FCRA) mandates that credit bureaus investigate disputes within a reasonable period, generally within 30 days of receiving your request. This period can be extended to 45 days if you provide additional information after the initial 30-day period. During this time, the credit bureau will contact the furnisher of the information (e.g., the creditor) to verify the accuracy of the disputed item.

Once the investigation is complete, the credit bureau must inform you of the results and, if an error is found, correct your report.

“The credit bureaus have a legal obligation to investigate your disputes thoroughly and in a timely manner.”

Addressing Accurate Negative Information

While disputing errors is important, it’s equally vital to address negative information that is factually correct. This information, such as late payments, high credit utilization, or collection accounts, can significantly impact your credit score. The strategy here is not to remove the information prematurely but to mitigate its ongoing impact and to build positive credit history.

Actionable Steps for Accurate Negative Information

To effectively manage accurate negative information, consider the following:

- Pay down high credit card balances: Aim to keep your credit utilization ratio below 30% for each card and overall. High utilization signals to lenders that you are using a large portion of your available credit, which can be seen as a risk.

- Catch up on past-due accounts: If you have accounts that are currently delinquent, make arrangements to bring them current as soon as possible. The longer an account remains past due, the more it will negatively affect your score.

- Settle or pay off collection accounts: While settled accounts may still appear on your report, paying them off or settling them can prevent further negative reporting and demonstrate responsibility. Consider negotiating a “pay for delete” agreement with the collection agency, though this is not always successful.

- Be patient: Negative information typically remains on your credit report for seven years, with the exception of bankruptcies, which can stay for up to 10 years. Focus on building positive credit history, which will gradually outweigh the impact of older negative items.

Utilizing Report Information for Credit Improvement

Your annual credit report is a roadmap to your financial health. By carefully analyzing its contents, you can identify areas for improvement and create a personalized plan to enhance your creditworthiness. This proactive approach can lead to better interest rates on loans, easier approval for credit, and greater financial flexibility.

Developing a Credit Improvement Plan

To leverage your credit report for positive change, follow these steps:

- Set Clear Financial Goals: Define what you want to achieve. This could be saving for a down payment on a house, buying a new car, or simply reducing your overall debt. Having specific goals will motivate your efforts.

- Prioritize Debt Reduction: Based on your report, identify which debts are costing you the most in interest. Consider using debt reduction strategies like the debt snowball or debt avalanche method.

- Build Positive Payment History: The most significant factor in your credit score is your payment history. Ensure all your bills are paid on time, every time. Consider setting up automatic payments or reminders.

- Manage Credit Utilization: Actively work to lower your credit utilization ratios on all credit cards. If necessary, consider requesting a credit limit increase on existing cards, provided you don’t increase your spending.

- Regularly Monitor Your Progress: Obtain your credit report annually, as mandated, and also consider using free credit monitoring services offered by many financial institutions. This allows you to track your improvements and catch any new issues promptly.

- Seek Professional Advice (If Needed): If you are struggling with debt or managing your credit, consider consulting with a non-profit credit counseling agency. They can offer personalized guidance and help you create a sustainable financial plan.

By diligently reviewing your credit report and taking informed action, you can effectively manage inaccuracies, address negative marks, and systematically build a stronger credit profile for a more secure financial future.

Visualizing Credit Report Components

Understanding the visual layout of your credit report is key to efficiently navigating and interpreting the information it contains. A well-structured report makes it easier to identify critical details and understand your credit standing. This section will guide you through the typical presentation of a credit report, from its overall design to the specific ways different data elements are displayed.A credit report is essentially a detailed ledger of your credit history, compiled by the major credit bureaus.

While the exact formatting may vary slightly between bureaus, the core sections and the information they present remain consistent. Familiarizing yourself with this structure will empower you to quickly locate the data that matters most to your financial health.

Typical Credit Report Layout

A standard credit report is generally organized into distinct sections, each serving a specific purpose. Understanding where each piece of information resides will significantly streamline your review process.A descriptive representation of a typical credit report layout includes the following key sections, usually presented in this order:

- Personal Information: This section at the top typically includes your name, current and previous addresses, Social Security number (often partially masked for security), and date of birth. It’s crucial to verify the accuracy of this information as discrepancies can sometimes lead to identity theft concerns.

- Credit Accounts: This is the largest and most detailed section, listing all your open and closed credit accounts. Each account is presented with its own set of details, which we will explore further.

- Credit Inquiries: This section shows who has recently requested access to your credit report. It’s divided into “hard inquiries” (which can affect your score) and “soft inquiries” (which do not).

- Public Records: This section contains information from public sources, such as bankruptcies, judgments, and liens.

- Credit Score: While not always present on the free annual reports, a credit score (e.g., FICO or VantageScore) is often provided, offering a numerical representation of your creditworthiness.

- Summary of Accounts: Some reports may offer a summary table at the beginning or end of the credit accounts section, providing a quick overview of your credit utilization, number of accounts, and payment history.

Visual Metaphor for Credit Account Representation

Think of your credit report as a detailed financial diary. Each credit account listed is like an individual chapter in that diary, chronicling its history and your interactions with it.Different types of credit accounts appear on a report like distinct entries in a ledger, each with its own unique identifier and activity log.

- Revolving Credit (e.g., Credit Cards): These are often depicted as ongoing relationships, showing the credit limit, current balance, and payment history over time. It’s like a running tab where you can borrow, repay, and borrow again, with each transaction noted.

- Installment Loans (e.g., Mortgages, Auto Loans, Personal Loans): These are represented as fixed-term commitments. Each entry details the original loan amount, current balance, monthly payment, interest rate, and the remaining term. This is akin to a payment schedule for a specific purchase, with each payment reducing the principal over a set period.

- Charge Cards: These are similar to credit cards but typically require full payment each month. Their display might emphasize the payment due date and whether it was paid in full.

Illustrative Example of a Credit Inquiry Display

A credit inquiry on your report serves as a record of who has recently looked at your credit history. When a lender or other authorized entity requests your credit report, it’s logged in this section.An illustrative example of how a credit inquiry is displayed typically includes:

- Date of Inquiry: The specific date the report was accessed.

- Company Name: The name of the business or individual that requested the report (e.g., “Chase Bank,” “Auto Finance Co.”).

- Type of Inquiry: This is crucial. It will usually specify whether it was a “hard inquiry” (initiated by you applying for credit) or a “soft inquiry” (for background checks, pre-approved offers, or your own credit monitoring). Hard inquiries are generally the ones that can slightly impact your credit score.

For instance, a hard inquiry might appear as: “08/15/2023 – Capital One – Hard Inquiry.” A soft inquiry might be listed as: “09/01/2023 – Experian – Soft Inquiry.”

Breakdown of a Hypothetical Public Record Entry

Public records are official documents that can significantly influence your creditworthiness. Their inclusion on your report is a reflection of serious financial events that have been officially documented.A breakdown of a hypothetical public record entry, such as a bankruptcy, would typically include:

- Type of Record: Clearly stating the nature of the public record, e.g., “Bankruptcy.”

- Date Filed: The date the bankruptcy was officially filed with the court.

- Case Number: A unique identifier for the legal case.

- Court Name: The specific court where the record was filed.

- Discharge Date (if applicable): The date the bankruptcy was discharged, meaning the legal process was completed.

- Creditors Affected: Information about which debts were included in the bankruptcy.

For example, a hypothetical public record entry for a Chapter 7 bankruptcy might look like this:

Public Record: Bankruptcy (Chapter 7)

Date Filed: 03/10/2020

Case Number: BK-20-12345

Court: U.S. Bankruptcy Court, Southern District of New York

Discharge Date: 07/15/2020

Notes: This bankruptcy included unsecured debts.

Closing Notes

In essence, securing your annual credit report is a straightforward yet profoundly impactful action you can take for your financial well-being. By understanding the available avenues for obtaining your report, whether through the official AnnualCreditReport.com portal, direct requests to credit bureaus, or through credit monitoring services, you gain control over a critical aspect of your financial identity. Armed with this knowledge, you are well-equipped to review, interpret, and act upon the information within your report, paving the way for improved creditworthiness and a more secure financial future.