How to Set Up Automatic Payments to Avoid Late Fees is your comprehensive guide to mastering effortless bill management and reclaiming your financial peace of mind. This exploration delves into the intricacies of automated billing, transforming a potentially tedious chore into a streamlined process that safeguards your finances.

We will embark on a journey to understand the fundamental principles of automatic payments, uncovering their myriad benefits for managing regular expenses. From identifying the most suitable bills for automation to meticulously setting them up, this guide provides actionable steps. Furthermore, we will address the critical aspects of managing your financial accounts and payment methods, ensuring security and accuracy. Our discussion will also cover effective monitoring and troubleshooting techniques, empowering you to navigate any challenges with confidence.

Finally, we will explore advanced strategies and considerations, solidifying automatic payments as a powerful tool for proactive financial management and the ultimate avoidance of costly late fees.

Understanding Automatic Payments for Bill Management

Automatic payments, often referred to as auto-pay or direct debit, represent a convenient and efficient method for managing recurring financial obligations. This system allows you to authorize a service provider or creditor to automatically withdraw funds from your bank account or charge your credit card on a predetermined schedule to cover your bills. Setting up automatic payments can significantly streamline your financial life, reducing the administrative burden and ensuring timely settlement of your financial commitments.The fundamental concept of automatic bill payments involves granting permission for recurring transactions to occur without manual intervention each billing cycle.

This is typically established through an agreement with the biller, where you provide your banking or credit card details and authorize them to debit your account for the amount due on specific dates. This process is designed to automate the payment, making it a hands-off experience for the consumer once initially configured.

Core Benefits of Automatic Payments

Embracing automatic payments for your regular expenses offers a multitude of advantages that contribute to improved financial management and peace of mind. These benefits extend beyond mere convenience, impacting your financial health and reducing potential stress.

- Avoidance of Late Fees: The most direct benefit is the elimination of late fees. By ensuring payments are made on time, every time, you sidestep the financial penalties associated with missed deadlines.

- Improved Credit Score: Consistent on-time payments are a cornerstone of a healthy credit score. Automatic payments help maintain this positive payment history, which is crucial for securing loans, mortgages, and favorable interest rates in the future.

- Time Savings: Manually paying multiple bills each month can be time-consuming. Automating this process frees up your time, allowing you to focus on other important tasks or leisure activities.

- Budgeting Predictability: Knowing that your essential bills will be paid automatically on specific dates provides greater predictability in your budget, making it easier to manage your cash flow and plan for other expenditures.

- Reduced Stress and Mental Load: The worry of forgetting to pay a bill and facing consequences is a common source of stress. Automatic payments alleviate this burden, offering a sense of financial security.

Common Bills Suitable for Automatic Payment

A wide array of recurring bills can be effectively managed through automatic payment systems, simplifying household and personal financial management. The key is identifying expenses that have a consistent amount or a predictable range.

- Utilities: Electricity, gas, water, and internet bills are prime candidates for auto-pay, as they occur monthly and are essential services.

- Mortgage or Rent: Your housing payment is a significant recurring expense that can be reliably automated to prevent any issues with your landlord or lender.

- Loan Payments: Auto-pay is ideal for car loans, student loans, and personal loans, ensuring these obligations are met promptly.

- Credit Card Bills: While some prefer to manually manage credit card payments to control spending, setting up auto-pay for at least the minimum payment can prevent late fees and credit score damage.

- Subscription Services: Streaming services, gym memberships, software subscriptions, and other recurring digital or physical subscriptions are perfectly suited for automation.

- Insurance Premiums: Auto insurance, health insurance, and homeowner’s insurance premiums can be automatically debited, ensuring continuous coverage.

Potential Risks and Mitigation Strategies for Automatic Payments

While automatic payments offer significant advantages, it is essential to be aware of potential pitfalls and implement strategies to mitigate them, ensuring the system works to your benefit without unforeseen complications.

Insufficient Funds

A primary risk is having insufficient funds in your account when an automatic payment is scheduled to be debited. This can lead to overdraft fees from your bank and potential late fees from the biller, in addition to negative impacts on your credit score.

“Always maintain a buffer in your checking account to cover scheduled automatic payments, especially if your income is irregular.”

Mitigation:

- Regularly Monitor Account Balances: Make it a habit to check your bank account balance frequently, especially in the days leading up to scheduled payment dates. Many banking apps provide real-time balance updates and low-balance alerts.

- Set Up Low-Balance Alerts: Configure your bank to send you notifications when your account balance drops below a certain threshold. This proactive alert can give you time to transfer funds before a payment is due.

- Align Payment Dates with Income: If possible, schedule automatic payments to occur a few days after you typically receive your income. This ensures funds are available when needed.

- Create a Dedicated Account: For highly critical bills, consider using a separate checking account solely for automatic payments. This can simplify tracking and prevent accidental overdrafts on your primary account.

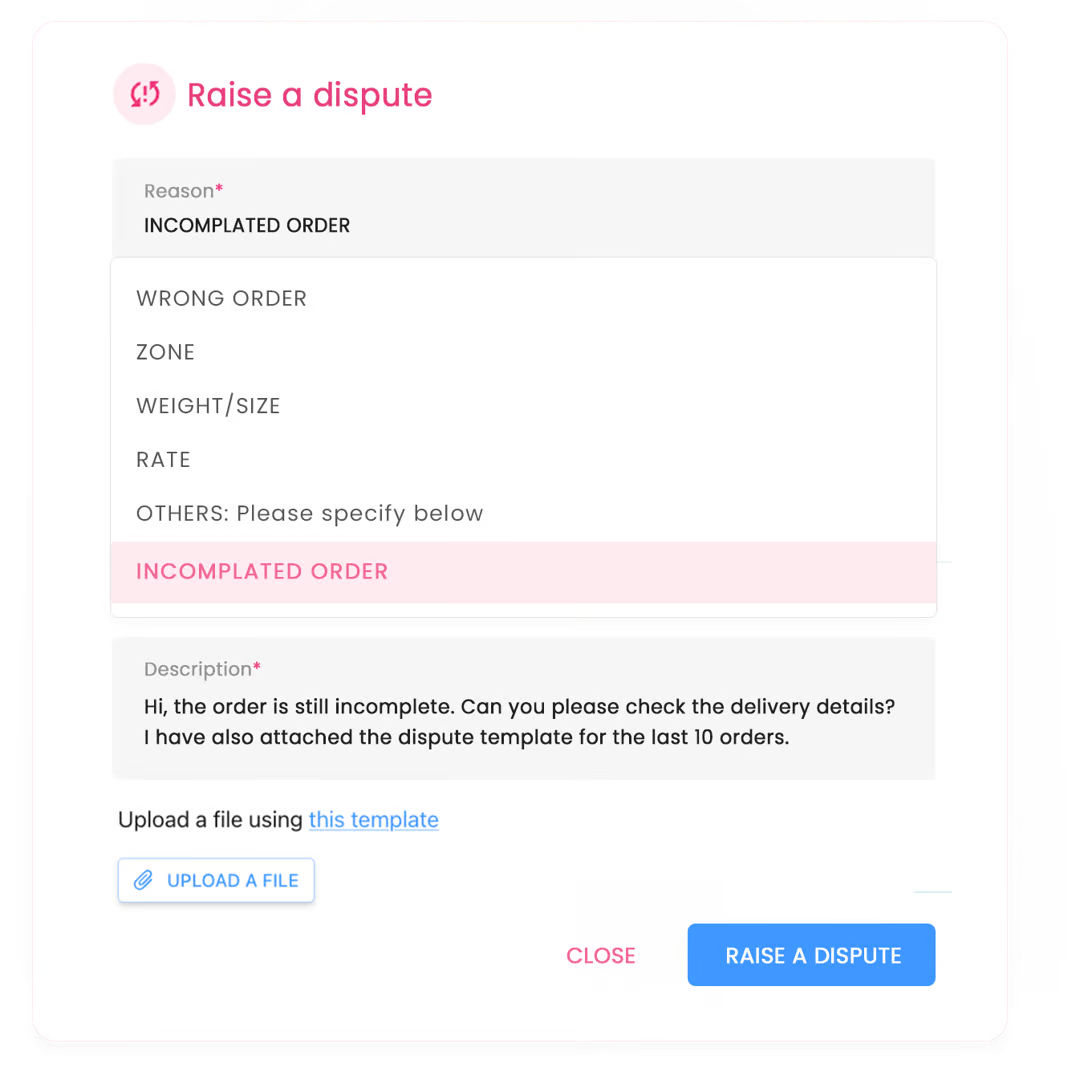

Billing Errors or Unexpected Increases

There’s a possibility that a biller might incorrectly charge your account or significantly increase the amount due without adequate notice. Without oversight, these errors could go unnoticed for some time. Mitigation:

- Review Bills Promptly: Even with auto-pay, it is crucial to review your bills as soon as they arrive or before the payment is processed. Compare the billed amount to previous statements and your expected charges.

- Set Up Email Notifications for Bills: Opt-in to receive electronic billing statements. This allows you to receive alerts and review charges promptly, giving you an opportunity to dispute any discrepancies before the automatic payment is made.

- Understand Your Service Agreement: Be familiar with the terms and conditions of your service agreements, including how price changes are communicated and what recourse you have in case of billing disputes.

- Maintain Records: Keep copies of your bills and payment confirmations. This documentation can be invaluable if you need to dispute a charge or resolve a billing error.

Changes in Payment Information

If your bank account number or credit card details change (e.g., due to a new card being issued or a bank switch), and you fail to update this information with all your service providers, your automatic payments will fail. Mitigation:

- Update Information Immediately: As soon as you receive a new credit card or change bank accounts, proactively update your payment information with all relevant billers. Many companies offer online portals for easy updates.

- Keep a List of Auto-Pay Accounts: Maintain a central list of all services for which you have set up automatic payments. This list should include the biller’s name and the payment method used.

- Periodically Review Auto-Pay Setups: Once or twice a year, review your list of automatic payments to ensure all information is current and that the services are still active and needed.

Service Cancellations or Discontinuation

If you decide to cancel a service or if a provider discontinues service, it is vital to ensure that the automatic payments associated with that service are also stopped. Failure to do so can result in continued charges. Mitigation:

- Confirm Cancellation of Auto-Pay: When canceling a service, explicitly confirm that the automatic payment arrangement will also be terminated. Request written confirmation if possible.

- Monitor Statements After Cancellation: Continue to monitor your bank and credit card statements for a few billing cycles after canceling a service to ensure no further charges are applied.

- Contact Your Bank or Credit Card Company: If unauthorized charges continue to appear after a service cancellation, contact your financial institution immediately to dispute the charges and potentially block further payments to that vendor.

Identifying Bills Suitable for Automatic Payment Setup

Choosing which bills to automate requires a thoughtful approach to ensure it benefits your financial management. Not all expenses are created equal when it comes to automatic payments. This section will guide you through identifying the most appropriate candidates from your monthly outgoings.The key to successful automation lies in understanding the nature of each bill. Some bills are predictable and consistent, making them ideal for automatic payments.

Others, however, fluctuate significantly or have variable components that require your active review before payment. By categorizing your bills, you can make informed decisions that prevent unexpected overdrafts or missed payments due to automation.

Typical Household Bills for Automatic Payment

Several common household expenses are excellent candidates for automatic payment setup due to their regularity and predictable nature. Automating these can significantly reduce the mental load of bill management and help avoid late fees.Here is a list of typical household bills that are generally well-suited for automatic payments:

- Mortgage or Rent Payments: These are usually fixed amounts paid on a specific date each month.

- Loan Payments: This includes auto loans, student loans, and personal loans, which typically have consistent monthly installments.

- Insurance Premiums: Homeowners insurance, auto insurance, and life insurance premiums are often set amounts paid monthly or annually.

- Subscription Services: Streaming services, gym memberships, software subscriptions, and other recurring services are prime candidates for automation.

- Utility Bills (with fixed rate or predictable average): While some utility bills can vary, many providers offer average payment plans or allow you to set a maximum payment to prevent overspending.

- Property Taxes (if paid in installments): Many municipalities allow for installment payments that can be automated.

Factors for Bill Automation Decision-Making

When determining if a bill should be set up for automatic payment, several crucial factors should be considered. The predictability of the bill amount and your comfort level with the payment process are paramount.The primary distinction to make is between bills with fixed costs and those with variable costs.

- Fixed Costs: These are bills that remain the same amount each payment cycle. Examples include mortgage payments, car loan installments, and most subscription services. Automating fixed-cost bills is generally straightforward and highly recommended as there’s little risk of unexpected charges.

- Variable Costs: These are bills where the amount can change from month to month. Utility bills (electricity, water, gas) are common examples, as their cost depends on usage. Credit card payments, while often having a minimum due, can also have variable balances. For variable bills, it’s essential to set up automation with caution.

Decision-Making Framework for Bill Automation

To systematically assess your bills for automation, a structured framework can be highly beneficial. This framework helps you weigh the pros and cons of automating each specific bill.Consider the following framework to evaluate each of your bills:

| Bill Type | Cost Predictability | Automation Recommendation | Considerations for Automation |

|---|---|---|---|

| Mortgage/Rent | High (Fixed) | Strongly Recommended | Ensure sufficient funds are always available. Confirm due date aligns with your payment cycle. |

| Loan Payments (Auto, Student, Personal) | High (Fixed) | Strongly Recommended | Verify the payment amount and due date. |

| Insurance Premiums | High (Fixed) | Strongly Recommended | Check for any annual premium adjustments. |

| Subscription Services | High (Fixed) | Recommended | Periodically review subscriptions to ensure they are still needed. |

| Utility Bills (Electricity, Water, Gas) | Low to Medium (Variable) | Cautiously Recommended | Set up with a buffer or maximum payment limit. Monitor usage and bills regularly. Consider average payment plans if available. |

| Credit Card Payments | Low (Variable Balance) | Not Recommended for Full Balance Payment | Automate minimum payment to avoid late fees, but manually pay the full balance to avoid interest. Alternatively, automate a fixed amount that is higher than the minimum but less than the full balance if you are confident in managing the remaining amount. |

| Medical Bills | Very Low (Highly Variable) | Not Recommended | These often require review due to insurance adjustments and potential payment plans. |

When automating variable bills like utilities, it is prudent to set up the automatic payment to cover the average monthly cost plus a small buffer. This approach helps to prevent insufficient funds when usage is higher than average, while still benefiting from the convenience of automation. Regularly reviewing your statements for these variable bills will help you stay aware of your spending patterns and make adjustments to your automated payment settings if necessary.

Step-by-Step Guide to Setting Up Automatic Payments

Setting up automatic payments is a straightforward process that can significantly simplify your bill management and help you avoid the stress and cost of late fees. This guide will walk you through the general procedure, how to locate the option with your service providers, and the information you’ll typically need to have on hand.The core principle behind automatic payments is authorizing your service provider to withdraw funds from your designated account on a recurring basis, usually on or around your due date.

This eliminates the need for manual payments each month, ensuring your bills are consistently paid on time.

Locating Automatic Payment Options

Most service providers offer the option to enroll in automatic payments through their online portals or mobile applications. Navigating these platforms is generally intuitive, and the automatic payment feature is often prominently displayed to encourage adoption.To find the automatic payment option on a biller’s website or app, begin by logging into your account. Once logged in, look for sections labeled “Billing,” “Payments,” “Account Settings,” or “Manage AutoPay.” These are common locations where you’ll find the option to set up recurring payments.

Sometimes, it might be integrated directly into the payment screen when you make a one-time payment.

Information Required for Automatic Payment Setup

When you decide to enroll in automatic payments, you’ll need to provide certain information to authorize the recurring transactions. Having this information readily available will make the setup process quick and seamless.The following details are typically required to set up an automatic payment:

- Payment Method: This usually involves providing your bank account details (routing and account number) for direct debit or your credit/debit card number, expiration date, and CVV.

- Authorization: You will need to agree to the terms and conditions of the automatic payment service, which often includes authorizing the biller to charge your account for the outstanding balance.

- Contact Information: Confirming your email address and phone number is important for receiving notifications about your automatic payments.

Checklist Before Initiating Automatic Payment Setup

Before you begin the enrollment process, it’s wise to prepare a few things to ensure a smooth and successful setup. This proactive approach helps prevent any potential issues and confirms your readiness.Consider the following checklist of actions needed before initiating the setup process:

- Gather Payment Information: Have your bank account and routing numbers, or your credit/debit card details, readily accessible.

- Review Your Billing Cycle: Understand your bill’s due date and the typical amount due to ensure your payment method has sufficient funds.

- Check Your Bank/Card Limits: Ensure there are no daily spending limits or insufficient funds that could cause a payment to fail.

- Confirm Account Information: Verify that your account number with the service provider is correct.

- Understand the Terms and Conditions: Briefly review the automatic payment policy of the service provider, paying attention to any specific rules or cancellation procedures.

Managing Bank Accounts and Payment Methods for Automation

Ensuring your automatic payments run smoothly hinges on meticulously managing the bank accounts and payment methods linked to these services. This involves not only initial setup but also ongoing vigilance to prevent disruptions and potential late fees. By paying close attention to these details, you can build a robust system for automated bill management.The integrity of your automatic payment system is directly tied to the accuracy and suitability of the financial instruments you designate.

Choosing the right account or card and keeping its details current is paramount to avoiding missed payments and the associated financial penalties.

Linking the Correct Bank Account or Payment Method

The foundation of successful automatic payments lies in connecting them to the most appropriate financial resource. This decision impacts your cash flow management and the overall reliability of the automated process. It’s crucial to select an account or card that you regularly monitor and can comfortably allocate funds towards.Consider the following when linking your accounts:

- Primary Checking Account: This is often the most straightforward choice, as it’s typically where your income is deposited and where you manage your day-to-day expenses. Linking automatic payments here ensures that funds are readily available if you manage your balance effectively.

- Dedicated Savings Account: For predictable bills, some individuals prefer to link payments to a separate savings account. This can help earmark funds specifically for these obligations, preventing accidental overspending from your primary checking account.

- Credit Card: Using a credit card for automatic payments can be beneficial for earning rewards or building credit history. However, it’s essential to ensure you can pay off the balance in full each month to avoid accruing high interest charges, which would negate the benefit of avoiding late fees.

Ensuring Sufficient Funds for Automatic Payments

A common pitfall in automatic payment systems is insufficient funds, which can lead to declined transactions and late fees. Proactive management of your account balances is key to preventing this issue. Regularly reviewing your upcoming bills and comparing them against your available funds will help you stay ahead.It is highly recommended to implement a system that alerts you to low balances.

Many banking institutions offer customizable alerts that can notify you via email or text message when your account balance drops below a certain threshold.

“Maintain a buffer in your linked account that exceeds the total amount of your scheduled automatic payments to account for any unexpected transactions or timing discrepancies.”

To effectively manage your funds for automatic payments:

- Track Your Spending: Use budgeting apps or spreadsheets to monitor your expenses and income, giving you a clear picture of your cash flow.

- Set Up Low Balance Alerts: Configure your bank to send notifications when your account balance falls below a pre-determined amount, ideally higher than your total automatic payment obligations.

- Review Upcoming Bills: Before the due date of any automatic payment, cross-reference it with your current account balance to ensure it can be covered.

- Consider a “Rainy Day” Fund: Having a small emergency fund can provide an extra layer of security against unforeseen financial challenges that might impact your ability to cover automatic payments.

Updating Payment Information for Expired Cards or Changed Bank Accounts

Financial institutions frequently update card expiration dates and sometimes account details. It is imperative to promptly update this information with all service providers that utilize automatic payments to prevent service interruptions or missed payments. Failure to do so can result in your automatic payments being declined.The process for updating your payment information is generally straightforward and can typically be done through the online portal or mobile app of the service provider.Here’s a typical process for updating your payment details:

- Log In to Your Account: Access the website or app of the service provider (e.g., utility company, streaming service, loan provider).

- Navigate to Billing or Payment Settings: Look for sections labeled “Billing,” “Payment Methods,” “Account Settings,” or similar.

- Edit or Add New Payment Information: You will usually find an option to edit your existing card details or add a new payment method. Enter the updated card number, expiration date, CVV code, and billing address, or provide your new bank account and routing numbers.

- Confirm Changes: Save the updated information and ensure it is reflected as the primary payment method for your account.

Some providers may send a notification or reminder before your card expires, but it is wise not to rely solely on these prompts.

Best Practices for Securely Managing Payment Details for Automated Services

Protecting your sensitive financial information is of utmost importance when setting up and managing automatic payments. Implementing strong security practices will safeguard you against potential fraud and identity theft.The following best practices will help you securely manage your payment details:

- Use Strong, Unique Passwords: For each online account where you manage payment information, create a complex password that is difficult to guess and unique to that service. Consider using a password manager to generate and store these securely.

- Enable Two-Factor Authentication (2FA): Whenever available, enable 2FA on your online accounts. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password.

- Be Wary of Phishing Attempts: Never click on suspicious links in emails or text messages that ask for your payment information. Always navigate directly to the service provider’s official website to update your details.

- Regularly Review Bank and Credit Card Statements: Scrutinize your financial statements for any unauthorized transactions. Report any discrepancies immediately to your bank or credit card company.

- Secure Your Devices: Ensure that the devices you use to access online banking and payment portals are protected with up-to-date antivirus software and strong screen locks.

- Opt for Secure Networks: Avoid entering sensitive payment information when connected to public Wi-Fi networks, as these can be less secure.

By adhering to these security measures, you can confidently utilize automatic payments while minimizing the risk of your financial information being compromised.

Monitoring and Troubleshooting Automatic Payments

Setting up automatic payments is a significant step towards efficient bill management and avoiding late fees. However, the process doesn’t end once the automation is configured. Ongoing monitoring and a clear understanding of how to troubleshoot any issues are crucial to ensure your bills are paid on time and accurately, maintaining your financial health.Regularly reviewing your automatic payment setup and transactions helps prevent unexpected problems.

This proactive approach ensures that your financial obligations are met without manual intervention, providing peace of mind and safeguarding your credit score.

Verifying Successful Automatic Payment Processing

Confirming that your automatic payments have been processed successfully is a fundamental aspect of managing this feature. This verification process ensures that funds have been debited from your account as intended and that your billers have received the payments.There are several reliable methods to verify successful payment processing:

- Check Your Bank or Credit Card Statement: The most direct way to confirm a payment is to review your transaction history on your bank statement or credit card statement. Look for the specific biller’s name and the amount paid on or around the due date.

- Review Biller’s Online Account: Most utility companies, credit card providers, and other service providers offer online portals where you can view your account activity. Check the payment history section to see if the automatic payment has been recorded.

- Email Notifications: Many billers and financial institutions send email confirmations for successful automatic payments. Ensure you have enabled these notifications and check your inbox regularly.

- Mobile Banking Apps: If you use a mobile banking application, you can often view recent transactions and pending payments directly from your smartphone.

Tracking Payment History and Identifying Discrepancies

Maintaining a clear record of your payment history is essential for financial organization and for quickly spotting any errors or discrepancies. This practice allows you to reconcile your records with those of your billers and financial institutions.To effectively track your payment history and identify discrepancies, consider the following:

- Utilize a Spreadsheet or Budgeting App: Create a dedicated spreadsheet or use a personal finance app to log all automatic payments, including the date, biller, amount, and confirmation number. This centralized record makes it easy to review past transactions.

- Regularly Reconcile Bank Statements: At least once a month, reconcile your bank or credit card statements with your own records. This process involves comparing every transaction listed on your statement against your logged payments.

- Note Any Unrecognized Transactions: During reconciliation, pay close attention to any transactions that do not match your expected automatic payments. These could be incorrect charges, duplicate payments, or fraudulent activity.

- Compare with Biller Statements: Periodically compare the payments recorded by your billers with your own transaction records. Discrepancies may indicate a processing error or a misunderstanding of the bill amount.

Common Issues with Automatic Payments and Their Resolutions

While automatic payments offer convenience, various issues can arise that may lead to missed payments or incorrect charges. Understanding these common problems and their solutions can help you prevent them or resolve them quickly.Here are some frequent issues and their corresponding resolutions:

- Insufficient Funds: If your account does not have enough funds when an automatic payment is scheduled, the payment will likely be declined.

Resolution: Ensure you maintain an adequate balance in your bank account or have sufficient credit available on your credit card to cover scheduled payments. Consider setting up low balance alerts from your bank.

- Expired Payment Method: Credit cards expire, and debit cards can be reissued. If your payment method expires, automatic payments will fail.

Resolution: Keep your payment information updated with your billers. Many services allow you to update your card details online, and some will notify you before a card expires.

- Incorrect Billing Information: Errors in account numbers or billing addresses provided to the biller can lead to payment processing issues.

Resolution: Double-check all billing information when setting up automatic payments. Contact the biller if you suspect an error in their system.

- System Glitches or Downtime: Occasionally, technical issues with your bank, the biller’s system, or payment processors can cause a payment to be missed.

Resolution: If a system issue is suspected, contact both your bank and the biller to report the problem and arrange for the payment to be made. Keep records of all communications.

- Changes in Bill Amount: If a bill amount fluctuates significantly and exceeds a pre-set limit (if applicable), or if you expected a different amount, the automatic payment might still proceed.

Resolution: For variable bills, it’s advisable to review the bill before the payment date or set up notifications for significant changes. Some services allow you to set payment limits for automatic deductions.

Troubleshooting Flowchart for Failed or Incorrect Automatic Payments

When an automatic payment fails or an incorrect amount is charged, a systematic approach to troubleshooting can help identify the root cause and implement a solution efficiently. This flowchart provides a step-by-step guide to resolving such issues.

Troubleshooting Flowchart: Failed or Incorrect Automatic Payments

| Step | Action | Possible Cause | Resolution |

|---|---|---|---|

| 1 | Identify the failed or incorrect payment. | Notification from bank, biller, or statement review. | Proceed to Step 2. |

| 2 | Check your bank/credit card account for the transaction. | Insufficient funds, expired card, incorrect details, system error. | If transaction is missing, proceed to Step 3. If transaction is present but incorrect, proceed to Step 4. |

| 3 | Contact your bank or financial institution. | Payment was not initiated by the bank, or there was an internal processing error. | Inquire about the status of the payment and if any issues were flagged. Request a manual payment if necessary and update your automatic payment setup with correct details. |

| 4 | Contact the biller or service provider. | Incorrect amount billed, duplicate charge, or error in their system. | Explain the discrepancy and request a refund or adjustment. Verify the correct billing amount and ensure your automatic payment settings are aligned with the correct amount. |

| 5 | Review and update automatic payment details. | Expired credit/debit card, incorrect account number, outdated contact information. | Log in to your biller’s portal or contact them to update all relevant payment and contact information. Ensure the payment method is current and valid. |

| 6 | Monitor subsequent payments. | Ensure the issue is fully resolved and no further errors occur. | Check your statements and biller accounts for the next few payment cycles to confirm successful and accurate processing. |

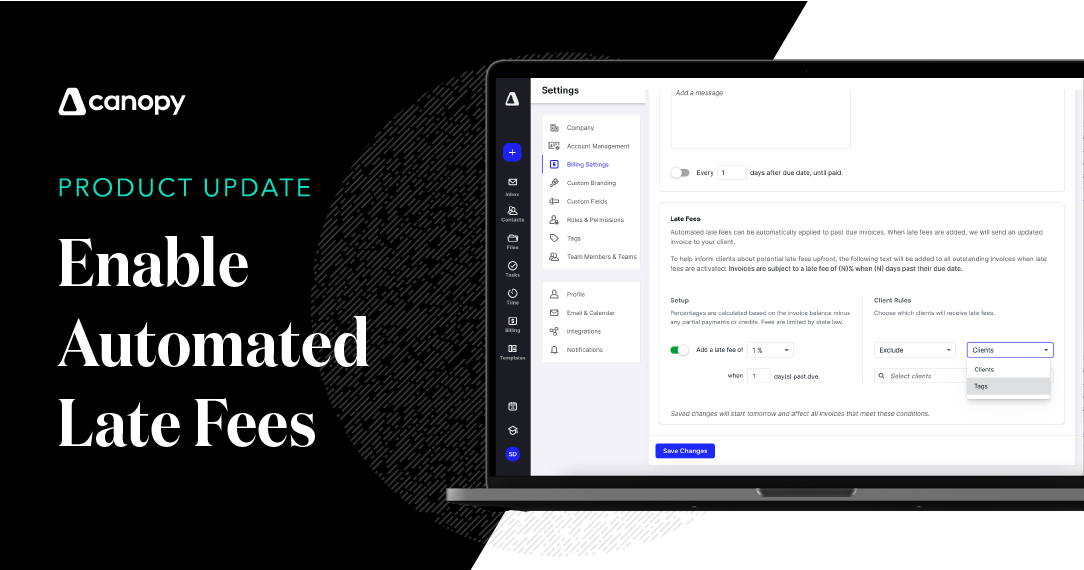

Leveraging Automatic Payments to Avoid Late Fees

Setting up automatic payments is a cornerstone of effective bill management, directly contributing to the avoidance of costly late fees. By entrusting your recurring bills to an automated system, you ensure timely payments, thereby safeguarding your financial health and peace of mind. This proactive approach transforms a potentially stressful chore into a seamless part of your financial routine.Consistent automatic payments directly prevent late fees by ensuring that funds are debited from your account on or before the due date, regardless of whether you actively remember to make the payment.

This eliminates the human element of forgetting or delaying, which are the primary causes of late payments. The reliability of automated systems means your bills are consistently met, keeping your accounts in good standing.

Financial Impact of Accumulating Late Fees

The financial consequences of accumulating late fees can be substantial and far-reaching. These fees, often small on an individual bill, can quickly escalate into significant expenses when applied across multiple accounts or over extended periods. Beyond the direct cost of the fees themselves, late payments can negatively impact your credit score, making it more difficult and expensive to secure loans, mortgages, or even rent an apartment in the future.

A damaged credit score can lead to higher interest rates on all forms of credit, costing you more money over the long term.Consider a scenario where an individual has three bills with a late fee of $35 each. If these bills are paid late twice in a year, the total late fees incurred would be $35 x 3 bills x 2 instances = $210 annually.

This amount does not account for potential over-limit fees or interest charges that might also accrue due to late payments. Over five years, this could amount to over $1,000 in unnecessary expenses.

Cost Comparison: Late Fees Versus Automation Setup

The effort involved in setting up automatic payments is minimal when compared to the financial burden of recurring late fees. The initial setup typically involves a few minutes of online navigation or a brief phone call to your service providers. This one-time investment of time and attention yields ongoing savings.Let’s analyze the cost:

| Expense Type | Estimated Cost/Effort | Frequency | Total Annual Impact |

|---|---|---|---|

| Late Fees (Average) | $35 per late payment | 2 instances per bill, 3 bills | $210 |

| Setting Up Automatic Payments | 15-30 minutes of time | One-time setup per bill | Negligible financial cost, significant time savings |

The comparative analysis clearly demonstrates that the small investment of time required to set up automatic payments offers a significant return in terms of avoiding financial penalties.

Strategies for Proactive Financial Management with Automatic Payments

Automatic payments serve as a powerful tool for proactive financial management, enabling you to stay ahead of your financial obligations. By automating recurring expenses, you free up mental bandwidth and ensure that essential payments are handled consistently, allowing you to focus on broader financial goals.Here are key strategies for leveraging automatic payments:

- Budgeting and Cash Flow Management: By knowing when automatic payments will be debited, you can better plan your budget and ensure sufficient funds are available, preventing overdrafts and associated fees. This predictability aids in maintaining a stable cash flow.

- Debt Reduction: For loan payments, automatic payments ensure you never miss a due date, which is crucial for staying on track with debt reduction plans and avoiding potential penalties or interest rate increases that could hinder your progress.

- Building and Maintaining Credit: Consistent, on-time payments are a primary factor in building and maintaining a good credit score. Automating these payments removes the risk of human error and contributes positively to your credit history.

- Identifying and Automating Variable Bills: While some bills are fixed, others, like utility bills, can vary. Many providers allow you to set up automatic payments for the average amount or to pay the full statement balance, offering flexibility and control.

- Regular Review and Adjustment: Periodically reviewing your automatic payment setup is essential. This ensures that payment amounts are still accurate, that linked bank accounts are still valid, and that the system is functioning as intended. This proactive monitoring prevents potential issues.

Advanced Tips and Considerations for Automated Billing

While setting up automatic payments is a significant step towards efficient bill management, several advanced strategies can further optimize this process. These tips focus on leveraging technology and proactive management to ensure your automated system works seamlessly and adapts to your financial needs, even with fluctuating bills.

Utilizing Payment Apps and Services for Centralized Management

Modern payment applications and financial management services offer powerful tools to consolidate and oversee multiple automatic payments. These platforms can streamline the process of setting up, tracking, and modifying recurring payments across various service providers, providing a single dashboard for all your automated transactions.

Many popular apps and services provide features such as:

- Consolidated Bill Tracking: View all upcoming and past due bills in one place, regardless of the provider.

- Automated Payment Setup: Initiate automatic payments for new bills directly through the app.

- Payment Scheduling: Set specific payment dates or choose to pay when funds are available, with customizable rules.

- Alerts and Notifications: Receive reminders for upcoming payments, low balances, or successful transactions.

- Categorization and Budgeting: Track spending patterns and integrate bill payments into your overall budget.

Examples of such services include personal finance management apps like Mint, YNAB (You Need A Budget), or even direct features within banking applications that allow for bill pay management. These tools empower users to maintain a bird’s-eye view of their financial commitments.

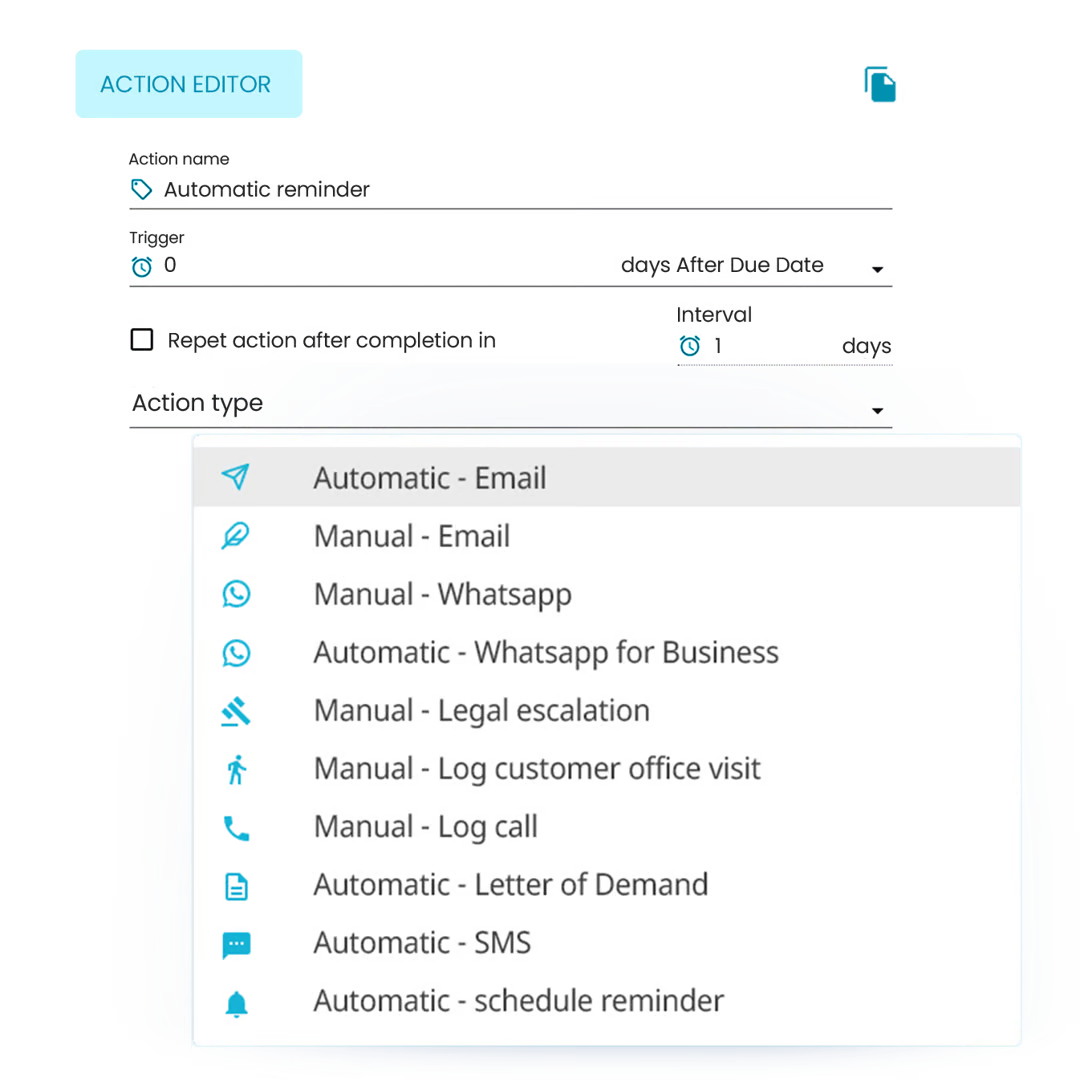

Implementing Payment Reminders Alongside Automation

Even with automatic payments in place, setting up supplementary reminders can provide an extra layer of security and awareness. These reminders act as a safeguard against unforeseen issues, such as insufficient funds or a change in payment details, ensuring you are always informed about your financial obligations.

Consider these strategies for setting up reminders:

- Calendar Alerts: Schedule recurring alerts in your digital calendar a few days before the automatic payment is due.

- Bank Notifications: Many banks offer customizable alerts for upcoming automatic withdrawals or low account balances.

- App-Based Reminders: Utilize the notification features within your chosen payment app or banking app to receive alerts.

- Manual Check-ins: Periodically review your bank statements and payment app dashboards to confirm successful transactions.

The primary benefit of these reminders is to allow for timely intervention. For instance, if a reminder signals an unusually high bill amount, you have the opportunity to verify the charge before it’s automatically deducted.

Adjusting Automatic Payment Amounts for Variable Bills

Variable bills, such as those for utilities, credit cards, or fluctuating service subscriptions, require a more dynamic approach to automatic payments. Simply setting a fixed automatic payment amount might lead to overpayment or underpayment, incurring potential fees or service disruptions.

To effectively manage variable bills with automation:

- Set Payment Thresholds: Configure your automatic payment to cover the full amount of the bill up to a certain limit, or to pay a minimum amount if the bill exceeds a predefined threshold.

- Link to Statement Balance: Many services allow you to set automatic payments to deduct the exact statement balance, ensuring accuracy each billing cycle.

- Pre-payment Options: For utilities, consider setting up automatic payments for an estimated average amount, with a review and adjustment process at least quarterly.

- Manual Review Before Payment: For high-value or unpredictable bills, schedule a manual review of the bill amount a few days before the automatic payment is set to process. If the amount is satisfactory, confirm the payment; otherwise, you can adjust or pause the automatic payment.

For example, with a variable electricity bill, you might set your automatic payment to cover the full statement balance. If the bill is unexpectedly high due to increased usage, you’ll be prepared. Conversely, if it’s lower, the exact amount will be paid, preventing overspending.

Frequently Asked Questions on Advanced Automatic Payment Scenarios

Addressing common queries can help users navigate more complex situations related to automated billing and ensure they are maximizing the benefits of this financial tool.

| Question | Answer |

|---|---|

| What happens if my bank account balance is insufficient for an automatic payment? | If your account lacks sufficient funds, the automatic payment will likely be declined. This can result in a non-sufficient funds (NSF) fee from your bank and a late fee from the biller. It is crucial to monitor your bank balance and set up low balance alerts. |

| Can I set different automatic payment dates for different bills? | Yes, most bill pay services and banking platforms allow you to customize the payment date for each individual bill. You can schedule payments to align with your pay cycle or the bill’s due date. |

| How do I update my payment method for an automatic bill? | To update your payment method, you typically need to log in to the portal of the service provider (e.g., your internet company, credit card issuer) and navigate to their billing or payment settings. You will then be able to add a new payment method and designate it as the primary for automatic payments, or remove the old one. |

| Is it safe to link multiple bank accounts for automatic payments? | Linking multiple bank accounts can be safe if done through reputable and secure platforms. Many financial management apps allow you to link various accounts, but always ensure the platform uses robust encryption and security protocols. It’s also wise to use this feature judiciously and only link accounts that are intended for bill payments. |

| How can I ensure I’m not overpaying for a service with automatic payments? | For variable bills, it’s best to set automatic payments to match the statement balance. For fixed bills, regularly review your statements to ensure the amount being deducted is correct. Some services also allow you to set a maximum payment amount to prevent unexpected overcharges. |

Closing Notes

In conclusion, embracing automatic payments is more than just a convenience; it’s a strategic move towards robust financial health. By diligently following the steps Artikeld, you can effortlessly prevent the accumulation of late fees, understand the financial implications of missed payments, and appreciate the significant cost savings compared to the minimal effort required for setup. This proactive approach not only simplifies your bill management but also positions you for greater financial control and peace of mind, making it an indispensable tool in your personal finance arsenal.