How to Decide When to Ask for a Credit Limit Increase is a journey we embark on to empower you with the knowledge to strategically approach your credit card issuer. This guide delves into the nuances of understanding your current financial standing, assessing your genuine need for a higher limit, and meticulously preparing your application. We will navigate the process, explore potential outcomes, and ultimately equip you with the insights to manage your credit responsibly post-increase.

This comprehensive exploration will illuminate the critical factors lenders consider, such as your payment history, credit utilization, and income, while also guiding you on how to determine if your spending habits align with responsible credit management. We will provide practical advice on gathering necessary documentation, understanding credit inquiries, and communicating your request effectively. By the end, you will be well-prepared to make an informed decision about when and how to pursue a credit limit increase, ensuring it aligns with your financial goals and contributes positively to your credit health.

Understanding Your Credit Card’s Current Standing

Before you consider asking for a credit limit increase, it’s crucial to thoroughly understand your current financial standing with your credit card issuer. This involves grasping the typical processes, the metrics lenders use, favorable credit score ranges, and how different card types might influence the outcome. A solid understanding here will empower you to make a well-informed decision and a more compelling request.Reviewing your credit card statement and payment history is a fundamental step.

It provides a clear snapshot of your spending habits, your repayment reliability, and your overall relationship with the issuer. This self-assessment is invaluable before initiating any formal request for an increase.

Credit Limit Increase Request Process

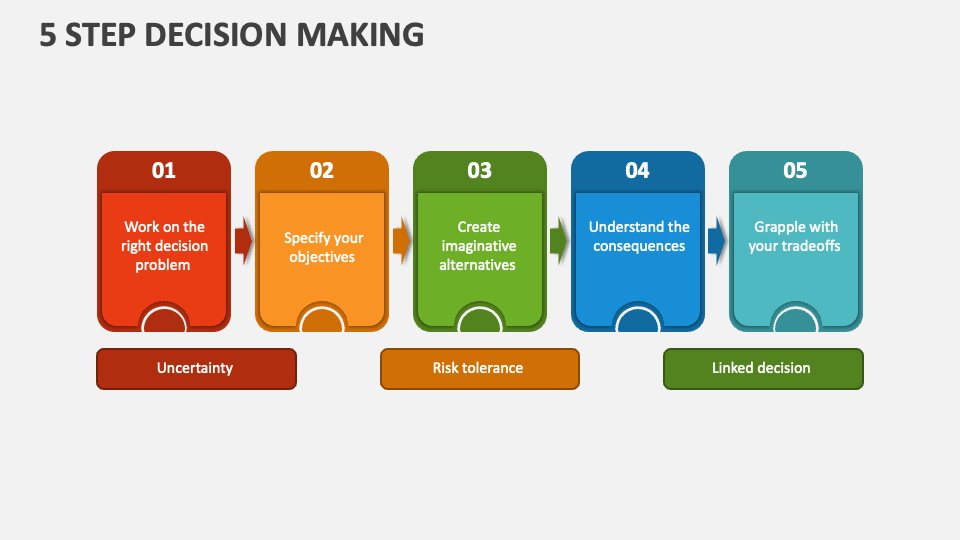

The process for requesting a credit limit increase typically follows a structured approach, though it can vary slightly between major credit card issuers. Most issuers offer multiple avenues for submitting a request, making it convenient for cardholders.The typical credit limit increase request process involves the following steps:

- Online Request: The most common method is through the issuer’s website or mobile app. Cardholders can usually find a dedicated section for account management where a credit limit increase request option is available. This often involves a short form to fill out.

- Phone Request: Some issuers allow or encourage requests via phone. You can call the customer service number on the back of your credit card and speak to a representative who can guide you through the process or submit the request on your behalf.

- Written Request: While less common now, some issuers might still accept written requests via mail. This is usually the slowest method and not recommended unless other options are unavailable.

- Automatic Review: Many issuers periodically review accounts for potential credit limit increases based on your payment history and account activity. This can happen without you initiating a request.

Metrics Used by Lenders

Lenders employ a variety of metrics to evaluate a credit limit increase application, aiming to assess your creditworthiness and your ability to manage a higher credit line responsibly. These metrics help them gauge the risk associated with extending you more credit.Common metrics used by lenders include:

- Payment History: This is paramount. Lenders want to see a consistent track record of on-time payments. Late payments, even by a few days, can significantly detract from your application.

- Credit Utilization Ratio: This is the amount of credit you are currently using compared to your total available credit. A lower utilization ratio (ideally below 30%) indicates you are not over-reliant on credit and can manage your existing debt well.

- Income Verification: While not always explicitly requested for smaller increases, lenders may verify your income to ensure you have the financial capacity to handle a larger credit limit. This can be done through self-reporting or by requesting pay stubs or tax returns.

- Length of Credit History: A longer history of responsible credit management demonstrates a stable financial behavior, which is viewed favorably.

- Number of Recent Credit Inquiries: A high number of recent credit inquiries, especially for new credit accounts, can signal financial distress or overspending, potentially leading to a denial.

- Existing Debt Load: Lenders will consider your overall debt obligations across all your credit accounts to assess your debt-to-income ratio.

Favorable Credit Score Ranges

Your credit score is a critical factor in determining the likelihood of your credit limit increase request being approved. While there’s no absolute guarantee, certain score ranges generally indicate a lower risk to lenders, making them more receptive to granting higher credit limits.The typical credit score ranges that are favorable for securing a credit limit increase are as follows:

- Excellent Credit (750+): Individuals with excellent credit scores are highly likely to be approved for a credit limit increase. Lenders see these scores as a strong indicator of responsible credit behavior and a low risk of default.

- Very Good Credit (700-749): This range also presents a strong case for approval. While not as high as excellent credit, these scores still demonstrate a consistent ability to manage credit effectively.

- Good Credit (650-699): Approval in this range is possible, especially if your payment history is impeccable and your credit utilization is low. However, it might be more challenging than with higher scores, and the increase might be more modest.

It’s important to note that even with a good credit score, other factors like income and payment history play a significant role. Lenders may also consider your relationship with them, such as how long you’ve been a customer and your spending patterns on their card.

Credit Card Types and Limit Increase Policies

Different types of credit cards often come with specific policies and expectations regarding credit limit increases. Understanding these nuances can help you tailor your request and manage your expectations.The following types of credit cards might have specific policies regarding limit increases:

- Rewards Credit Cards: For premium rewards cards with high annual fees, issuers may be more amenable to increasing credit limits, as they often target consumers with higher spending capacities and a strong credit profile.

- Secured Credit Cards: These cards are designed for individuals with limited or poor credit history and require a security deposit. Credit limit increases on secured cards are often tied to responsible usage and may involve a review process that could lead to a higher limit or the return of your deposit.

- Store Credit Cards: Retail store credit cards often have lower initial credit limits and may have more stringent requirements for increases, sometimes requiring a longer history of on-time payments and consistent spending with that particular retailer.

- Travel Rewards Credit Cards: Similar to general rewards cards, travel cards often cater to individuals who travel frequently and spend significantly, and issuers may be more willing to increase limits to accommodate larger travel expenses.

- Business Credit Cards: For business credit cards, lenders will typically assess the business’s financial health, revenue, and the owner’s personal creditworthiness when considering a limit increase.

Reviewing Your Current Credit Card Statement and Payment History

Before formally requesting a credit limit increase, a thorough review of your current credit card statement and payment history is an essential preparatory step. This self-assessment provides critical insights into your financial habits and your standing with the issuer, enabling you to make a more informed and strategic request.The importance of reviewing your current credit card statement and payment history lies in several key areas:

- Assessing Spending Habits: Your statements reveal your typical spending patterns, including where you spend most of your money and how much you spend monthly. Understanding this helps you justify the need for a higher limit, perhaps for larger purchases or increased everyday spending.

- Evaluating Payment Reliability: Your payment history is a direct reflection of your reliability as a borrower. A consistent record of on-time payments, ideally full payments, demonstrates to the issuer that you can manage credit responsibly. Any missed or late payments will be red flags.

- Calculating Current Credit Utilization: Reviewing your statements allows you to accurately calculate your current credit utilization ratio. This metric is crucial, as lenders generally prefer to see utilization below 30%. If your current utilization is high, it’s advisable to pay down your balance before requesting an increase.

- Identifying Potential Issues: A close examination of your statements might uncover any recurring fees, unexpected charges, or errors that you can address before or during your request.

- Demonstrating Account Activity: Consistent use of the card, coupled with timely payments, shows the issuer that you are an active and valuable customer, which can strengthen your case for an increase.

By diligently reviewing these aspects, you gain a comprehensive understanding of your credit card’s current standing, which is foundational for a successful credit limit increase request.

Assessing Your Need and Readiness for a Higher Limit

Before you consider requesting a credit limit increase, it’s crucial to evaluate whether you genuinely need one and if your financial habits demonstrate readiness for a higher credit line. This assessment involves understanding the potential benefits, aligning your spending with responsible credit utilization, and recognizing any red flags that might indicate you’re not yet prepared.A higher credit limit can be a valuable financial tool when managed wisely.

It can provide greater flexibility for significant expenses, offer peace of mind during unexpected events, and even positively impact your credit score by improving your credit utilization ratio. However, it also requires discipline to ensure it contributes to your financial well-being rather than leading to debt.

Beneficial Scenarios for a Higher Credit Limit

There are several situations where a higher credit limit can be advantageous. These often involve planned large expenditures or circumstances that require immediate access to funds.

- Large Purchases: For significant purchases such as appliances, furniture, or home renovations, a higher credit limit can allow you to make the purchase without maxing out your current limit, potentially earning rewards or taking advantage of special financing offers. For instance, if you’re planning to buy a new refrigerator costing $2,000 and your current card has a $3,000 limit, a higher limit would allow for this purchase while still maintaining a low utilization ratio.

- Travel Expenses: Booking flights, hotels, and covering expenses during a vacation can accumulate quickly. A higher credit limit can accommodate these costs, especially for extended trips or international travel where currency exchange and unexpected expenses are common.

- Emergency Fund Supplement: While not a replacement for a dedicated emergency fund, a higher credit limit can serve as a crucial backup for unforeseen circumstances like medical emergencies, urgent home repairs, or unexpected job loss. It provides a safety net when immediate cash is not available.

- Rental Car and Hotel Reservations: Many rental car companies and hotels place a hold on your credit card for a significant amount. A higher credit limit ensures these holds do not prevent you from making other necessary purchases or approaching your current limit.

Aligning Spending Habits with Responsible Credit Utilization

Responsible credit utilization is a cornerstone of good credit management. It signifies your ability to manage borrowed funds effectively without overextending yourself.The credit utilization ratio is a key metric that lenders consider when evaluating your creditworthiness. It represents the amount of credit you are currently using compared to your total available credit. Maintaining a low credit utilization ratio is generally viewed favorably by credit bureaus and lenders.

Calculating Your Current Credit Utilization Ratio

Your credit utilization ratio is calculated by dividing your total outstanding credit card balances by your total credit card limits. This ratio is typically calculated for each card individually and then often aggregated for an overall utilization percentage.

Credit Utilization Ratio = (Total Balances / Total Credit Limits) – 100

For example, if you have one credit card with a balance of $1,000 and a credit limit of $5,000, your utilization ratio for that card is ($1,000 / $5,000) – 100 = 20%.

Understanding a Healthy Credit Utilization Ratio

A healthy credit utilization ratio is generally considered to be below 30%. However, aiming for an even lower ratio, ideally below 10%, can have a more significant positive impact on your credit score. Lenders prefer to see that you are not relying heavily on your credit lines.

Estimating a Reasonable Credit Limit Increase

When considering how much of an increase might be appropriate, it’s wise to base your request on your income and current spending patterns. A common guideline is to ensure that even with an increase, your utilization remains low.A good approach is to consider your annual income. Lenders often look for a debt-to-income ratio that is manageable. If your annual income is $60,000, and you’re aiming for a total credit limit that would keep your overall utilization below 20% when you typically carry $2,000 in balances, you might aim for a total credit limit of $10,000 or more.

This means if your current limit is $5,000, a request for an additional $5,000 would be reasonable.

Indicators of Unreadiness for a Higher Credit Limit

Certain financial behaviors can signal that you may not be ready for a higher credit limit. Approving a request under these circumstances could lead to increased debt and financial strain.

- Missed Payments: Consistently missing payment due dates demonstrates a struggle to manage existing credit obligations. This is a significant red flag for lenders.

- High Balances on Current Cards: If you are already consistently carrying high balances that approach your current credit limit, it suggests you may not be managing your credit effectively. A higher limit could exacerbate this issue.

- Frequent Overspending: If you find yourself regularly spending more than you can afford to pay off each month, a higher credit limit could enable more overspending and lead to accumulating debt.

- Lack of a Budget: Without a clear understanding of your income and expenses, it’s difficult to manage credit responsibly. A lack of budgeting can lead to impulse spending and an inability to track your financial obligations.

- Recent Credit Limit Increases: If you have recently received a credit limit increase on this or other cards, it might be prudent to wait a period before requesting another one, allowing time to demonstrate responsible management of the increased credit.

Preparing Your Application and Gathering Information

Once you’ve determined that a credit limit increase is the right step for you, meticulous preparation is key to a successful request. This involves understanding what information your credit card issuer will likely need and ensuring your financial profile is in order. By gathering the necessary details beforehand, you streamline the application process and present yourself as a responsible borrower.The process of requesting a credit limit increase is significantly smoother when you have all your information readily available.

This not only saves you time but also demonstrates to the credit card issuer that you are organized and serious about managing your credit responsibly. Having your financial data organized can also help you articulate your need for a higher limit more effectively.

Essential Personal and Financial Information

Credit card issuers require specific personal and financial details to evaluate your creditworthiness for a limit increase. This information helps them assess your ability to manage a higher credit line responsibly and determines if granting the increase aligns with their risk management policies.The following are the typical pieces of information you will need to provide:

- Full Name and Contact Information: This includes your current address, phone number, and email address, ensuring they can reach you with updates or decisions.

- Date of Birth and Social Security Number: These are standard identifiers used to verify your identity and access your credit history.

- Employment Status and Income: You will likely need to provide details about your current employment, including your employer’s name, your job title, and your annual income. This demonstrates your capacity to repay a larger debt.

- Monthly Housing Payment: Information about your rent or mortgage payment helps assess your overall monthly financial obligations.

- Existing Credit Card Balances and Limits: While they can see this on your credit report, having this information handy can be useful for your own reference.

Checking Your Credit Report for Accuracy

Before submitting your request, it is crucial to review your credit report for any inaccuracies. Errors on your credit report can negatively impact your credit score and, consequently, your chances of getting a credit limit increase. Taking the time to identify and dispute any discrepancies demonstrates due diligence.The steps involved in checking your credit report are as follows:

- Obtain Your Credit Reports: You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. You can request these through AnnualCreditReport.com.

- Review for Errors: Carefully examine each section of your report, including personal information, account history, credit inquiries, and public records. Look for accounts you don’t recognize, incorrect payment statuses, or duplicate entries.

- Dispute Inaccuracies: If you find any errors, contact the credit bureau directly to initiate a dispute. They are required to investigate your claims and make corrections if necessary. It is advisable to do this well in advance of applying for a credit limit increase to allow time for resolutions.

Useful Documents to Have on Hand

While not always required for every issuer or every request, having certain documents readily accessible can expedite the process and provide strong support for your application. These documents serve as tangible proof of your financial stability and income.Consider having the following documents prepared:

- Recent Pay Stubs: These provide current evidence of your income and employment.

- Recent Tax Returns: Especially if you are self-employed or your income fluctuates, tax returns offer a comprehensive overview of your earnings.

- Bank Statements: These can show consistent income deposits and responsible management of your finances.

- Proof of Address: A utility bill or lease agreement can confirm your current residential information.

Finding Your Credit Card Issuer’s Contact Information or Online Portal

Locating the correct channel to submit your request is essential. Most credit card issuers provide convenient online portals or dedicated customer service lines for managing your account and submitting requests like credit limit increases.To find the specific contact information:

- Check Your Credit Card Statement: The issuer’s website, customer service phone number, and mailing address are typically printed on your monthly statement.

- Visit the Issuer’s Website: Navigate to the official website of your credit card issuer. Look for sections like “Customer Service,” “Account Management,” or “Help.”

- Log In to Your Online Account: If you have an online account for your credit card, logging in will usually provide direct access to features for managing your account, including options to request a credit limit increase.

- Call Customer Service: The customer service number, often found on the back of your credit card, can connect you with a representative who can guide you through the process.

Benefits of a Consistent and Positive Payment History

A consistent and positive payment history on your current credit card is arguably the most significant factor in securing a credit limit increase. It serves as direct evidence of your reliability and responsible credit behavior. Issuers view this as a strong indicator that you can handle a higher credit line without defaulting.The advantages of maintaining such a history include:

- Demonstrated Reliability: Paying your bills on time, every time, shows the issuer that you are a dependable customer who meets their financial obligations.

- Reduced Risk for the Issuer: A history of on-time payments minimizes the perceived risk for the credit card company, making them more willing to extend you additional credit.

- Improved Credit Score: Payment history is a major component of your credit score. A strong record boosts your score, which in turn makes you a more attractive candidate for a credit limit increase.

- Trust and Confidence: Over time, a positive payment record builds trust between you and the issuer, often leading to proactive offers for limit increases or a smoother application process when you initiate the request.

This consistent positive behavior on your existing card is a powerful testament to your financial discipline.

Navigating the Request and Potential Outcomes

Once you’ve thoroughly assessed your financial standing and prepared your application, the next crucial step is to actually make the request and understand the potential responses you might receive. This phase involves clear communication with your credit card company and a realistic understanding of how credit limit increase requests are evaluated.

Credit Inquiry Types

When you request a credit limit increase, the credit card issuer will likely review your credit report. It’s important to be aware of the two main types of inquiries that can appear on your credit report: a hard inquiry and a soft inquiry. Understanding the difference is key to managing your credit health.A hard inquiry occurs when a lender checks your credit report as part of a decision on a new credit application.

This includes applications for credit cards, mortgages, auto loans, and personal loans. Hard inquiries can temporarily lower your credit score by a few points, as they suggest you are actively seeking new credit, which can be seen as a higher risk.A soft inquiry, on the other hand, happens when your credit is checked for reasons other than a new credit application.

This can include checking your own credit report, pre-qualification offers, or when an employer performs a background check. Soft inquiries do not affect your credit score. Most credit limit increase requests result in a hard inquiry, though some issuers may use a soft inquiry if they have sufficient information about your account. It is advisable to confirm with your credit card issuer which type of inquiry they perform.

Effective Communication Strategies

Communicating your request for a credit limit increase effectively can significantly improve your chances of a positive outcome. This involves being clear, concise, and providing relevant information that supports your request.When contacting your credit card company, whether by phone or through their online portal, be prepared to state your request directly. It’s helpful to have your account information readily available.

Highlight your positive payment history and how you’ve managed your account responsibly. If you have a specific reason for needing a higher limit, such as upcoming large purchases or a desire to improve your credit utilization ratio, mentioning this can be beneficial.

Polite and Persuasive Language Examples

Using polite and persuasive language can make your request more impactful. The tone should be respectful and confident, emphasizing your value as a customer.Here are a few examples of phrases you can adapt:

- “I’ve been a loyal customer with [Credit Card Company Name] for [Number] years and have consistently managed my account responsibly, always making payments on time. I would like to request an increase in my credit limit to [Desired Amount] to better accommodate my spending needs and improve my credit utilization.”

- “My financial situation has improved, and I’m looking to consolidate some of my larger planned expenses. Given my strong payment history with your card, I believe a higher credit limit would be beneficial. Could you please consider increasing my current limit?”

- “I’m interested in exploring the possibility of a higher credit limit on my account. I’ve been using my card for [Purpose, e.g., travel rewards, everyday purchases] and would appreciate the flexibility that a larger limit would provide, especially as I plan to [mention upcoming expense or goal].”

Potential Outcomes of Your Request

When you request a credit limit increase, there are typically two primary outcomes: your request is approved, or it is denied. Each outcome has its own implications and subsequent steps. Successful Request: If your request is approved, your credit card issuer will increase your credit limit to the requested amount or a slightly lower amount they deem appropriate. This can be very beneficial for managing your finances, as it can lower your credit utilization ratio (the amount of credit you’re using compared to your total available credit), which is a significant factor in your credit score.

A lower utilization ratio generally leads to a higher credit score. It also provides more flexibility for larger purchases or emergencies. Denied Request: If your request is denied, it’s important not to be discouraged. A denial simply means that based on your current credit profile and the issuer’s policies, they are not comfortable extending more credit at this time. It’s crucial to understand the reason for the denial to address any underlying issues.

Addressing a Denied Request and Reapplication

If your credit limit increase request is denied, the first step is to understand why. Most credit card companies will provide a reason for the denial, either in writing or verbally if you call to inquire. Once you know the reason, you can take steps to improve your creditworthiness.If the denial was due to insufficient credit history, focus on building a longer and more positive credit track record.

This involves using your existing credit responsibly and making all payments on time. If the denial was related to high credit utilization on other cards, work on paying down those balances. If recent late payments were the issue, maintaining a perfect payment history moving forward is essential.When you are ready to reapply, ensure you have addressed the reasons for the previous denial.

It’s generally recommended to wait a period of time before reapplying, as multiple recent applications within a short span can negatively impact your credit score. The timeframe for reapplying varies depending on the reason for denial.

Common Reasons for Denial and Solutions

Here is a table outlining common reasons for credit limit increase denials and how to address them, along with recommended reapplication timeframes:

| Reason for Denial | Potential Solutions | Timeframe to Reapply |

|---|---|---|

| Insufficient Credit History | Continue responsible credit use, make timely payments. | 6-12 months |

| High Credit Utilization on Other Cards | Reduce balances on other credit accounts. | 3-6 months |

| Recent Late Payments | Maintain a perfect payment record going forward. | 6-12 months |

| Insufficient Income or Debt-to-Income Ratio | Provide updated income documentation if possible, or focus on reducing existing debt. | 6-12 months |

| Too Many Recent Credit Inquiries | Allow time for previous inquiries to age on your credit report. | 6-12 months |

Post-Increase Management and Benefits

Receiving a credit limit increase is a positive step, but it also introduces new responsibilities. Effective management of your newly expanded credit line is crucial to harness its benefits without jeopardizing your financial health. This section will guide you through best practices for managing your credit post-increase and highlight the advantages you can expect.Effectively managing your credit card after an increase involves mindful spending and strategic utilization.

This ensures you capitalize on the increased limit for your financial goals while maintaining a strong credit profile.

Budget Adjustment and Spending Habit Adaptation

A higher credit limit can be tempting, but it’s essential to integrate it responsibly into your financial plan. Adjusting your budget and spending habits proactively prevents overspending and ensures the increase serves your financial goals rather than hindering them. It’s about treating the higher limit as an opportunity for enhanced financial flexibility, not an invitation for impulsive purchases.When adapting your spending habits, consider the following:

- Re-evaluate your monthly budget: Incorporate potential increased spending scenarios or planned larger purchases that the higher limit now makes feasible.

- Distinguish needs from wants: With more available credit, it’s easier to blur this line. Prioritize essential expenses and allocate discretionary spending carefully.

- Set spending limits for specific categories: Even with a higher overall limit, designate sub-limits for categories like dining, entertainment, or shopping to maintain control.

- Automate payments: Ensure you don’t miss payments by setting up automatic transfers from your bank account to your credit card, especially if your spending patterns change.

- Regularly review transactions: A quick check of your credit card statement at least weekly can help you stay on top of your spending and identify any unexpected charges.

Maintaining a Low Credit Utilization Ratio

The credit utilization ratio (CUR) is a key factor in your credit score, representing the amount of credit you’re using compared to your total available credit. Even with a higher limit, maintaining a low CUR is paramount. Aiming for a CUR below 30% is generally recommended, with lower being even better for your credit score.Best practices for maintaining a low credit utilization ratio include:

- Pay down balances strategically: Even if you don’t spend more, a higher limit means a larger balance relative to that limit. Make more than the minimum payment whenever possible.

- Make multiple payments per billing cycle: Paying down your balance before the statement closing date can reduce the reported utilization to credit bureaus.

- Spread large purchases across multiple cards: If you have other credit cards, consider distributing significant expenses among them to keep the utilization on any single card low.

- Avoid maxing out cards: This is a cardinal rule, regardless of your credit limit. High utilization signals to lenders that you may be overextended.

- Requesting a limit increase specifically to lower utilization: If your spending remains consistent but your limit increases, your CUR automatically decreases, which can be a significant boost.

The ideal credit utilization ratio is below 30%, but keeping it below 10% can have an even more positive impact on your credit score.

Positive Impact on Credit Score Over Time

A higher credit limit, when managed responsibly, can significantly boost your credit score over time. This is primarily due to the positive effect it has on your credit utilization ratio. A lower CUR indicates to credit bureaus that you are managing your credit responsibly and are not over-reliant on borrowed funds.The benefits to your credit score include:

- Improved credit utilization ratio: As explained, this is the most immediate and impactful benefit. A lower ratio signals lower risk to lenders.

- Demonstration of responsible credit management: Successfully managing a higher credit limit over time shows lenders your ability to handle increased credit responsibly, which builds a positive credit history.

- Potential for higher credit scores: Over months and years of consistent low utilization and on-time payments with a higher limit, your credit score can see a notable increase. This can lead to better interest rates on future loans and credit cards.

For instance, if you previously had a $5,000 credit limit and a $2,000 balance, your utilization was 40%. If your limit is increased to $10,000 and your balance remains $2,000, your utilization drops to 20%, a substantial improvement.

Leveraging a Higher Credit Limit for Specific Financial Goals

A higher credit limit can be a powerful tool for achieving various financial goals, from managing unexpected expenses to planning for larger purchases. It provides the flexibility to navigate financial milestones more smoothly.Examples of how to leverage a higher credit limit include:

- Emergency fund supplement: While not a replacement for a dedicated emergency fund, a higher limit can provide a safety net for unforeseen critical expenses, such as medical bills or urgent home repairs, allowing you to cover them without derailing your budget.

- Financing large purchases: For significant purchases like appliances, electronics, or even a down payment on a vehicle, a higher limit can allow you to make the purchase and pay it off over time, potentially earning rewards or taking advantage of introductory 0% APR offers.

- Travel planning: Booking flights, accommodations, and other travel expenses can be managed more effectively with a higher limit, allowing you to secure better deals and pay them off gradually.

- Debt consolidation (with caution): In some situations, a balance transfer to a new card with a higher limit and a 0% introductory APR could be used to consolidate higher-interest debt, provided a clear payoff plan is in place. This should be approached with careful consideration of fees and the long-term plan.

Considering Future Increases

The decision to request another credit limit increase should be strategic and based on your evolving financial needs and your history of responsible credit management. It’s not about continuously seeking higher limits, but rather about ensuring your credit lines align with your financial capacity and goals.Factors to consider before requesting another increase:

- Sufficient time has passed: Typically, waiting at least six months to a year after your last increase is advisable to demonstrate continued responsible usage.

- Consistent on-time payments: Your payment history is the most critical factor. Ensure you have a perfect record of paying your bills on time.

- Low credit utilization: Continue to maintain a low utilization ratio on your current higher limit.

- Improved income or financial stability: Lenders often consider your income and overall financial stability when approving limit increases. An increase in income or a more stable financial situation can strengthen your case.

- Demonstrated need or plan: Having a clear reason for needing a higher limit, such as an upcoming large purchase or a consistent spending pattern that warrants it, can be beneficial.

Final Conclusion

In conclusion, mastering the art of deciding when to ask for a credit limit increase is about more than just seeking additional funds; it’s about strategic financial planning and demonstrating responsible credit behavior. By understanding your current credit standing, honestly assessing your needs and readiness, diligently preparing your application, and navigating the request process with confidence, you can significantly improve your chances of success.

Remember that a higher credit limit is a tool that, when managed wisely, can unlock new financial opportunities and positively influence your credit score over time. This guide has provided you with the essential roadmap to make informed decisions and leverage your credit effectively.