How to Re-establish Credit After a Financial Hardship, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Experiencing financial hardship can significantly impact your credit score, making it challenging to access loans, housing, or even certain job opportunities. This guide provides a comprehensive roadmap to understand how these setbacks affect your credit and Artikels practical strategies to rebuild your financial standing responsibly. We will explore how to assess your current credit situation, utilize effective credit-building tools, manage existing debt, and cultivate healthy financial habits for lasting success.

Understanding the Impact of Financial Hardship on Credit

Financial hardship can be a deeply challenging period, often stemming from unforeseen circumstances that disrupt one’s financial stability. It’s a situation many individuals and families unfortunately face at some point in their lives, and its effects can ripple through various aspects of personal finance, most notably impacting one’s creditworthiness. Understanding these impacts is the crucial first step in the process of re-establishing credit.The repercussions of financial hardship on credit scores are significant and multifaceted.

When individuals experience a downturn, their ability to manage existing financial obligations can be severely tested. This often leads to a cascade of negative events that are meticulously recorded by credit bureaus, ultimately affecting the numbers that lenders use to assess risk.

Common Causes of Financial Hardship

Financial hardship is rarely caused by a single event but is often a confluence of factors that overwhelm an individual’s financial resilience. These events can range from sudden and unexpected crises to gradual declines in income or increased expenses. Recognizing these common triggers is essential for understanding the broader context of credit damage.Common reasons for experiencing financial hardship include:

- Job Loss or Reduced Income: A sudden termination of employment or a significant reduction in work hours can drastically decrease household income, making it difficult to meet financial obligations.

- Medical Emergencies: Unforeseen medical treatments, hospitalizations, or chronic illnesses can lead to substantial out-of-pocket expenses and lost income due to inability to work.

- Divorce or Separation: The dissolution of a marriage often involves dividing assets and debts, which can strain individual finances, especially if one party was not the primary income earner or is now solely responsible for previously shared expenses.

- Natural Disasters: Events like floods, fires, or hurricanes can cause significant property damage, leading to costly repairs and temporary displacement, impacting both income and expenses.

- Unexpected Major Expenses: Large, unforeseen costs such as significant home repairs, car breakdowns, or the need to care for a sick family member can deplete savings and create financial strain.

- Economic Downturns: Broader economic recessions or industry-specific downturns can lead to widespread job losses and reduced earning potential, affecting many individuals simultaneously.

Negative Effects of Hardship on Credit Scores

When individuals encounter financial difficulties, their credit reports often reflect a series of negative events that directly contribute to a decline in their credit scores. These events signal to lenders a higher risk of default, making it more challenging to secure new credit or favorable terms on existing loans.Events like job loss, medical emergencies, or divorce can negatively affect credit scores in several ways:

- Missed or Late Payments: The most direct impact comes from an inability to make timely payments on credit cards, loans, mortgages, or other bills. Each missed or late payment is a significant negative mark on a credit report.

- High Credit Utilization: When income decreases, individuals may rely more heavily on credit cards to cover expenses. This leads to a higher credit utilization ratio, which is the amount of credit used compared to the total available credit. A high utilization ratio negatively impacts credit scores.

- Debt Collection Accounts: If debts go unpaid for an extended period, they may be sent to collections. A collection account is a severe negative item that significantly lowers a credit score.

- Charge-offs: When a lender determines that a debt is unlikely to be repaid, they may “charge it off.” This means the lender writes off the debt as a loss, and it remains on the credit report as a negative entry.

- Bankruptcy: Filing for bankruptcy, whether Chapter 7 or Chapter 13, is one of the most damaging events for a credit score. It indicates a severe inability to manage debt and remains on a credit report for many years.

- Foreclosure: If a homeowner can no longer afford mortgage payments, the lender may foreclose on the property. This is a severe negative event that significantly damages credit.

Typical Credit Score Drops Associated with Financial Setbacks

The exact credit score drop associated with financial hardship varies greatly depending on the severity and duration of the setback, as well as the individual’s credit history prior to the event. However, significant financial setbacks can lead to substantial reductions in credit scores.For instance, a single late payment can lower a score by tens of points. Multiple late payments or a 30-day delinquency can have an even greater impact.

A 60-day or 90-day delinquency will result in a more severe score reduction.Consider these examples:

- A 30-day late payment can reduce a FICO score by approximately 60-80 points for someone with excellent credit.

- A 90-day late payment or a charge-off can reduce a score by 100 points or more.

- A bankruptcy filing can reduce a FICO score by 150-200 points or even more, and it can remain on a credit report for up to 10 years.

- A foreclosure can also lead to a significant drop of 100 points or more.

It’s important to remember that these are estimates, and the actual impact can be influenced by other factors on the credit report.

Key Credit Report Components Most Affected by Hardship

A credit report is a detailed record of an individual’s credit history. When financial hardship strikes, certain components of this report are particularly vulnerable and often bear the brunt of the negative impact. Understanding which parts of your credit report are most affected can help you prioritize your efforts in rebuilding your credit.The key credit report components most affected by hardship include:

- Payment History: This is the most critical factor influencing credit scores, accounting for about 35% of a FICO score. Late payments, missed payments, and defaults directly impact this section, leading to significant score degradation.

- Amounts Owed (Credit Utilization): This component, accounting for about 30% of a FICO score, reflects how much credit you are using compared to your total available credit. During hardship, increased reliance on credit cards can lead to high utilization, negatively affecting your score.

- Length of Credit History: While not directly impacted by a single event, prolonged hardship can lead to accounts being closed by lenders or the inability to open new accounts, which can shorten the average age of your accounts over time, indirectly affecting this component.

- New Credit: If you are forced to open new credit accounts to manage expenses, or if lenders close your existing accounts due to non-payment, this can affect the “New Credit” and “Credit Mix” components.

- Public Records: This section includes items like bankruptcies, foreclosures, and judgments, which are severe negative marks that have a profound impact on credit scores.

Assessing Your Current Credit Situation

Understanding where you stand financially after a period of hardship is the crucial next step in re-establishing your credit. This involves a thorough examination of your credit reports and scores to identify both strengths and areas needing improvement. A clear picture of your current credit landscape will guide your strategy for rebuilding.This section will walk you through the essential process of gathering and analyzing your credit information.

By following these steps, you will gain a comprehensive understanding of your creditworthiness and the specific factors influencing it post-hardship.

Obtaining and Reviewing Credit Reports

Your credit reports are detailed summaries of your credit history. They are maintained by three major credit bureaus in the United States: Equifax, Experian, and TransUnion. It is vital to obtain your reports from all three, as they may contain slightly different information or errors.To get your free credit reports, you are entitled to one free report from each of the three bureaus every 12 months.

This can be accessed through the official website, AnnualCreditReport.com. This website is the only federally authorized source for your free annual credit reports.Here is a step-by-step guide to obtaining and reviewing your credit reports:

- Visit AnnualCreditReport.com.

- Click on the link to request your credit reports.

- Provide the necessary personal information to verify your identity. This typically includes your name, address, Social Security number, and date of birth.

- Select the credit bureaus from which you wish to receive your reports. It is highly recommended to select all three (Equifax, Experian, and TransUnion).

- Follow the on-screen instructions to access and download your reports. You may receive them immediately online or via mail.

- Once you have your reports, review each one meticulously. Pay close attention to your personal information, account details, payment history, and any public records or collections.

Take your time to compare the information across all three reports. Note any discrepancies or items you do not recognize.

Identifying Errors or Inaccuracies on Credit Reports

Errors on your credit report can significantly hinder your credit rebuilding efforts. These can range from incorrect personal information to inaccurate account statuses or duplicate entries. It is imperative to identify and dispute any inaccuracies promptly.Common errors include:

- Incorrect personal information (e.g., wrong address, misspelled name).

- Accounts that do not belong to you.

- Incorrectly reported late payments or missed payments.

- Closed accounts that are still showing as open.

- Incorrect balances or credit limits.

- Duplicate negative entries for the same delinquency.

If you discover an error, you have the right to dispute it with the credit bureau and the creditor that reported the information. The process typically involves submitting a dispute in writing, along with supporting documentation. The credit bureaus are required to investigate your dispute within a reasonable timeframe, usually 30 days.

Understanding Credit Utilization Ratio

Your credit utilization ratio (CUR) is a critical factor in your credit score calculation. It represents the amount of credit you are using compared to your total available credit. A high utilization ratio can negatively impact your score, especially after financial hardship.The formula for calculating your credit utilization ratio is:

Credit Utilization Ratio = (Total Balances on Credit Cards / Total Credit Limits on Credit Cards) – 100

For example, if you have a total credit card balance of $2,000 and a total credit limit of $10,000 across all your cards, your CUR would be 20% ($2,000 / $10,000 – 100).Experts generally recommend keeping your overall credit utilization below 30%, and ideally below 10%, for optimal credit scoring. After financial hardship, it’s common for balances to be higher relative to limits.

Actively working to reduce these balances is a key step in improving your credit utilization and, consequently, your credit score.

Tracking Credit Score Progress

Monitoring your credit score’s progress is essential to gauge the effectiveness of your credit rebuilding strategies. Regularly checking your score allows you to see how your actions are impacting your creditworthiness and to make necessary adjustments to your approach.Here is a method for tracking your credit score’s progress:

- Choose a Credit Monitoring Service: Many financial institutions and credit bureaus offer free credit score monitoring services to their customers. There are also third-party services available, some of which offer free access to your score and credit report.

- Understand Which Score You Are Tracking: Be aware that there are different scoring models (e.g., FICO, VantageScore) and variations within those models. While they are generally correlated, they may not always show the exact same number.

- Establish a Baseline Score: Obtain your credit score from a reliable source and record it. This will be your starting point for comparison.

- Regularly Check Your Score: Aim to check your credit score at least once a month. This frequency allows you to observe trends without being overly fixated on minor daily fluctuations.

- Review Associated Factors: Most credit monitoring services will also provide information on the factors influencing your score, such as payment history, credit utilization, and length of credit history. Reviewing these factors alongside your score will help you understand what is driving any changes.

- Document Your Progress: Keep a simple log or spreadsheet of your credit score each month, along with any significant financial actions you’ve taken (e.g., paying down a credit card, opening a new account). This documentation will help you identify which strategies are most effective.

Consistent monitoring provides valuable feedback, reinforcing positive financial behaviors and highlighting areas where further attention is needed.

Strategies for Rebuilding Credit Responsibly

Rebuilding credit after financial hardship is a journey that requires patience, discipline, and a strategic approach. It’s about demonstrating to lenders that you can manage credit responsibly over time. This section Artikels key strategies to help you navigate this process effectively and lay a solid foundation for your financial future.The cornerstone of credit rebuilding is establishing a consistent history of responsible financial behavior.

This means understanding what actions positively impact your credit score and diligently implementing them. By focusing on these core principles, you can gradually improve your creditworthiness.

Importance of On-Time Payments

Making on-time payments is the single most significant factor influencing your credit score. Payment history accounts for approximately 35% of your FICO score, making it crucial for rebuilding credit. Consistently paying your bills by their due date demonstrates reliability and reduces the risk for potential lenders. Late payments, even by a few days, can have a detrimental effect, lowering your score and making it harder to secure future credit.To ensure you never miss a payment, proactive measures are essential.

This involves organizing your bills and setting up systems that remind you of upcoming due dates or automate the payment process altogether.

Methods for Setting Up Payment Reminders or Automatic Payments

Implementing a robust system for managing payments is vital for maintaining an excellent payment history. Fortunately, there are several convenient methods available to help you stay on track.

- Calendar Alerts: Set recurring reminders on your smartphone, computer, or digital calendar a few days before each bill is due. This provides a visual cue and allows ample time for processing.

- Email Notifications: Many service providers and credit card companies offer email alerts for upcoming due dates or when a payment is due. Ensure your contact information is up-to-date with all your creditors.

- Bank Bill Pay Services: Most financial institutions offer online bill pay services. You can schedule payments in advance, either as one-time transactions or recurring payments, ensuring they are sent out before the due date.

- Automatic Payments (AutoPay): This is often the most effective method for ensuring on-time payments. You can set up automatic withdrawals from your bank account or charges to a debit/credit card for a fixed amount or the full balance. It’s important to monitor your account to ensure sufficient funds are available to avoid overdraft fees or returned payments.

Role of a Secured Credit Card in Credit Rebuilding

A secured credit card is an invaluable tool for individuals looking to establish or rebuild their credit history, especially after financial hardship. Unlike traditional credit cards, secured cards require a cash deposit upfront, which typically serves as your credit limit. This deposit mitigates risk for the lender, making it easier for individuals with no or poor credit history to get approved.By using a secured credit card responsibly, you can demonstrate to credit bureaus that you can manage credit.

The issuer reports your payment activity to the major credit bureaus, just like a regular credit card.To maximize the benefits of a secured credit card:

- Make small, regular purchases that you can easily afford to pay off.

- Always pay your balance in full and on time each month.

- Avoid maxing out the card, as high credit utilization can negatively impact your score.

Over time, with consistent responsible use, your secured credit card can help you transition to an unsecured credit card and build a positive credit profile.

Sample Budget to Prioritize Credit-Related Expenses

Creating a budget is fundamental to managing your finances effectively and ensuring you can meet your credit obligations. A well-structured budget helps you allocate funds specifically for credit rebuilding expenses, preventing overspending and missed payments.Here is a sample budget framework designed to prioritize credit-related expenses. This is a flexible template and should be adapted to your individual income and expenses.

| Expense Category | Budgeted Amount | Actual Amount | Notes |

|---|---|---|---|

| Income (Net) | $X,XXX | $X,XXX | After taxes and deductions |

| Essential Living Expenses | |||

| Housing (Rent/Mortgage) | $XXX | $XXX | |

| Utilities (Electricity, Water, Gas, Internet) | $XXX | $XXX | |

| Groceries | $XXX | $XXX | |

| Transportation (Gas, Public Transport, Car Payment) | $XXX | $XXX | |

| Insurance (Health, Auto, Renters) | $XXX | $XXX | |

| Credit Rebuilding Expenses | |||

| Secured Credit Card Payment (Minimum/Full) | $XX | $XX | Prioritize paying in full if possible |

| Loan Payment (if applicable) | $XX | $XX | |

| Credit Monitoring Service (Optional) | $XX | $XX | |

| Discretionary Spending | |||

| Entertainment | $XX | $XX | Adjust as needed |

| Dining Out | $XX | $XX | |

| Personal Care | $XX | $XX | |

| Savings & Debt Reduction | |||

| Emergency Fund Contribution | $XX | $XX | Crucial for unexpected expenses |

| Additional Debt Payment | $XX | $XX | To accelerate debt reduction |

| Total Expenses | $X,XXX | $X,XXX | Should not exceed Income |

| Remaining Balance | $XX | $XX | Ideally a surplus for savings or extra debt payment |

When creating your budget, it is essential to allocate sufficient funds for your credit card payments. Aim to pay more than the minimum amount due whenever possible, as this reduces the overall interest paid and helps you pay down the balance faster. If your income is tight, consider areas of discretionary spending that can be reduced to free up funds for credit-related obligations.

A consistent surplus in your budget can be directed towards building an emergency fund, which acts as a buffer against future financial shocks, preventing the need to rely on credit in unexpected situations.

Utilizing Credit-Building Tools and Products

Re-establishing credit after a financial hardship often requires a strategic approach, and fortunately, several tools and products are specifically designed to assist in this process. These resources can help individuals demonstrate responsible credit behavior and gradually rebuild their creditworthiness. It is important to understand the nuances of each option to select the most suitable ones for your personal situation.The careful selection and responsible use of credit-building tools are paramount.

By understanding their benefits, potential risks, and how they are reported to credit bureaus, individuals can effectively leverage them to improve their financial standing.

Credit-Builder Loans

Credit-builder loans are a unique financial product designed to help individuals with no or poor credit history establish or rebuild their credit. The fundamental principle behind these loans is that the borrowed money is held in an account by the lender and is gradually released to the borrower as they make payments. This process allows the borrower to demonstrate consistent repayment behavior.The benefits of credit-builder loans include their direct impact on credit scores through timely payments, the security of knowing the funds are being saved, and often, a low-interest rate.

However, potential risks include the inability to access the funds until the loan is fully repaid, and the possibility of incurring fees or higher interest rates if payments are missed. It is crucial to read the loan agreement carefully to understand all terms and conditions.

Secured Credit Cards Versus Unsecured Credit Cards

Both secured and unsecured credit cards can be valuable tools for rebuilding credit, but they operate differently and cater to distinct needs. Understanding these differences is key to choosing the right card.A secured credit card requires a cash deposit upfront, which typically becomes the credit limit on the card. This deposit acts as collateral for the lender, significantly reducing their risk.

The primary benefit of secured cards is their accessibility for individuals with poor credit. Responsible use, such as making on-time payments and keeping balances low, is reported to credit bureaus, thereby helping to build a positive credit history.

In contrast, unsecured credit cards do not require a security deposit. They are typically offered to individuals with a fair to good credit history. For those rebuilding credit, obtaining an unsecured card may be more challenging initially. However, if approved, they offer the same benefits as secured cards in terms of credit building through responsible usage.

| Feature | Secured Credit Card | Unsecured Credit Card |

|---|---|---|

| Security Deposit | Required (acts as credit limit) | Not Required |

| Approval Likelihood | High, even with poor credit | Lower for those with poor credit |

| Credit Limit | Usually equal to the deposit | Based on creditworthiness |

| Primary Use for Rebuilding | Excellent entry point | A goal to work towards after demonstrating responsibility |

Alternative Credit Reporting Options

Beyond traditional credit accounts, several alternative data sources can now be reported to credit bureaus, offering new avenues for individuals to demonstrate their creditworthiness. These options are particularly beneficial for those who may not yet qualify for traditional credit products or who want to supplement their credit profile.The inclusion of rent and utility payments in credit reports is a significant development.

Many individuals consistently pay these bills on time, but this positive payment history was often not reflected in their credit scores. By opting into services that report these payments, individuals can showcase their reliability to lenders.

To leverage these alternative reporting options, individuals can:

- Inquire with their landlords or utility providers if they offer reporting services.

- Utilize third-party services that specialize in reporting rent and utility payments to credit bureaus. These services often require verification of payment history.

- Understand that not all lenders consider alternative data equally, but its inclusion can provide a more comprehensive picture of an individual’s financial habits.

Credit Monitoring Services

Credit monitoring services play a crucial role in the credit rebuilding journey by providing individuals with regular access to their credit reports and scores. This ongoing oversight is essential for tracking progress, identifying errors, and staying vigilant against identity theft.The effective use of a credit monitoring service involves several key practices:

- Regularly Review Credit Reports: Access your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) at least annually, or more frequently through your monitoring service. Look for any inaccuracies, such as incorrect personal information, accounts you don’t recognize, or incorrect payment statuses.

- Track Credit Score Changes: Monitor your credit score trends over time. This allows you to see the impact of your responsible credit habits and identify areas that may need further attention. Many services offer daily or weekly score updates.

- Set Up Alerts: Most credit monitoring services offer alerts for significant changes to your credit report, such as new account openings, credit inquiries, or changes in your credit score. These alerts are invaluable for early detection of potential fraud.

- Understand Credit Report Components: Familiarize yourself with the information contained in your credit report, including your personal information, account history, inquiries, and public records. This knowledge empowers you to better interpret your score and identify areas for improvement.

“Consistent and timely payments are the bedrock of a strong credit history. Utilizing credit-building tools responsibly allows you to demonstrate this consistency to lenders.”

Managing Debt After Financial Hardship

Navigating debt after experiencing financial hardship is a crucial step in rebuilding your creditworthiness. This phase requires a strategic and disciplined approach to regain control of your finances and establish a healthier relationship with your creditors. The following sections Artikel key strategies for managing your existing debt effectively.Effectively managing debt after a period of financial difficulty involves proactive communication and careful planning.

It’s essential to understand your options and implement a structured approach to repayment.

Negotiating with Creditors and Lenders

Open communication with your creditors is paramount when facing financial challenges. Many lenders are willing to work with you to find a solution that prevents default, especially if you demonstrate a genuine commitment to repayment. Before initiating contact, gather all relevant financial information, including your income, expenses, and a clear understanding of the amounts owed.Strategies for successful negotiation include:

- Contacting them early: Do not wait until you miss payments. Reach out as soon as you anticipate difficulty.

- Being honest and transparent: Explain your situation clearly and concisely.

- Proposing a solution: Come prepared with a realistic repayment proposal, such as a temporary reduction in payments, a deferment, or a modified payment plan.

- Asking about hardship programs: Many institutions have specific programs designed for individuals experiencing financial distress.

- Getting everything in writing: Once an agreement is reached, ensure all terms are documented in writing.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is the backbone of financial recovery. It provides a clear roadmap for tackling your obligations and helps you prioritize which debts to address first. Developing a plan involves understanding your total debt, your income, and your ability to allocate funds towards repayment.Two popular methods for creating a debt repayment plan are:

- The Debt Snowball Method: This strategy involves paying off your smallest debts first, regardless of interest rate. Once a small debt is paid off, you roll that payment amount into the next smallest debt, creating a “snowball” effect. This method can provide psychological wins and build momentum.

- The Debt Avalanche Method: This approach prioritizes paying off debts with the highest interest rates first, while making minimum payments on all other debts. Mathematically, this method saves you the most money on interest over time.

Regardless of the method chosen, it’s vital to create a realistic budget that allocates a specific amount each month towards debt repayment.

Debt Settlement Versus Bankruptcy

When facing overwhelming debt, debt settlement and bankruptcy are two potential, albeit significant, options. Both have profound implications for your credit report and financial future. Understanding their differences is crucial for making an informed decision.

Debt Settlement

Debt settlement involves negotiating with creditors to pay off a portion of your outstanding debt for a lump sum amount that is less than the full balance owed. This is typically done through a debt settlement company. While it can reduce the total amount you owe, it often comes with significant fees and a negative impact on your credit score, as the settlement will be reported.

It can also trigger taxable income if the forgiven debt is considered cancellation of debt income.

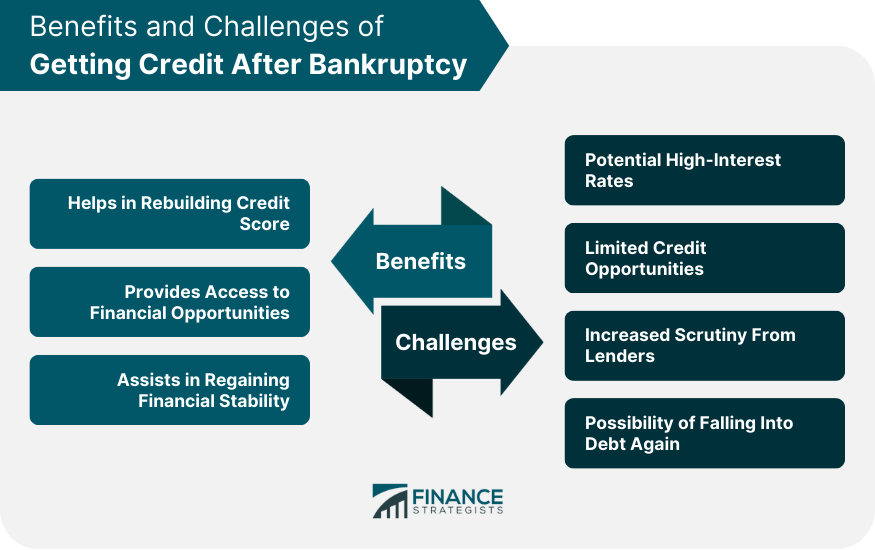

Bankruptcy

Bankruptcy is a legal process that can discharge or reorganize your debts. There are different types of bankruptcy, such as Chapter 7 (liquidation) and Chapter 13 (reorganization), each with its own set of rules and consequences. Filing for bankruptcy has a severe and long-lasting negative impact on your credit score, remaining on your report for seven to ten years. However, it can offer a fresh start and a more comprehensive resolution for unmanageable debt.The choice between debt settlement and bankruptcy depends heavily on the individual’s financial situation, the amount of debt, and their long-term financial goals.

Consulting with a credit counselor or legal professional is highly recommended before making a decision.

Handling Collections Accounts

Collections accounts arise when a debt has gone unpaid for an extended period and has been turned over to a third-party collection agency. These accounts can significantly damage your credit score. It is important to address them strategically and assertively.The process for handling collections accounts typically involves the following steps:

- Verify the debt: Upon receiving notice of a collections account, you have the right to request debt validation from the collection agency. This means they must provide proof that you owe the debt and that they have the legal right to collect it.

- Communicate in writing: All communication with collection agencies should be in writing. This creates a paper trail and protects your rights.

- Negotiate a settlement: If the debt is valid, you may be able to negotiate a settlement for less than the full amount. Be prepared to offer a lump sum payment or a structured payment plan.

- Dispute inaccuracies: If you find any inaccuracies in the collection agency’s reporting or your account information, dispute them immediately with both the collection agency and the credit bureaus.

- Understand your rights: Familiarize yourself with the Fair Debt Collection Practices Act (FDCPA), which Artikels the rules collection agencies must follow and protects consumers from abusive or deceptive practices.

It is important to be aware that paying a collections account may not always remove it from your credit report, but it will reflect that the account is no longer delinquent, which is generally viewed more favorably by lenders than an unpaid collection.

Developing Healthy Financial Habits for Long-Term Success

Rebuilding credit after financial hardship is a significant accomplishment, but maintaining that progress requires cultivating sustainable financial habits. This section focuses on establishing practices that will not only safeguard your credit but also contribute to your overall financial well-being and long-term security. By integrating these habits into your daily life, you can build a robust financial foundation that withstands future challenges.The transition from financial difficulty to stability is a journey that involves more than just managing debt and credit.

It necessitates a fundamental shift in financial behavior, prioritizing prudence and foresight. Developing healthy financial habits is the cornerstone of this transformation, ensuring that the progress made is not only maintained but also continues to grow.

Establishing an Emergency Fund

An emergency fund serves as a critical safety net, protecting you from unexpected expenses that could otherwise derail your financial progress or force you back into debt. It’s a proactive measure that provides peace of mind and financial resilience. The goal is to accumulate enough savings to cover essential living expenses for a specified period, typically three to six months.The importance of an emergency fund cannot be overstated.

It acts as a buffer against life’s uncertainties, such as job loss, medical emergencies, or significant home repairs. Without this fund, such events can quickly lead to taking on new, high-interest debt, negating the hard work of credit rebuilding.Methods for building an emergency fund include:

- Automating Savings: Set up automatic transfers from your checking account to a dedicated savings account each payday. Treat this transfer as a non-negotiable bill.

- Direct Deposit Allocation: If your employer offers direct deposit, you can often split your paycheck, directing a portion directly into your savings account.

- Windfall Allocation: When you receive unexpected income, such as a tax refund, bonus, or gift, allocate a significant portion to your emergency fund.

- Cutting Expenses: Identify areas in your budget where you can reduce spending and redirect those savings to your emergency fund. Even small, consistent contributions add up over time.

The target amount for an emergency fund varies based on individual circumstances, including job stability, dependents, and essential monthly expenses. However, starting with a smaller, achievable goal, such as $500 or $1,000, can build momentum and confidence.

Creating and Sticking to a Realistic Budget

A budget is an essential tool for understanding where your money goes and for making informed decisions about your spending. It provides a roadmap for your finances, allowing you to allocate funds towards your goals, including debt repayment and savings, while ensuring your essential needs are met. A realistic budget is one that accurately reflects your income and expenses and is flexible enough to adapt to changes.The process of creating a budget involves tracking your income and all your expenses.

This can be done manually using a spreadsheet, or through various budgeting apps and software. The key is to be thorough and honest in your tracking.Steps to creating and adhering to a budget:

- Calculate Total Income: Determine your net income (after taxes and deductions) from all sources.

- Track All Expenses: For at least one month, meticulously record every dollar spent. Categorize these expenses (e.g., housing, food, transportation, entertainment, debt payments).

- Analyze Spending Patterns: Review your tracked expenses to identify areas where you might be overspending or where cuts can be made.

- Set Spending Limits: Based on your income and expense analysis, establish realistic spending limits for each category.

- Prioritize Needs Over Wants: Ensure that essential needs are covered before discretionary spending.

- Regularly Review and Adjust: Your budget is not static. Review it monthly and make adjustments as your income, expenses, or financial goals change.

Sticking to a budget requires discipline and commitment. It is helpful to visualize your financial goals and remind yourself why you are budgeting. Engaging in mindful spending, questioning purchases before making them, and finding free or low-cost alternatives for entertainment can also aid in adherence.

Tips for Avoiding New Debt While Rebuilding

Preventing the accumulation of new debt is paramount during the credit rebuilding phase. It requires a conscious effort to live within your means and to resist the temptation of immediate gratification that often comes with credit. The goal is to break the cycle of debt that may have led to past financial hardship.Strategies to avoid new debt include:

- Cash-Only Spending: For non-essential purchases, consider using cash. When the cash is gone, the spending stops, which can be a powerful psychological barrier to overspending.

- Delaying Purchases: For significant non-essential items, implement a waiting period (e.g., 24-48 hours). This allows time to assess if the purchase is truly necessary and if it aligns with your budget.

- Seeking Free Entertainment: Explore free community events, parks, libraries, and at-home activities instead of expensive outings.

- Negotiating Bills: Periodically review your recurring bills (e.g., cable, internet, insurance) and negotiate for lower rates or explore more affordable providers.

- Avoiding Impulse Buys: Unsubscribe from marketing emails that trigger impulse purchases and avoid browsing online stores without a specific need.

- Utilizing Your Emergency Fund Appropriately: Remember that your emergency fund is for true emergencies, not for discretionary spending or convenience purchases.

A commitment to living below your means is the most effective way to avoid new debt. This means consistently spending less than you earn and directing any surplus towards debt reduction or savings.

Checklist for Ongoing Credit Health Maintenance

Maintaining good credit health is an ongoing process that requires regular attention and proactive management. This checklist provides a framework for regularly assessing and safeguarding your credit standing to ensure long-term financial stability.

| Frequency | Action Item | Notes/Importance |

|---|---|---|

| Monthly | Review credit reports from all three bureaus (Equifax, Experian, TransUnion). | Check for accuracy, unauthorized accounts, and any suspicious activity. You are entitled to a free report from each bureau annually at AnnualCreditReport.com, but checking monthly can help catch issues sooner. |

| Monthly | Track spending against your budget. | Ensure you are staying within your established limits and identify any potential overspending early. |

| Monthly | Monitor your credit utilization ratio. | Keep credit card balances low, ideally below 30% of the credit limit, to positively impact your credit score. |

| Monthly | Review your bank and credit card statements. | Verify all transactions and look for any fraudulent activity or unexpected fees. |

| Quarterly | Assess your progress towards savings goals (e.g., emergency fund). | Celebrate milestones and adjust contributions if necessary to stay on track. |

| Quarterly | Review your debt repayment plan. | Ensure you are meeting your payment obligations and explore opportunities to accelerate repayment if possible. |

| Annually | Review your credit score. | Understand what factors are influencing your score and identify areas for improvement. |

| Annually | Re-evaluate your budget and financial goals. | Life circumstances change; ensure your budget and goals remain relevant and achievable. |

| As Needed | Address any inaccuracies or disputes on your credit report immediately. | Prompt action is crucial for correcting errors and protecting your credit. |

| As Needed | Seek professional financial advice if facing significant challenges or complex financial decisions. | A financial advisor can provide guidance and support tailored to your situation. |

Illustrative Scenarios of Credit Rebuilding Journeys

Embarking on a credit rebuilding journey after financial hardship can feel daunting, but understanding the experiences of others can provide valuable insight and motivation. These real-world scenarios demonstrate that with consistent effort and strategic planning, significant improvements in creditworthiness are achievable. By examining these diverse paths, individuals can identify strategies that best align with their unique circumstances.The following case studies illustrate the varied approaches and timelines involved in successfully rebuilding credit.

Each narrative highlights specific actions taken, the tools utilized, and the tangible results achieved, offering a roadmap for those seeking to regain financial footing.

Credit Rebuilding After Job Loss: Sarah’s Story

Sarah, a marketing professional, faced unexpected job loss which led to a period of financial strain. This impacted her credit score significantly due to missed payments on her existing credit card and a personal loan. Upon securing new employment, Sarah was determined to rebuild her credit. Her first step was to contact her creditors to set up a payment plan for the outstanding balances, ensuring all future payments were made on time.

She then decided to open a secured credit card with a small credit limit, using it for minor, recurring expenses like her monthly streaming service subscription. She made sure to pay the full balance of this secured card every month, well before the due date. Additionally, Sarah utilized a budgeting app to meticulously track her income and expenses, preventing overspending.

She also enrolled in a credit monitoring service to keep a close eye on her progress. Within 18 months, her consistent on-time payments and responsible utilization of the secured card led to a noticeable increase in her credit score, allowing her to qualify for an unsecured credit card with a better interest rate.

Secured Credit Card and Credit-Builder Loan for Medical Debt Recovery: Mark’s Case

Mark accumulated substantial medical debt following an unforeseen illness, which negatively affected his credit history. To address this, he first negotiated a manageable payment plan with the medical provider. Simultaneously, Mark applied for a secured credit card, depositing $300 to secure a credit line of the same amount. He used this card for small, essential purchases and paid it off in full each month.

To further bolster his credit, Mark also obtained a credit-builder loan from his local credit union. This loan involved him making regular payments into a savings account, which he could access upon completion of the loan term, while the payments themselves were reported to the credit bureaus. This dual strategy of responsible credit card use and consistent credit-builder loan payments allowed Mark to demonstrate his renewed ability to manage credit.

After two years, his credit score had improved enough for him to refinance his car loan at a more favorable rate, a significant step towards his long-term financial goals.

Impact of Consistent On-Time Payments on Credit Score Increase

The most critical factor in credit score improvement is consistently making on-time payments. Even with a new credit account, demonstrating reliability can yield substantial results. For instance, an individual who opens a new credit card with a $500 limit and utilizes only 10% of that limit ($50) each month, paying the full balance by the due date, will observe a positive impact on their credit score over time.

This behavior signals to lenders that the individual is a responsible borrower. Over a 12-month period, this consistent pattern of low credit utilization and perfect payment history on a single account can lead to a credit score increase of 50 to 100 points, depending on the individual’s starting score and other factors in their credit report. This illustrates the power of simple, consistent positive actions.

Hypothetical Timeline of Credit Score Improvement

The rebuilding of credit is typically a gradual process, not an overnight transformation. The following hypothetical timeline illustrates the expected progression of credit scores after a period of significant financial difficulty, such as bankruptcy or multiple defaults.

Initial Stage (Months 0-6): Stabilizing and Establishing New Habits

- Credit Score: Remains low, potentially in the low 500s.

- Focus: Addressing immediate financial needs, creating a budget, and making all essential payments on time. Opening a secured credit card or credit-builder loan.

- Actions: Making minimum payments on any existing debts, avoiding new debt, and starting to use a secured card for small purchases, paying it off in full monthly.

Early Improvement (Months 7-18): Demonstrating Consistency

- Credit Score: May see an increase to the mid-to-high 500s.

- Focus: Consistent on-time payments on new credit accounts and any manageable payment plans for old debts. Maintaining low credit utilization.

- Actions: Continuing to use secured credit responsibly, making all payments on time. If a credit-builder loan is in place, making those payments diligently.

Moderate Growth (Months 19-36): Building a Positive History

- Credit Score: Can reach the high 600s.

- Focus: Continued responsible credit management, potentially opening an additional, small unsecured credit card if approved.

- Actions: Paying off secured credit card balances in full, making on-time payments on any new accounts. Avoiding applying for too much new credit at once.

Significant Advancement (Months 37+): Approaching Good Credit Standing

- Credit Score: Can reach the low to mid-700s.

- Focus: Maintaining a strong payment history, keeping credit utilization low, and having a diverse mix of credit (if applicable and managed responsibly).

- Actions: Managing multiple credit accounts responsibly, continuing to monitor credit reports for accuracy, and avoiding high-risk financial behaviors.

Conclusive Thoughts

Rebuilding credit after a financial hardship is a journey that requires patience, discipline, and a strategic approach. By understanding the impact of past events, diligently reviewing your credit reports, and implementing responsible financial practices, you can gradually restore your creditworthiness. Embracing tools like secured credit cards and credit-builder loans, coupled with consistent on-time payments and sound budgeting, will pave the way for a stronger financial future and greater peace of mind.