Kicking off with How to Manage Student Loans to Build Your Credit Score, this opening paragraph is designed to captivate and engage the readers, setting the tone for a comprehensive exploration of this crucial financial topic. Understanding the intricate link between your student loan obligations and your creditworthiness is a fundamental step towards achieving long-term financial health.

This guide delves into the core principles of student loan management, illuminating how responsible repayment directly influences your credit utilization and payment history. We will demystify common misconceptions, identify the key players in credit reporting, and equip you with actionable strategies to transform your student loans from a potential burden into a powerful tool for building a robust credit score.

Understanding Student Loans and Credit Scores

Managing student loans effectively is a cornerstone of building a robust credit score. Your approach to repaying these significant financial obligations directly influences how lenders perceive your creditworthiness. This section will illuminate the fundamental connection between student loan management and credit score development, demystify common misconceptions, and identify the key entities involved in tracking your loan activity.The relationship between student loans and credit scores is symbiotic; responsible management enhances your score, while neglect can severely damage it.

Every payment you make, or miss, is meticulously recorded and factored into your credit report. Understanding this dynamic is crucial for leveraging your student loans as a tool for financial growth rather than a hindrance.

The Fundamental Relationship Between Student Loans and Credit Scores

Student loans represent a form of debt that, when managed responsibly, can significantly contribute to establishing and improving your credit history. As a borrower, your consistent and timely repayment of these loans demonstrates your reliability and ability to meet financial obligations. This positive behavior is precisely what credit bureaus look for when assessing an individual’s creditworthiness. By successfully navigating student loan repayment, you are actively building a track record of financial responsibility, which is the bedrock of a strong credit score.

How Responsible Student Loan Repayment Impacts Credit Utilization and Payment History

Responsible student loan repayment directly influences two of the most critical factors in credit scoring: payment history and credit utilization. Your payment history, which accounts for a substantial portion of your credit score (typically around 35%), is built by making all your loan payments on time. Even a single late payment can have a negative impact. For credit utilization, which is the amount of credit you are using compared to your total available credit (typically around 30% of your score), student loans, especially federal ones with deferred payment options, generally do not contribute to this ratio in the same way as revolving credit like credit cards.

However, if you have private student loans that require immediate repayment or if you are actively paying down your loans, this demonstrates a commitment to reducing debt, which is viewed favorably.

Common Misconceptions About Student Loans and Their Effect on Creditworthiness

Several widespread misunderstandings can lead borrowers to make suboptimal financial decisions regarding their student loans and credit. One common misconception is that student loans do not affect credit scores at all, or that they only affect it negatively. In reality, timely payments on student loans are a powerful way to build a positive credit history. Another myth is that consolidating or refinancing student loans automatically improves your credit score.

While these actions can sometimes lead to better terms, the impact on your credit score depends on how the process is managed and whether it results in a new credit inquiry or a change in your payment history. Furthermore, some believe that deferring or forbearance options will not impact their credit, but while they may prevent immediate negative marks for non-payment, they do not contribute to building a positive payment history.

The Primary Credit Bureaus and the Information They Collect Regarding Loan Activity

The three primary credit bureaus in the United States are Equifax, Experian, and TransUnion. These organizations are responsible for collecting and maintaining detailed credit reports for individuals. When you take out a student loan, the lender reports your loan activity to these bureaus. This information includes:

- The original loan amount

- Your current outstanding balance

- Your payment history (on-time payments, late payments, missed payments)

- The date your loan was opened

- The type of loan (e.g., federal, private)

This data is compiled into your credit report, which is then used by credit scoring models to generate your credit score. A consistent record of responsible borrowing and repayment will lead to a favorable credit report and, consequently, a higher credit score.

Strategies for On-Time Student Loan Payments

Making consistent, on-time payments on your student loans is a cornerstone of building a strong credit score. This diligence not only demonstrates financial responsibility to lenders but also actively contributes to a positive credit history. By adopting strategic payment habits, you can effectively manage your loan obligations and simultaneously enhance your creditworthiness.This section will guide you through practical methods to ensure your student loan payments are always made on time, explore how to integrate these payments into your financial planning, and highlight the advantages of going beyond the minimum payment.

We will also introduce helpful tools to keep you organized and on track.

Setting Up Automatic Loan Payments

Automating your student loan payments is one of the most effective ways to guarantee timeliness and avoid late fees, which can negatively impact your credit score. Most loan servicers offer a direct debit option that automatically withdraws the payment amount from your bank account on a set date.Here are common methods for setting up automatic payments:

- Through Your Loan Servicer’s Website: Log in to your online account provided by your student loan servicer. Navigate to the payment options section and select “auto-pay” or “automatic withdrawal.” You will typically need to provide your bank account and routing numbers.

- Via Phone: Contact your loan servicer directly. A customer service representative can assist you in setting up automatic payments over the phone.

- By Mail (with Recurring Payments): While less common for automatic payments, some servicers may allow you to set up recurring payments via mail with pre-authorized checks or payment slips. However, this method is generally less reliable for consistent on-time payments compared to electronic options.

It is crucial to ensure sufficient funds are available in your bank account on the scheduled payment date to prevent overdraft fees and failed payment notifications. Many servicers also offer the option to adjust the payment date to better align with your income schedule.

Creating a Personal Budget for Loan Payments

A well-structured personal budget is essential for ensuring that your student loan installments are consistently met without straining your finances. By understanding your income and expenses, you can allocate funds effectively and prioritize your loan payments.Follow these steps to create a budget that prioritizes your student loan payments:

- Track Your Income: Determine your total monthly income after taxes. This includes your salary, any freelance earnings, or other consistent sources of revenue.

- Identify Fixed Expenses: List all expenses that remain the same each month. This includes rent or mortgage payments, insurance premiums, and existing loan payments (including your student loans).

- Estimate Variable Expenses: Document your discretionary spending, such as groceries, transportation, utilities, entertainment, and personal care. Review past spending habits to get accurate estimates.

- Calculate Your Surplus or Deficit: Subtract your total expenses (fixed and variable) from your total income. This will reveal how much money you have left over or if you are spending more than you earn.

- Prioritize Student Loan Payments: If you have a surplus, allocate a portion towards your student loan payments. If you have a deficit, identify areas where you can reduce variable expenses to free up funds for your loans. Consider making student loan payments a “must-have” expense, similar to rent or utilities.

- Regularly Review and Adjust: Your financial situation can change. Review your budget at least monthly to ensure it still aligns with your income, expenses, and financial goals, making adjustments as needed.

By integrating your student loan payments as a non-negotiable line item in your budget, you are actively working towards timely payments and a healthier financial future.

Benefits of Paying More Than the Minimum Payment

While making the minimum payment on your student loans fulfills your contractual obligation, strategically paying more can significantly accelerate your debt repayment and positively impact your credit score. This approach demonstrates a proactive stance towards financial management and can yield substantial long-term benefits.The advantages of exceeding the minimum payment include:

- Faster Debt Reduction: Any amount paid above the minimum directly reduces the principal balance of your loan. This means less interest accrues over the life of the loan, allowing you to pay off your debt much sooner. For example, on a $30,000 loan with a 5% interest rate and a 10-year repayment term, consistently paying an extra $100 per month could shave off over two years from your repayment period and save you thousands in interest.

- Improved Credit Utilization Ratio: While not directly tied to student loans in the same way as credit cards, reducing your overall debt burden through accelerated payments can indirectly contribute to a better credit profile. A lower debt-to-income ratio, which can be influenced by managing student loan debt effectively, is a positive factor in credit scoring.

- Reduced Interest Paid: The longer it takes to pay off a loan, the more interest you will pay. By paying down the principal faster, you significantly reduce the total interest paid over the loan’s lifetime. This saved money can be redirected to other financial goals.

- Enhanced Financial Freedom: Becoming debt-free sooner provides greater financial flexibility. You can allocate funds towards savings, investments, or other personal goals without the ongoing burden of student loan payments.

When making extra payments, it is crucial to specify to your loan servicer that the additional amount should be applied to the principal balance, not to future payments. This ensures your extra funds are working efficiently to reduce your debt.

Tools and Apps for Tracking Loan Due Dates and Payments

Staying organized with multiple loan payments can be challenging. Fortunately, a variety of digital tools and mobile applications are available to help you track your student loan due dates, payment amounts, and overall balances, ensuring no payment is missed.Here is a list of helpful tools and apps that can assist you:

- Loan Servicer Portals: Most student loan servicers provide online portals where you can view all your loan details, including balances, interest rates, due dates, and payment history. These portals often have features for setting up reminders or auto-pay.

- Budgeting Apps (e.g., Mint, YNAB, Personal Capital): These comprehensive budgeting applications allow you to link your bank accounts and loan accounts. They can track your spending, categorize expenses, and provide reminders for upcoming bill payments, including your student loans. Many offer a consolidated view of your financial picture.

- Dedicated Loan Management Apps: Some apps are specifically designed for managing student loans. These might offer features like payment calculators, payoff projections, and alerts for significant changes in loan terms or interest rates. Examples include applications like LoanFountain or other similar services that focus on student loan organization.

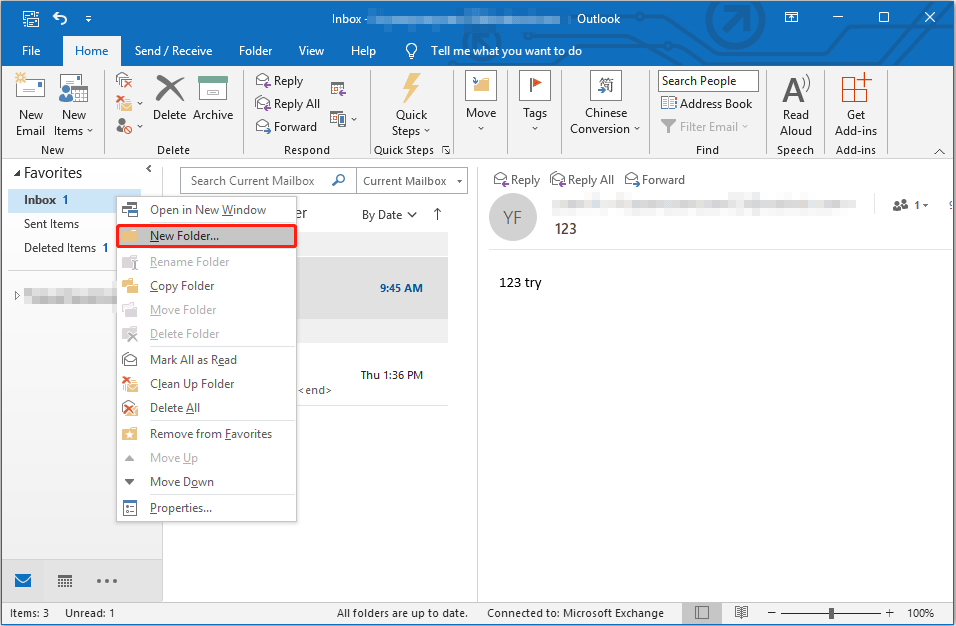

- Calendar Applications (e.g., Google Calendar, Outlook Calendar): For a simpler approach, you can manually set recurring reminders in your digital calendar for each loan payment due date. You can also add notes about the payment amount and the servicer’s contact information.

- Spreadsheets (e.g., Microsoft Excel, Google Sheets): Creating a custom spreadsheet allows you to meticulously track all your loan information, including original loan amounts, current balances, interest rates, payment dates, and amounts paid. You can also use formulas to calculate projected payoff dates and total interest paid.

Utilizing these tools can significantly reduce the mental load of managing student loans, increase your confidence in meeting payment obligations, and contribute to a more robust credit history.

Navigating Different Student Loan Types

Understanding the nuances of various student loan types is crucial for effectively managing your debt and positively impacting your credit score. Federal and private loans have distinct characteristics, repayment options, and implications for credit building. By familiarizing yourself with these differences, you can make informed decisions that align with your financial goals.This section delves into the specific credit-building implications of federal versus private student loans, the role of income-driven repayment plans, and the processes and potential effects of loan consolidation and refinancing.

Federal Versus Private Student Loans: Credit-Building Implications

Federal student loans are generally considered more credit-friendly due to their standardized terms, flexible repayment options, and borrower protections. Private student loans, while offering potentially lower initial interest rates for some, can have a more varied impact on your credit, depending on the lender and the loan terms.Federal loans, such as Direct Subsidized and Unsubsidized loans, are reported to credit bureaus.

Consistent, on-time payments on these loans will contribute positively to your credit history, demonstrating your reliability as a borrower. The sheer volume and widespread availability of federal loans mean that managing them well can build a significant positive credit history.Private student loans are also reported to credit bureaus, but their impact can be more pronounced due to potentially higher interest rates and less flexible repayment terms if you encounter financial difficulties.

If a private loan is obtained with a co-signer, the co-signer’s credit history is also impacted by the loan’s repayment. A default on a private loan can severely damage both the borrower’s and the co-signer’s credit scores.It is important to note that while both types of loans can build credit, federal loans often offer a safer pathway due to their built-in flexibility.

Income-Driven Repayment Plans and Credit Score Development

Income-driven repayment (IDR) plans are designed to make monthly payments more affordable by basing them on your income and family size. While these plans can be a lifesaver for managing monthly expenses, their impact on credit score development requires careful consideration.Under most IDR plans, your monthly payment is recalculated annually. If your income is low, your monthly payment could be as low as $0.

While making a $0 payment does not directly contribute to a positive payment history, it is crucial to understand that not making a payment, even if it’s $0, is not considered a delinquency. As long as you recertify your income annually and make the required payment (even if it’s $0), your loan remains in good standing, and this will not negatively impact your credit score.However, if you miss the recertification deadline or fail to make any payment when one is due, it can lead to delinquency and negatively affect your credit.

The long-term benefit of IDR plans is that they can prevent defaults, which are highly damaging to credit scores. Furthermore, some IDR plans offer loan forgiveness after a certain period of repayment, and this forgiveness itself does not typically have a negative impact on your credit.

Consolidating Student Loans and Its Potential Impact on Credit History

Student loan consolidation is the process of combining multiple federal student loans into a single new loan. This can simplify your repayment by having one monthly payment and potentially a fixed interest rate.When you consolidate federal loans, a new loan is created, and the original loans are paid off. The credit bureaus will see the closure of the old accounts and the opening of a new one.

The impact on your credit score is generally neutral to slightly negative in the short term. The new loan will have a new origination date, which can slightly lower the average age of your credit accounts. Additionally, the interest rate on the consolidated loan is a weighted average of the interest rates of the original loans, rounded up to the nearest one-eighth of a percent.The primary benefit of consolidation for credit building is the simplification of management and the prevention of missed payments.

By having one payment due, you reduce the risk of inadvertently missing a payment on one of your previous loans, which would negatively affect your credit. It’s essential to understand that consolidation does not erase your payment history; the history of the original loans is not directly transferred to the new consolidated loan in a way that preserves its full age.

Scenarios Where Refinancing Student Loans Might Be Beneficial for Credit Enhancement

Refinancing student loans involves replacing your existing student loans with new private loans. This process is distinct from consolidation, which typically applies only to federal loans. Refinancing can be beneficial for credit enhancement in specific circumstances, primarily when you can secure more favorable terms that allow for better management and potential savings.Here are scenarios where refinancing can be advantageous:

- Securing a Lower Interest Rate: If your credit score has improved significantly since you first took out your student loans, you may qualify for a lower interest rate when refinancing with a private lender. A lower interest rate means less interest paid over the life of the loan, making it easier to manage your payments and potentially freeing up funds to allocate towards other credit-building activities or paying down debt faster.

- Shortening the Loan Term: Refinancing with a shorter loan term can lead to higher monthly payments but will result in paying off your debt sooner and saving on interest. This accelerated repayment demonstrates strong financial discipline to credit bureaus.

- Switching from Variable to Fixed Interest Rate: If you have federal loans with a variable interest rate that is rising, refinancing into a private loan with a fixed interest rate can provide payment stability and predictability, reducing the risk of future payment shock.

- Simplifying Multiple Private Loans: If you have multiple private student loans from different lenders, refinancing them into a single loan can simplify your repayment process and make it easier to track your payment history.

It is crucial to note that refinancing federal loans into private loans means losing access to federal benefits such as income-driven repayment plans, deferment, and forbearance options. Therefore, carefully weigh the benefits of a lower interest rate or simplified payment against the loss of these federal protections. A strong credit profile is a prerequisite for successful refinancing with favorable terms.

Dealing with Delinquency and Default

Falling behind on student loan payments, even by a few days, can have a significant and lasting impact on your financial health. Understanding the consequences of delinquency and default is the first step in proactively managing these challenges and mitigating their damage to your credit score and overall financial well-being. This section will guide you through the potential pitfalls and provide concrete strategies for recovery.The repercussions of missed payments extend far beyond immediate penalties.

Your credit score, a crucial indicator of your financial trustworthiness, is particularly sensitive to late or missed student loan payments. This can make it harder and more expensive to secure future loans, rent an apartment, or even obtain certain employment opportunities.

Consequences of Delinquency and Default on Credit Scores

Missing student loan payments directly impacts your credit score through several mechanisms. Payment history is the most significant factor in credit scoring models, typically accounting for about 35% of your score. Each late payment, especially those that are 30 days or more past due, will be reported to credit bureaus, lowering your score. As delinquencies progress to 60, 90, or 120 days past due, the negative impact intensifies.

Default, which occurs when payments are significantly overdue (often 270 days for federal loans), can result in a drastic drop in your credit score, potentially by over 100 points. This mark on your credit report can remain for up to seven years, making it a substantial long-term obstacle.

Actionable Steps for Borrowers Behind on Payments

If you find yourself falling behind on your student loan payments, immediate action is crucial to prevent further damage. The key is to communicate with your loan servicer as soon as possible. They are often willing to work with borrowers who are proactive.Here are some essential steps to take:

- Contact your loan servicer immediately: Do not wait for the situation to worsen. Explain your financial hardship and inquire about available options.

- Review your budget: Identify areas where you can cut expenses to free up funds for loan payments.

- Prioritize your debts: While all debts are important, understand the consequences of non-payment for each. Student loans may have different penalties than other debts.

- Explore repayment options: Your servicer can guide you through income-driven repayment plans, deferment, or forbearance, which may temporarily reduce or suspend your payments.

- Document everything: Keep records of all communications with your loan servicer, including dates, names of representatives, and what was discussed or agreed upon.

Loan Deferment and Forbearance Options and Credit Reporting

Deferment and forbearance are temporary relief options that can help borrowers facing financial difficulties. While they can provide much-needed breathing room, it’s important to understand how they affect your credit reporting.

- Deferment: This allows you to postpone your loan payments for a specific period. During deferment, interest may or may not be paid by the government, depending on the type of loan. Importantly, most deferments do not negatively impact your credit score because your loan is not considered delinquent or in default. However, it’s crucial to confirm with your loan servicer how this specific deferment will be reported.

- Forbearance: This is a period where you can temporarily stop making payments, or reduce the amount you pay. Unlike deferment, interest typically accrues during forbearance and is added to your principal balance, increasing the total amount you owe. Forbearance can sometimes be reported to credit bureaus as a temporary pause in payments, which might have a minor negative effect on your credit score, although it is generally less severe than a delinquency.

It’s vital to clarify with your servicer if and how forbearance will be reported.

It is essential to understand that while deferment and forbearance can prevent immediate delinquency and default reporting, they are not a permanent solution and can lead to increased overall loan costs.

Communication Strategy for Lenders Facing Repayment Difficulties

When you anticipate or are experiencing difficulty in making your student loan payments, a proactive and clear communication strategy with your lender is paramount. Open dialogue can unlock solutions and prevent more severe consequences.Here’s a strategic approach to communicating with your lender:

- Initiate Contact Early: Reach out to your loan servicer as soon as you foresee a problem, ideally before you miss a payment. This demonstrates responsibility and increases the likelihood of finding a workable solution.

- Be Honest and Transparent: Clearly explain your situation and the reasons for your financial hardship. Lenders are more likely to assist borrowers who are upfront about their circumstances.

- Know Your Loan Type: Understand whether you have federal or private student loans, as the options and processes for assistance can differ significantly. Federal loans generally offer more flexible repayment and relief options.

- Inquire About All Available Options: Ask specifically about:

- Income-driven repayment plans (IDR)

- Deferment

- Forbearance

- Loan consolidation or refinancing (though be cautious with refinancing private loans, as it may eliminate federal protections)

- Temporary payment reductions

- Ask About the Impact on Your Credit: Specifically inquire how each potential solution will be reported to credit bureaus. This is critical for understanding the long-term implications for your credit score.

- Get Agreements in Writing: Once a solution is agreed upon, ensure you receive all details and terms in writing from your loan servicer. This provides a record of your agreement.

- Follow Up Consistently: If you are on a repayment plan or deferment/forbearance, make sure to adhere to any requirements, such as annual income recertification for IDR plans, to maintain your arrangements.

Effective communication can transform a potentially devastating situation into a manageable challenge, protecting your credit and your financial future.

Leveraging Student Loans for Credit Growth

Managing your student loans effectively is not just about avoiding debt; it’s a powerful opportunity to actively build and improve your credit score. By treating your student loans as a tool for financial growth, you can establish a positive credit history that will benefit you for years to come. This section explores how consistent, responsible student loan management can significantly contribute to a healthier credit profile.Responsible student loan repayment is a cornerstone of credit building.

When you consistently make your payments on time, you are demonstrating to lenders and credit bureaus that you are a reliable borrower. This positive behavior is a key factor in credit scoring models, directly impacting your overall creditworthiness.

Student Loan Payment Timeline for Credit Improvement

Establishing a consistent payment history is crucial for building a strong credit score. The impact of timely student loan payments unfolds over time, gradually enhancing your creditworthiness. The following timeline illustrates the progression of credit score improvement through positive student loan management.

- 1-12 Months: Establishing a Payment HistoryDuring the first year of repayment, your primary focus is on making every payment on time. This period establishes the foundation of your credit history with your student loans. While significant score jumps may not be immediate, you are actively building a positive track record.

- 1-3 Years: Demonstrating Consistency and ReliabilityAs you continue to make on-time payments for one to three years, credit bureaus begin to see a pattern of reliability. This consistent behavior starts to positively influence your credit utilization (if you have other revolving credit) and payment history, which are weighted heavily in credit scoring.

- 3-5 Years: Building a Solid Credit FoundationWith three to five years of consistent, on-time student loan payments, you will have a substantial positive payment history. This longevity of good behavior significantly strengthens your credit score, making you a more attractive borrower for future loans, mortgages, or credit cards.

- 5+ Years: Sustained Credit Growth and DiversificationBeyond five years, continued responsible management of your student loans contributes to a mature credit profile. This long-term positive behavior can lead to better interest rates on future credit products and demonstrates a sustained ability to manage financial obligations responsibly.

Diversifying Your Credit Profile with Student Loans

A diversified credit profile is generally viewed favorably by lenders. It indicates that you can successfully manage different types of credit responsibly. Student loans, being an installment loan, play a vital role in this diversification.A well-managed student loan adds an installment loan component to your credit report, complementing any revolving credit you may have (like credit cards). This balance between different credit types signals to lenders a broader capacity to handle financial commitments.

For instance, having both a student loan and a credit card, both managed responsibly, shows you can handle both regular, fixed payments and variable credit limits. This diversification can positively impact your credit score by demonstrating a well-rounded approach to credit management.

Complementary Credit-Building Activities

Managing student loans effectively can work in synergy with other credit-building strategies. By combining these approaches, you can accelerate your credit score improvement.

- Responsible Credit Card Use: Use a credit card for everyday purchases and pay the balance in full each month. This builds a positive revolving credit history and keeps your credit utilization low, complementing your installment student loan payments.

- Secured Credit Cards or Credit-Builder Loans: If you are new to credit or rebuilding, consider a secured credit card or a credit-builder loan. These products are designed to help individuals establish credit history and can be managed alongside your student loan payments.

- Monitoring Credit Reports: Regularly checking your credit reports is essential. It ensures that your student loan information is reported accurately and that there are no errors that could negatively impact your score.

Importance of Regular Credit Report Checks

Your credit reports are a detailed record of your credit history. Ensuring the accuracy of the information contained within them, especially regarding your student loans, is paramount for maintaining and improving your credit score.Regularly reviewing your credit reports allows you to identify any discrepancies or errors related to your student loan accounts. This includes checking that payments are being reported correctly, that balances are accurate, and that there are no unauthorized inquiries or accounts.

For example, an error showing a late payment when you made it on time could significantly harm your score. By catching these issues early, you can contact the credit bureau and the lender to have them corrected, thereby protecting your creditworthiness.

“Accuracy on your credit report is the bedrock of a healthy credit score. Regularly verifying your student loan information ensures that your diligent repayment efforts are accurately reflected.”

Advanced Tactics for Credit Optimization

Beyond the foundational strategies, several advanced tactics can significantly enhance your credit profile by leveraging your student loan management. These methods require a more proactive and informed approach, aiming to maximize the positive impact of your loan repayment on your creditworthiness over the long term.

Student Loan Repayment Strategies and Credit Score Projections

Selecting the right repayment strategy for your student loans can have a measurable impact on your credit score over time. Different approaches prioritize different aspects of repayment, which in turn influence credit utilization, payment history, and the length of your credit history – all key factors in credit scoring. The following table Artikels common repayment strategies and their projected impact on credit scores at various time intervals.

| Repayment Strategy | Projected Credit Score Impact (1 Year) | Projected Credit Score Impact (3 Years) | Projected Credit Score Impact (5 Years) | Key Considerations |

|---|---|---|---|---|

| Standard Repayment (Fixed Payments) | Moderate Positive | Strong Positive | Very Strong Positive | Builds consistent payment history, predictable costs. |

| Income-Driven Repayment (IDR) Plans | Slightly Lower Positive (if payments are lower than standard) | Moderate Positive (with consistent on-time payments) | Strong Positive (with continued on-time payments and potential forgiveness) | Manages affordability, but lower payments may extend loan term. |

| Graduated Repayment (Increasing Payments) | Slightly Lower Positive (initially) | Moderate Positive (as payments increase) | Strong Positive (with consistent on-time payments) | Payments start lower and rise, can be beneficial for early career. |

| Extended Repayment (Longer Term) | Moderate Positive | Strong Positive | Very Strong Positive | Lower monthly payments, but significantly more interest paid over time. |

It is important to note that these are general projections. Actual impact can vary based on individual credit profiles, the specific terms of the loans, and overall credit utilization. Consistently making on-time payments is the most crucial factor across all strategies.

Verifying Credit Reporting Accuracy with Student Loan Statements

Ensuring your student loan activity is reported accurately to credit bureaus is vital for maintaining a healthy credit score. Discrepancies can negatively affect your credit without your knowledge. Your student loan statements provide the primary source of information to verify this accuracy.

To effectively use your student loan statements for verification, follow these steps:

- Obtain Your Credit Reports: Regularly request free copies of your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

- Locate Student Loan Information: On your credit report, find the section detailing your credit accounts. Your student loans should be listed here, including the lender, account number (often partially masked), current balance, credit limit (if applicable), and payment history.

- Compare with Statements: Carefully compare the information on your credit report with your most recent student loan statements. Pay close attention to:

- Current Balance: Does it match your statement?

- Payment History: Are all payments marked as on-time? Are any late payments incorrectly reported?

- Loan Status: Is the loan accurately described (e.g., in repayment, deferment, forbearance)?

- Lender Information: Is the lender name and contact information correct?

- Dispute Inaccuracies: If you find any discrepancies, it is crucial to dispute them immediately with both the credit bureau and the student loan servicer. Most credit bureaus have an online dispute process.

For example, if your statement shows a balance of $15,000 and your credit report shows $18,000, or if a payment you made on time is reported as late, you must initiate a dispute. Documenting your payments with statements provides the evidence needed for a successful dispute.

The Role of Credit Counseling Services in Student Loan Management

Credit counseling services can offer invaluable guidance and support for individuals navigating the complexities of student loan management and its impact on their credit. These non-profit organizations provide professional advice to help borrowers make informed decisions and improve their financial well-being.

Credit counselors can assist in several key areas related to student loans and credit:

- Budgeting and Financial Planning: They help create a realistic budget that incorporates student loan payments, allowing for consistent on-time payments which are critical for credit building.

- Understanding Repayment Options: Counselors can explain various federal and private student loan repayment plans, including income-driven repayment options, helping borrowers choose the most suitable plan for their financial situation.

- Negotiating with Lenders: In cases of financial hardship, credit counselors may assist in communicating with lenders to explore potential deferment, forbearance, or modification options, which can prevent delinquency and default.

- Debt Management Plans: While less common for student loans alone, if combined with other debts, counselors can help structure a comprehensive debt management plan.

- Credit Education: They provide education on how credit scores are calculated and how student loan repayment affects them, empowering borrowers to make better financial choices.

For instance, a borrower struggling to make payments on multiple federal loans might be unaware of the benefits of consolidating them into a Direct Consolidation Loan or enrolling in an income-driven repayment plan. A credit counselor can clarify these options, assess eligibility, and guide the borrower through the application process, ultimately preventing potential damage to their credit score.

Long-Term Benefits of Maintaining a Positive Student Loan Repayment History

Consistently managing your student loans responsibly yields significant long-term benefits that extend far beyond simply avoiding debt. A positive repayment history is a cornerstone of a strong credit profile, opening doors to numerous financial opportunities and advantages.

The enduring advantages of a good student loan repayment record include:

- Improved Credit Score: This is the most direct benefit. A consistently positive history will lead to a higher credit score, making it easier to qualify for future loans, mortgages, car loans, and credit cards with better interest rates.

- Lower Interest Rates on Future Borrowing: A strong credit score translates into lower interest rates on all forms of credit. Over the life of a mortgage or car loan, this can save you tens of thousands of dollars.

- Easier Approval for Housing and Rentals: Landlords and mortgage lenders view a responsible repayment history as a sign of financial reliability, increasing your chances of securing rental properties or obtaining a mortgage.

- Enhanced Employment Opportunities: Some employers, particularly in sensitive industries, conduct credit checks as part of their hiring process. A good credit history can be an advantage in such situations.

- Financial Peace of Mind: Knowing that your financial obligations are managed effectively reduces stress and provides a sense of security and control over your financial future.

Consider the scenario of someone who diligently paid off their student loans on time for several years. When they later apply for a mortgage, their excellent credit score, bolstered by that student loan history, might qualify them for a 0.5% lower interest rate compared to someone with a mediocre credit history. On a $300,000 mortgage, this seemingly small difference could amount to savings of over $50,000 in interest over 30 years.

Closing Notes

In conclusion, mastering the art of managing student loans is far more than just meeting payment deadlines; it’s a strategic pathway to cultivating a strong and reliable credit score. By diligently applying the principles of timely payments, understanding diverse loan types, and proactively addressing any challenges, you can effectively leverage your student loan journey to enhance your financial standing. Regularly reviewing your credit reports and utilizing advanced tactics will ensure your loan management consistently contributes to a positive and impressive credit profile for years to come.