How to Check for Credit Report Errors with All Three Bureaus sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

Understanding and maintaining the accuracy of your credit reports is a cornerstone of sound financial management. These comprehensive documents, provided by Equifax, Experian, and TransUnion, detail your credit history and significantly impact your ability to achieve financial goals. This guide will walk you through the essential steps of obtaining your reports, identifying potential inaccuracies, and navigating the dispute process, empowering you to safeguard your financial future.

Understanding Your Credit Reports

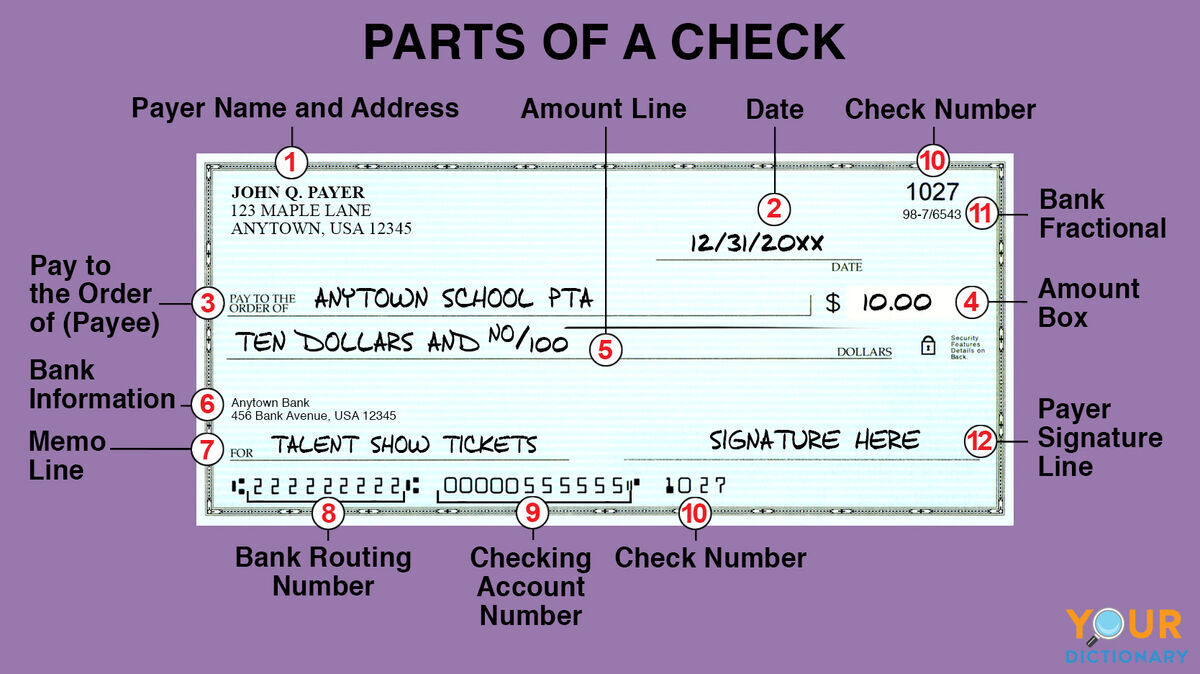

Your credit report is a comprehensive record of your credit history, serving as a vital document that lenders and other entities use to assess your creditworthiness. Obtaining and regularly reviewing your reports from all three major credit bureaus is a fundamental step in managing your financial health effectively. This proactive approach allows you to identify any inaccuracies that could negatively impact your ability to secure loans, rent an apartment, or even obtain certain employment opportunities.A credit report is a detailed summary of your borrowing and repayment activities.

It’s compiled and maintained by credit bureaus, which collect information from various sources, including lenders, creditors, and public records. Understanding what information is contained within these reports is the first step toward ensuring their accuracy and, consequently, protecting your financial future.

Purpose and Importance of Obtaining Credit Reports

The primary purpose of obtaining your credit reports from all three major bureaus is to gain a complete and accurate picture of your credit standing. Each bureau may have slightly different information due to reporting variations from creditors. Therefore, reviewing all three ensures you catch any discrepancies or errors that might be present on one report but not another. This comprehensive review is crucial because your credit report directly influences many significant financial decisions made about you.

Information Typically Found on a Credit Report

Credit reports contain a wealth of information that paints a detailed portrait of your financial behavior. This data is organized into several key sections to provide a clear overview.

- Personal Information: This includes your name, Social Security number, date of birth, current and previous addresses, and employment history. This section is important for identity verification and ensuring your report is not being mixed up with someone else’s.

- Credit Accounts: This is a core component detailing all your open and closed credit accounts, such as credit cards, mortgages, auto loans, and personal loans. For each account, you’ll find the lender’s name, account number (often partially masked), the date the account was opened, the credit limit or loan amount, the current balance, and your payment history.

- Payment History: This is arguably the most critical section, as it Artikels whether you have made payments on time for each of your credit accounts. It shows late payments, missed payments, defaults, and accounts sent to collections. A positive payment history is essential for a good credit score.

- Public Records: This section includes information from public records, such as bankruptcies, foreclosures, judgments, and liens. These are serious negative marks on your credit report and can significantly impact your creditworthiness.

- Credit Inquiries: When you apply for new credit, lenders often perform a “hard inquiry” on your credit report. This section lists these inquiries, showing which companies have accessed your report and when. Too many hard inquiries in a short period can negatively affect your credit score.

Primary Reasons for Checking for Errors

Errors on your credit report can have far-reaching and detrimental consequences for your financial well-being. Identifying and correcting these mistakes is paramount to maintaining a healthy credit profile.

- Impact on Credit Score: Inaccurate information, such as incorrect late payments or mistaken account balances, can artificially lower your credit score. A lower score can lead to higher interest rates on loans, increased insurance premiums, and even denial of credit.

- Denial of Credit or Loans: Lenders rely heavily on credit reports to make lending decisions. An error, such as an account belonging to someone else or an incorrect delinquency status, could lead to the rejection of your application for a mortgage, car loan, or credit card.

- Difficulty Renting or Obtaining Services: Beyond traditional lending, landlords and utility companies often check credit reports. Errors could result in being denied an apartment rental or facing higher security deposits for services like electricity or cell phone plans.

- Identity Theft: Inaccurate accounts or personal information on your credit report can be a sign of identity theft. Promptly identifying these errors allows you to take immediate action to protect yourself from further fraudulent activity.

- Misrepresentation of Financial Health: Errors can present a misleading picture of your financial habits, making it difficult to accurately assess your own financial situation or to receive favorable terms when you do need to borrow money.

The Three Major Credit Bureaus in the United States

In the United States, credit information is primarily collected and reported by three major national credit bureaus. It is essential to check your credit report from each of these bureaus to ensure comprehensive accuracy.

- Equifax: One of the longest-standing credit bureaus, Equifax provides a wide range of credit information and related services.

- Experian: Experian is another major player in the credit reporting industry, known for its extensive data and analytical capabilities.

- TransUnion: TransUnion is the third of the primary credit bureaus, offering credit reports and scoring services to consumers and businesses.

Accessing Your Credit Reports

:max_bytes(150000):strip_icc()/certified-check-vs-cashiers-check-which-safer-final-46f80549d89e41d9ae86fd5728692052.jpg)

Understanding your credit reports is a crucial step in managing your financial health. The next logical step is to know how to obtain these vital documents from the three major credit bureaus. Fortunately, accessing your credit reports is a straightforward process, and you are entitled to free reports annually.Knowing how to access your credit reports empowers you to proactively monitor your financial standing and identify any inaccuracies.

The three major credit bureaus in the United States – Equifax, Experian, and TransUnion – are legally obligated to provide you with free copies of your credit report each year. This ensures that everyone has the opportunity to review their credit information without financial barriers.

Annual Free Credit Reports

To exercise your right to a free annual credit report from each of the three major bureaus, you should utilize the centralized service established by federal law. This service is designed to simplify the process and ensure you receive accurate reports.The official website for obtaining your free annual credit reports is AnnualCreditReport.com . This is the only website authorized by federal law to provide these free reports.

You can also request your reports by phone or by mail.

Methods of Obtaining Credit Reports

There are several convenient methods available for you to request and receive your credit reports from Equifax, Experian, and TransUnion. Each method offers a different approach to suit your preferences.

- Online: Visiting AnnualCreditReport.com is the quickest and most efficient way to access your reports. You will typically need to provide personal information to verify your identity.

- By Mail: If you prefer to request your reports via mail, you can download a request form from AnnualCreditReport.com or write a letter including your name, address, Social Security number, and date of birth. Mail your request to the address provided on the website or form.

- By Phone: You can also request your reports by calling 1-877-322-8228. Be prepared to answer verification questions.

Prerequisites and Documentation

When requesting your credit reports, you will need to provide certain information to verify your identity and ensure that the reports are accurately linked to you. This is a standard security measure to protect your personal financial data.To successfully obtain your credit reports, you will generally need to provide the following:

- Your full legal name

- Your current address

- Your Social Security number (SSN)

- Your date of birth

- Potentially, answers to security questions based on your credit history (e.g., previous addresses, loan information, or account details).

In some cases, if you cannot be verified online, you may be asked to provide additional documentation, such as a copy of your driver’s license or a utility bill, if you are requesting by mail.

Costs Beyond the Free Annual Entitlement

While you are entitled to one free credit report from each bureau annually, there may be situations where you wish to obtain additional reports or specific credit monitoring services. It is important to be aware of potential costs associated with these services.The following are common scenarios where costs might apply:

- Additional Reports: If you request a credit report from a bureau more than once within a 12-month period, you may be charged a fee. The specific fee varies by state and bureau.

- Credit Monitoring Services: Many companies offer credit monitoring services that provide real-time alerts about changes to your credit report. These services typically come with a monthly or annual subscription fee.

- Credit Scores: While your credit report details your credit history, it does not always include your credit score for free. Many services offer credit scores for a fee, or as part of a paid monitoring package.

It is advisable to check the specific policies and pricing of each credit bureau and any third-party services before making a purchase to ensure you are getting the best value and only paying for what you need.

Identifying Common Credit Report Errors

Understanding your credit reports is a crucial step in managing your financial health. While credit bureaus strive for accuracy, errors can and do occur. These inaccuracies can negatively impact your credit score and your ability to obtain loans, housing, or even employment. This section will guide you through identifying common types of errors and how to spot discrepancies across your reports from the three major bureaus.The first step in identifying errors is to meticulously review each section of your credit report.

Pay close attention to personal information, account details, and credit inquiries. Comparing reports from Equifax, Experian, and TransUnion is essential, as information may differ between them. This comparison helps to highlight any inconsistencies that need to be addressed.

Inaccurate Personal Information

Your personal information forms the foundation of your credit report. Errors here can lead to your accounts being associated with the wrong individual or can cause confusion when lenders try to verify your identity. It is vital to ensure that all details are correct and up-to-date.Common types of inaccurate personal information include:

- Incorrect Social Security Number (SSN): An incorrect SSN can link your credit history to someone else’s or prevent lenders from accurately identifying you.

- Misspelled Names or Incorrect Addresses: While seemingly minor, these can lead to confusion and potentially the reporting of accounts that do not belong to you.

- Incorrect Employment Information: Outdated or wrong employer details can sometimes appear, though this is less common than other personal information errors.

- Aliases or Previous Names Used Incorrectly: If your report lists an alias or a previous name that you have not authorized, it could be a sign of identity theft or a clerical error.

Incorrect Account Statuses or Payment Histories

The accuracy of your account information and payment history is paramount to your credit score. Even small mistakes in how your accounts are reported can have a significant impact. Carefully examine each listed account to ensure the details align with your records.To effectively spot incorrect account statuses or payment histories, consider the following:

- Accounts You Do Not Recognize: If an account appears on your report that you have never opened or taken responsibility for, it is a serious error and could indicate identity theft.

- Incorrect Payment Status: Look for late payments that were actually made on time, or accounts that are marked as delinquent when they are current.

- Duplicate Accounts: Sometimes, the same account may be reported more than once, which can artificially inflate your credit utilization or appear as multiple debts.

- Incorrect Credit Limit or Balance: The reported credit limit or the outstanding balance on an account might be inaccurate, affecting your credit utilization ratio.

- Closed Accounts Still Reporting Activity: Accounts that you have legitimately closed should reflect this status and not show new activity or balances.

- Incorrect Date of Last Activity or Delinquency: These dates are critical for how long an item stays on your report and can affect your score if reported incorrectly.

To illustrate the importance of comparing reports, imagine you have a credit card with a balance of $500 and a credit limit of $2,000. This means your credit utilization is 25%. However, if one bureau reports the balance as $5,000, your utilization would incorrectly appear as 250%, which would severely damage your credit score. By comparing the reports, you would quickly notice this discrepancy.Another example of an inaccurate account status could be a loan that was paid off in full but is still being reported as having an outstanding balance.

This error would wrongly suggest you have more debt than you actually do.

“The devil is in the details when reviewing your credit report. Even minor inaccuracies can have significant consequences for your financial well-being.”

The Dispute Process for Credit Report Errors

Discovering an error on your credit report is a common occurrence, but thankfully, there is a structured process to address and rectify these inaccuracies. This process involves directly communicating with the credit bureaus and, in some cases, the original creditor. Understanding each step is crucial for a successful resolution.This section will guide you through the methodical approach to disputing an error, providing you with the necessary tools and knowledge to navigate this important consumer right.

We will cover the direct steps for filing a dispute, a template to help you craft your communication, the involvement of the original creditor, and the expected timelines for resolution.

Initiating a Dispute with a Credit Bureau

When you identify an inaccuracy on your credit report, the primary action is to formally dispute it with the respective credit bureau. Each of the three major credit bureaus – Equifax, Experian, and TransUnion – has a defined procedure for handling these disputes. It is advisable to dispute the error with each bureau that lists it on your report.The step-by-step procedure typically involves the following actions:

- Gather Documentation: Collect all relevant documents that support your claim of an error. This may include billing statements, payment records, loan agreements, or any correspondence related to the disputed item.

- Identify the Specific Error: Clearly pinpoint the exact information on your credit report that you believe is incorrect. Note the account number, the name of the creditor, and the nature of the error (e.g., incorrect balance, unauthorized account, wrong payment status).

- Choose Your Dispute Method: Credit bureaus offer several ways to file a dispute. The most common methods are online through their respective websites, by mail, or by phone. Filing online is often the fastest and allows for easy uploading of supporting documents.

- Submit Your Dispute:

- Online: Visit the “Dispute” or “Consumer Services” section of the credit bureau’s website. You will likely need to create an account or log in to submit your dispute electronically.

- By Mail: Send a written dispute letter to the credit bureau’s dispute department. It is highly recommended to send this via certified mail with a return receipt requested. This provides proof that your letter was received.

- By Phone: While some bureaus offer phone dispute options, it is generally less effective for complex issues as it lacks a documented trail.

- Provide Necessary Information: When filing, you will need to provide your full name, current address, date of birth, and Social Security number to verify your identity. You will also need to clearly describe the error and attach copies of your supporting documentation. Do not send original documents.

Dispute Letter Template

A well-crafted dispute letter is a critical component of the dispute process. It ensures that your concerns are clearly communicated and that all necessary information is provided to the credit bureau. Below is a template that includes essential elements for an effective dispute letter.

[Your Full Name]

[Your Street Address]

[Your City, State, Zip Code]

[Your Phone Number]

[Your Email Address]

[Date][Credit Bureau Name]

[Credit Bureau Dispute Department Address]

[Credit Bureau City, State, Zip Code]Subject: Dispute of Inaccurate Information on Credit Report – Account Number [Account Number, if applicable]

Dear Sir or Madam,

I am writing to dispute specific information appearing on my credit report furnished by your agency. I have reviewed my credit report dated [Date of your credit report], and I have identified the following inaccuracies:

1. [Describe the first inaccuracy clearly and concisely.] For example

“The account listed under [Creditor Name] with account number [Account Number] shows a late payment in [Month, Year], but I made this payment on time. My cancelled check/payment confirmation number is [Confirmation Number].”

[Describe the second inaccuracy, if applicable.] For example: “There is an account listed for [Creditor Name] that I do not recognize. I have never done business with this company.”

I have attached copies of the following documents to support my dispute:

- [List of attached documents, e.g., Copy of billing statement, Copy of cancelled check, Copy of loan agreement, etc.]

I request that you investigate this matter thoroughly and remove or correct the inaccurate information from my credit report. Please send me a written response detailing the results of your investigation within 30 days, as required by the Fair Credit Reporting Act (FCRA).

Thank you for your prompt attention to this important matter.

Sincerely,

[Your Signature (if mailing)]

[Your Typed Full Name]

The Role of the Original Creditor

In the credit report dispute process, the original creditor, also known as the furnisher of the information, plays a vital role. When you dispute an item with a credit bureau, the bureau is obligated to notify the creditor that provided the information about the dispute. The creditor then has a responsibility to investigate the accuracy of the information they reported.This investigation by the creditor typically involves reviewing their own records to confirm the details of the account, payment history, and any other relevant data.

If the creditor determines that the information they reported was indeed inaccurate, they must notify the credit bureau of the correction. The credit bureau will then update your report accordingly.It is important to note that if you are disputing an account that has been sold to a debt collector, the debt collector also has a responsibility to investigate and verify the debt.

If they cannot provide proof of the debt’s validity, it should be removed from your credit report.

Typical Timeframe for Dispute Resolution

The Fair Credit Reporting Act (FCRA) Artikels specific timeframes within which credit bureaus must investigate and respond to disputes. Generally, credit bureaus have 30 days from the date they receive your dispute to investigate and respond. This timeframe can be extended to 45 days if you provide additional information or documentation after the initial dispute submission.During this investigation period, the credit bureau will contact the furnisher of the information (the original creditor) to verify the disputed item.

Once the investigation is complete, the credit bureau will send you a written notification of the results. If the information is found to be inaccurate, it will be corrected on your credit report. If the information is verified as accurate, the credit bureau will provide you with a statement of their findings.It is important to keep records of all your communications with the credit bureaus and creditors, including dates and any reference numbers provided.

This documentation can be invaluable if further action is needed.

Preventing Future Credit Report Errors

Maintaining the accuracy of your credit report is an ongoing process that requires diligence and proactive management. By implementing sound financial habits and regularly reviewing your credit information, you can significantly minimize the likelihood of encountering errors and ensure your creditworthiness remains a true reflection of your financial behavior. This section Artikels key strategies and best practices to help you safeguard your credit report from future inaccuracies.The foundation of a pristine credit report lies in responsible financial management and consistent monitoring.

Think of your credit report as a financial report card; the better your habits, the better the grade. This proactive approach not only prevents errors but also builds a strong credit history, which is crucial for achieving significant financial goals such as securing a mortgage, obtaining favorable loan terms, or even renting an apartment.

Maintaining Accurate Credit Information

Ensuring your credit information remains accurate involves a combination of diligent record-keeping and careful communication with your creditors. By being attentive to the details of your financial accounts, you can catch potential discrepancies before they become significant issues.One of the most effective ways to maintain accuracy is to keep meticulous records of all your financial transactions. This includes saving receipts, statements, and any correspondence related to your credit accounts.

When you receive your monthly statements, take the time to review them carefully for any charges or information that you don’t recognize or that appears incorrect.It is also vital to ensure that your contact information is up-to-date with all your creditors and credit bureaus. Incorrect addresses or phone numbers can lead to important notices being missed, which can sometimes contribute to errors or missed payments being reported.

If you move or change your phone number, remember to update this information with all relevant parties promptly.Furthermore, when opening new credit accounts or making changes to existing ones, always verify that the information being reported by the creditor is accurate. This includes ensuring that the account numbers, credit limits, and reporting dates are correct.

Best Practices for Monitoring Your Credit Report Regularly

Regularly monitoring your credit report is a cornerstone of preventing and identifying errors. It allows you to stay informed about your credit health and catch any inaccuracies swiftly. The Fair Credit Reporting Act (FCRA) grants you the right to receive a free credit report from each of the three major credit bureaus annually.To effectively monitor your credit, make it a habit to obtain your free reports at least once a year from each bureau.

You can request these reports through AnnualCreditReport.com. Spreading out your requests throughout the year, for instance, by requesting one report every four months, can provide continuous oversight.When reviewing your reports, pay close attention to:

- Personal information: Verify your name, address, Social Security number, and date of birth are correct.

- Account information: Check all credit accounts, including credit cards, loans, and mortgages. Ensure the balances, credit limits, payment history, and dates of account opening/closing are accurate.

- Public records: Look for any public records, such as bankruptcies or tax liens, and confirm their accuracy and timeliness.

- Inquiries: Review the list of entities that have recently accessed your credit report. An excessive number of inquiries in a short period can negatively impact your score.

Consider setting reminders for yourself to pull your reports at regular intervals. Some services also offer credit monitoring, which can alert you to significant changes in your credit report, such as new accounts being opened or changes in your credit score.

The Importance of Timely Bill Payments and Managing Credit Responsibly

Your payment history is the most significant factor influencing your credit score, and by extension, the accuracy of your credit report. Consistently paying your bills on time and managing your credit utilization effectively are paramount to maintaining a positive credit profile.Timely bill payments demonstrate to lenders and credit bureaus that you are a reliable borrower. Even a single missed payment can have a detrimental impact on your credit report and score, potentially leading to errors if reported incorrectly.

Setting up automatic payments or calendar reminders for due dates can help ensure you never miss a payment.

“Payment history is the single most important factor in your credit score, accounting for about 35% of the total.”

Managing your credit responsibly also involves keeping your credit utilization low. Credit utilization is the amount of credit you are using compared to your total available credit. Experts generally recommend keeping this ratio below 30% for each credit card and overall. High utilization can signal to lenders that you may be overextended financially, which can affect your credit report and score.Responsible credit management also includes avoiding unnecessary credit applications and being mindful of the types of credit you use.

Diversifying your credit mix (e.g., having both revolving credit like credit cards and installment loans like mortgages) can be beneficial, but only if managed responsibly.

Proactive Steps to Safeguard Your Credit Information

Taking proactive steps can significantly fortify your credit information against errors and potential misuse. These actions empower you to maintain control over your financial data and ensure its integrity.Here is a checklist of proactive measures you can implement:

- Obtain and Review Credit Reports Regularly: As previously discussed, access your free reports annually from all three bureaus and scrutinize them for accuracy.

- Set Up Payment Reminders or Autopay: Never miss a payment by utilizing technology to manage your due dates.

- Maintain Low Credit Utilization: Keep your credit card balances well below their limits. Pay down balances strategically to reduce your utilization ratio.

- Secure Your Personal Information: Protect your Social Security number, account numbers, and other sensitive data from identity theft. Use strong, unique passwords for online accounts and be wary of phishing attempts.

- Communicate with Creditors: If you anticipate difficulty making a payment, contact your creditor immediately to discuss potential solutions.

- Dispute Any Identified Errors Promptly: Do not hesitate to dispute any inaccuracies you find on your credit report. The sooner you act, the faster the issue can be resolved.

- Monitor Your Bank and Credit Card Statements: Regularly review your financial statements for any unauthorized transactions or discrepancies.

- Be Cautious with New Credit Applications: Only apply for credit when you genuinely need it, as each application can result in a hard inquiry on your report.

- Consider Credit Monitoring Services: While not a substitute for regular review, these services can provide timely alerts to significant changes.

- Educate Yourself on Credit Practices: Continuously learn about credit scoring and responsible financial management to make informed decisions.

By consistently applying these practices, you build a robust defense against credit report errors and foster a healthy, accurate credit profile.

The Impact of Credit Report Accuracy on Financial Goals

Your credit report is a foundational document that significantly influences your ability to achieve various financial milestones. Ensuring its accuracy is paramount, as even minor inaccuracies can have far-reaching consequences on your financial journey. This section explores how a pristine credit report can unlock opportunities and how errors can present substantial roadblocks to your aspirations.A credit report serves as a detailed history of your borrowing and repayment behavior.

Lenders, landlords, and even potential employers use this information to assess your financial reliability and trustworthiness. Therefore, the accuracy of the data presented is not merely a matter of record-keeping; it directly impacts your access to essential financial products and services, and consequently, your overall financial well-being.

Loan Approvals and Interest Rates

The accuracy of your credit report is a primary determinant in whether you are approved for loans, such as mortgages, auto loans, or personal loans, and at what interest rate. Lenders rely on credit scores, which are derived from credit report data, to gauge risk. A report free of errors presents a clear and favorable picture of your financial habits, making you a more attractive borrower.

- Loan Approval Likelihood: Accurate credit reports demonstrate a consistent ability to manage debt responsibly. This increases the probability of loan approval across a wide spectrum of financial products. For instance, a mortgage lender will scrutinize your credit history to ensure you can handle the significant commitment of a home loan.

- Interest Rate Determination: Even if approved, the interest rate offered can vary dramatically based on your creditworthiness as reflected in your report. Lower interest rates mean lower monthly payments and less interest paid over the life of the loan, saving you substantial amounts of money. A report with errors, such as incorrect late payments or accounts you don’t recognize, can artificially inflate your risk profile, leading to higher interest rates.

- Example: Consider two individuals applying for a $300,000 mortgage. Individual A has a credit report with no errors, showing a history of on-time payments and responsible credit utilization, resulting in a credit score of 750. They might qualify for an interest rate of 4.5%. Individual B, however, has a credit report with an unaddressed error indicating a missed payment on a credit card they paid on time, leading to a credit score of 650.

They might be offered an interest rate of 6.0%. Over 30 years, this 1.5% difference translates to tens of thousands of dollars in additional interest paid.

Securing Housing and Employment

Beyond loans, accurate credit reports are increasingly becoming a prerequisite for securing stable housing and even employment in certain sectors. Landlords and employers are looking for indicators of responsibility and reliability, and your credit report provides a comprehensive overview.

- Housing Applications: Landlords frequently review credit reports to assess a prospective tenant’s ability to pay rent consistently. A good credit history suggests a tenant who is likely to be reliable and responsible. Errors on your report, such as collections or judgments, can lead to outright rejection of your rental application, regardless of your income.

- Employment Background Checks: For positions involving financial responsibility, handling sensitive data, or security clearances, employers may conduct credit checks. An accurate credit report assures them of your financial stability and integrity. Conversely, significant errors or negative marks can raise red flags and disqualify you from consideration, even if you are the most qualified candidate.

- Example: A person applying for a job as a financial advisor would likely undergo a thorough background check. If their credit report contains errors showing accounts in collections that they have already settled, or if it incorrectly lists them as having defaulted on loans, this could create serious doubts in the employer’s mind about their judgment and trustworthiness, potentially costing them the job.

Consequences of Unaddressed Errors on Long-Term Financial Planning

The ripple effect of unaddressed credit report errors can significantly derail your long-term financial planning. What might seem like a minor issue today can compound over time, impacting your ability to achieve major life goals.

- Compounded Interest Costs: As mentioned earlier, higher interest rates on loans mean paying more over time. This increased cost of borrowing can eat into savings designated for retirement, education, or other long-term objectives.

- Limited Investment Opportunities: Some investment firms or wealth management services may also review credit reports. Negative or inaccurate information could limit your access to certain investment vehicles or higher-tier financial advisory services.

- Delayed Major Purchases: The inability to secure favorable financing due to credit report errors can delay or even prevent significant purchases like a home or a business. This delay can have a cascading effect on wealth accumulation and life progression.

- Reduced Financial Flexibility: A compromised credit report can limit your options in emergencies. If you need to access funds quickly, a poor credit history might prevent you from obtaining a necessary personal loan or line of credit, exacerbating financial hardship.

Comparison of Financial Institution Views on Credit Reports

Financial institutions adopt distinct perspectives when evaluating credit reports, with accuracy being the critical differentiator.

| Aspect | Accurate Credit Report | Credit Report with Errors |

|---|---|---|

| Risk Assessment | Viewed as low risk; consistent repayment history is evident. | Viewed as higher risk; potential for unforeseen issues or lack of diligence. |

| Loan Eligibility | High likelihood of approval for various loan types. | Lower likelihood of approval; may face rejections or stricter conditions. |

| Interest Rates Offered | Access to the most competitive and lowest interest rates. | Offered higher interest rates to compensate for perceived risk. |

| Credit Limit & Terms | Favorable credit limits and repayment terms. | May receive lower credit limits or less flexible repayment terms. |

| Rental/Employment Prospects | Stronger standing for rental applications and employment background checks. | Potential for rejection in housing and employment opportunities. |

Final Wrap-Up

By diligently understanding your credit reports, accessing them regularly, and proactively addressing any discrepancies, you are taking a significant step towards securing your financial well-being. The ability to identify and correct errors empowers you to build a stronger credit profile, leading to better loan terms, housing opportunities, and overall financial stability. Remember, accurate credit information is not just about numbers; it’s about unlocking the doors to your aspirations.