How to Evaluate if a Fintech Credit-Building App is Right for You begins by acknowledging the growing need for accessible credit-building solutions in today’s financial landscape. Many individuals find themselves navigating the complexities of credit reports and scores, often seeking effective tools to achieve their financial aspirations, whether it’s securing a loan, renting an apartment, or simply improving their financial standing.

This guide is designed to empower you with the knowledge to discern which fintech credit-building app truly aligns with your unique circumstances and goals.

We will delve into understanding your personal credit-building needs, exploring the essential features that make these apps effective, and critically evaluating their functionality and user experience. Furthermore, we will dissect the crucial aspects of costs, fee structures, data security, and privacy, alongside researching app reputations and user reviews. Finally, we will consider alternative methods and practical steps for integrating a chosen app seamlessly into your financial routine, ensuring you make an informed decision that supports your journey towards a stronger financial future.

Understanding Your Credit-Building Needs

Embarking on the journey to improve your creditworthiness is a significant step towards achieving financial stability and unlocking new opportunities. Fintech credit-building apps offer a modern approach to this often complex process, but their effectiveness hinges on aligning with your unique financial circumstances and aspirations. Before diving into specific app features, it’s crucial to establish a clear understanding of why you need to build credit and what you aim to accomplish.This foundational understanding will guide your evaluation process, ensuring you select a tool that genuinely supports your financial growth rather than simply offering a superficial solution.

Recognizing your current credit challenges and future financial goals is the first and most important step in making an informed decision.

Reasons for Seeking Credit-Building Solutions

Individuals often seek credit-building solutions for a variety of fundamental reasons, primarily centered around improving their financial standing and accessing better financial products and services. A strong credit history is a cornerstone of financial health in many economies, influencing not only loan approvals but also rental agreements, insurance premiums, and even employment opportunities.

Common Financial Goals Supported by Credit-Building Apps

Credit-building apps can be instrumental in helping individuals achieve a wide array of financial goals. These platforms are designed to make the process of establishing or repairing credit more accessible and manageable.

- Securing Loans: A primary goal for many is to qualify for loans, such as mortgages, auto loans, or personal loans, at favorable interest rates.

- Improving Loan Terms: Even if credit is not a complete barrier, building it can lead to lower interest rates on existing or future loans, saving significant money over time.

- Renting Property: Landlords frequently check credit scores to assess a prospective tenant’s reliability in making timely rent payments.

- Obtaining Better Insurance Rates: In some regions, insurance companies use credit-based insurance scores to help determine premiums for auto and home insurance.

- Starting a Business: Entrepreneurs often need good credit to secure business loans, lines of credit, or favorable terms with suppliers.

- Accessing Credit Cards: Building credit allows access to credit cards, which can be useful for everyday purchases, earning rewards, and further credit building when managed responsibly.

Typical Credit Challenges Addressed

Users typically turn to credit-building apps when facing specific challenges that hinder their financial progress. These challenges often stem from a lack of credit history or past financial missteps.

- No Credit History: Many young adults or recent immigrants have a “thin file” or no credit history at all, making it difficult to obtain credit.

- Limited Credit History: Even with some credit activity, a limited history might not be sufficient to demonstrate a consistent ability to manage debt.

- Past Credit Issues: Individuals who have experienced late payments, defaults, bankruptcies, or collections may need to rebuild their credit from scratch.

- Low Credit Scores: Existing credit scores that are too low to qualify for desired financial products or services necessitate active credit improvement.

- Difficulty Accessing Traditional Credit: Some individuals find it hard to get approved for traditional credit cards or loans due to strict lender requirements.

Personal Financial Situations Requiring Credit Building

Certain personal financial situations underscore the critical importance of having a well-established credit history. Proactively building credit in these scenarios can prevent significant financial setbacks and open doors to better opportunities.

- First-Time Homebuyers: Securing a mortgage requires a strong credit score to get approved and to qualify for competitive interest rates, significantly impacting monthly payments and the total cost of the home. For example, a difference of just 1% in interest rate on a 30-year mortgage can amount to tens of thousands of dollars in savings over the loan’s life.

- Students Entering the Workforce: Upon graduation, individuals often need credit to rent an apartment, purchase a car for commuting, or obtain their first credit card to start building a financial foundation.

- Individuals Relocating: Moving to a new city or country often involves renting new accommodation, which typically involves a credit check. A good credit score can make the rental application process smoother.

- Those Seeking to Improve Debt Management: For individuals with existing debt, a good credit score can enable them to consolidate high-interest debt into a lower-interest loan, thereby reducing their overall interest payments and making debt repayment more manageable.

- Aspiring Entrepreneurs: To launch a business, founders often need to secure funding, which can come in the form of business loans or lines of credit. Lenders will scrutinize personal credit history, especially for new businesses.

- Individuals Planning Major Purchases: Whether it’s a new car or a significant home renovation, financing these purchases often relies on good credit to obtain favorable loan terms and interest rates.

Identifying Key Features of Fintech Credit-Building Apps

Selecting the right fintech credit-building app involves understanding the core functionalities that directly impact your financial journey. These applications are designed to offer a structured approach to improving your creditworthiness, but not all features are created equal. It’s crucial to identify the elements that align with your specific credit-building goals and current financial situation.These platforms leverage technology to make credit building more accessible and transparent.

By understanding the diverse features available, you can make an informed decision about which app will best support your efforts to establish or enhance your credit profile.

Essential Features for Credit Building

When evaluating fintech credit-building apps, several key features are paramount for effective credit improvement. These functionalities are the building blocks of a strong credit profile and are often the primary drivers of positive credit score changes.A comprehensive list of essential features to look for includes:

- Reporting to Major Credit Bureaus: The app must report your on-time payments to all three major credit bureaus (Equifax, Experian, and TransUnion). This is the most critical function, as it’s how your positive credit behavior is recorded.

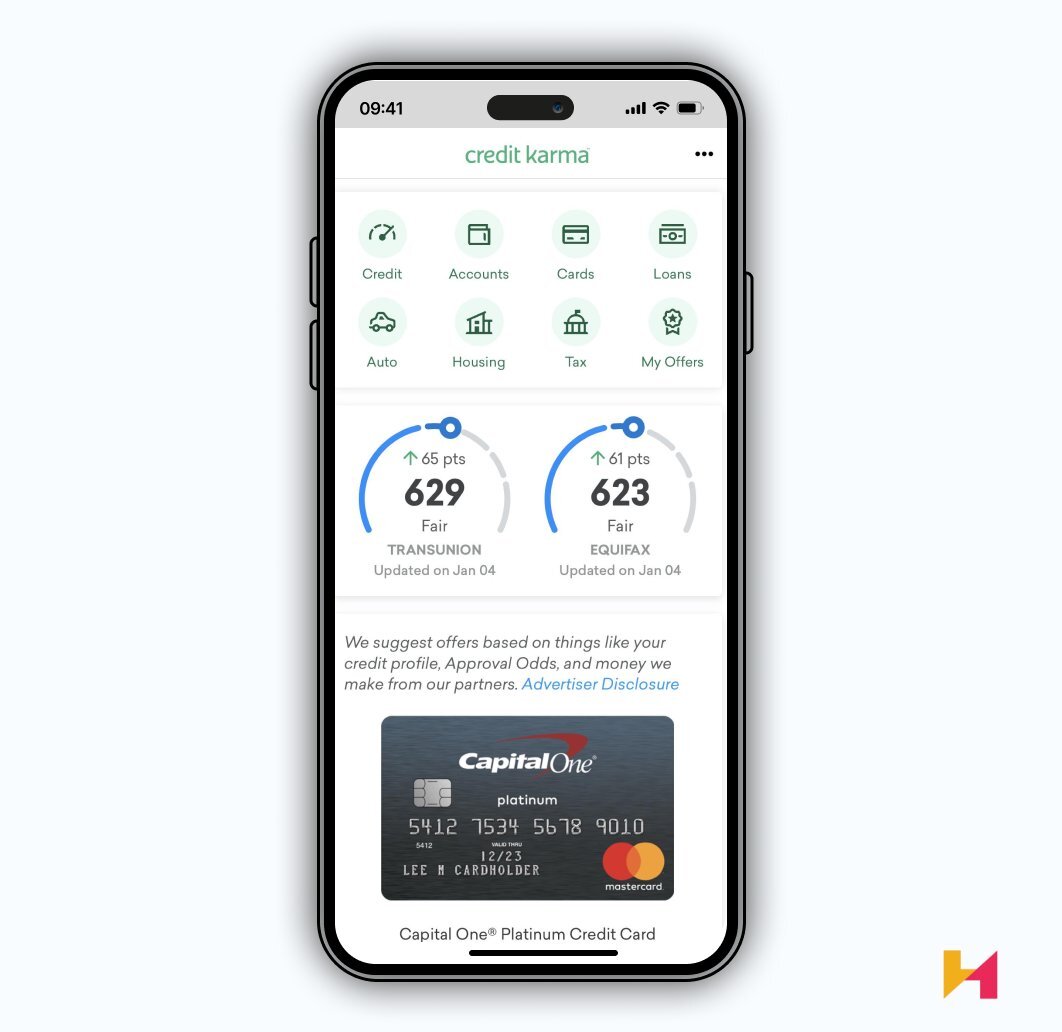

- Credit Score Monitoring: Real-time access to your credit score and detailed reports allows you to track your progress and understand the factors influencing your score.

- Payment Reminders and Autopay Options: Features that help you avoid late payments are crucial. Reminders and automated payment options ensure consistency in your repayment history.

- Secure Data Encryption: Protecting your personal and financial information is non-negotiable. Look for apps that employ robust security measures.

- User-Friendly Interface: An intuitive and easy-to-navigate app makes the credit-building process less daunting and more engaging.

- Customer Support: Accessible and helpful customer support can be invaluable if you encounter issues or have questions about your credit building.

Credit Score Improvement Functionalities

The core purpose of these apps is to actively improve your credit score. The functionalities that directly contribute to this goal are those that establish a positive credit history and demonstrate responsible financial management.The primary functionalities that drive credit score improvement include:

- Reporting of On-Time Payments: Consistently making payments on time for services or loans reported by the app is the single most impactful factor in building credit. Payment history accounts for a significant portion of your credit score.

- Credit Utilization Management (for credit products): If the app offers access to credit products like secured cards or credit-builder loans, managing the utilization of that credit responsibly (keeping balances low) will positively influence your score.

- Length of Credit History: As you use the app’s reporting features over time, you begin to establish a longer credit history, which is another important component of your credit score.

- Credit Mix (less common, but beneficial): Some apps might offer access to different types of credit products, which can contribute to a healthy credit mix, although this is usually a secondary benefit.

Credit-Building Mechanisms Employed by Apps

Fintech credit-building apps utilize various methods to help users establish or improve their credit. Understanding these mechanisms allows you to choose an app that best suits your financial needs and risk tolerance.The different types of credit-building mechanisms commonly employed by these apps include:

Rent Reporting

This mechanism allows you to have your monthly rent payments reported to credit bureaus. For many individuals, rent is their largest recurring expense, and by reporting these payments, apps can turn a regular financial obligation into a credit-building opportunity. It’s particularly beneficial for those who may not have traditional credit accounts.

Secured Credit Cards

Secured credit cards require a cash deposit that typically serves as your credit limit. This deposit mitigates risk for the issuer, making it easier for individuals with limited or no credit history to obtain a card. Responsible use, including making on-time payments, is then reported to credit bureaus.

Credit-Builder Loans

These are small loans specifically designed for credit building. The loan amount is usually held in an account by the lender and released to you after you have made all the required payments. Your on-time payments on the loan are reported to credit bureaus, helping you build a positive payment history.

Subscription Reporting

Similar to rent reporting, some apps allow you to report payments for other recurring subscriptions, such as streaming services or utilities, to credit bureaus. This expands the range of everyday expenses that can contribute to your credit history.

Educational Resources vs. Sole Reporting Focus

The approach taken by credit-building apps can be broadly categorized into those that primarily focus on reporting your financial activity and those that integrate comprehensive educational resources. Both have their merits, and the ideal choice depends on your current level of financial literacy and your learning preferences.

Apps that focus solely on reporting are efficient for users who already have a good understanding of credit management and simply need a mechanism to have their positive financial behaviors recorded. They streamline the process of data transmission to credit bureaus, offering a direct path to credit score improvement through established payment history.

Conversely, apps that incorporate educational resources offer a more holistic approach. They not only report your activity but also provide guidance, tools, and information to help you understand credit scores, budgeting, debt management, and other financial concepts. This can be invaluable for individuals who are new to credit or who want to deepen their financial knowledge.

Here’s a comparison of their pros and cons:

| Feature | Apps Focused Solely on Reporting | Apps with Educational Resources |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

Evaluating App Functionality and User Experience

Once you’ve identified your credit-building needs and understood the general features of fintech credit-building apps, the next crucial step is to assess how well these apps actually work for you. This involves diving into their functionality and the overall user experience they offer. A well-designed app can make the often-complex process of credit building feel manageable and even rewarding, while a clunky or confusing interface can quickly lead to frustration and disengagement.This section will guide you through a framework for evaluating an app’s ease of use, the process of getting started, how you can track your progress, and the quality of feedback you can expect.

By critically examining these aspects, you can make a more informed decision about which app, if any, aligns best with your personal preferences and goals.

Assessing Ease of Use and Intuitive Design

A user-friendly app should feel natural and straightforward to navigate, minimizing the learning curve for new users. This is particularly important for financial tools where clarity and precision are paramount.The framework for assessing ease of use includes several key components:

- Navigation Clarity: Evaluate how easily you can find different sections of the app, such as account management, progress tracking, and educational resources. Are menus logical and consistently placed?

- Information Hierarchy: Assess how information is presented. Is the most important data (like credit score, payment due dates, or available credit) immediately visible and easy to understand?

- Visual Appeal and Readability: Consider the app’s aesthetic. Are colors, fonts, and spacing used effectively to create a clean and uncluttered interface? Is the text legible and free from jargon?

- Task Completion Efficiency: Try performing common tasks, like making a payment or checking your credit report summary. How many steps does it take? Is the process streamlined?

- Error Prevention and Handling: Does the app provide clear confirmations for actions taken? If an error occurs, is the message helpful and does it guide you toward a solution?

Account Setup and Financial Information Linking

The initial steps of setting up an account and connecting your financial data are critical indicators of an app’s overall user experience. A smooth and secure process here builds confidence for future interactions.The process typically involves the following stages:

- Registration: This usually begins with providing basic personal information, such as your name, email address, and phone number. The app should clearly Artikel its data privacy policies during this stage.

- Identity Verification: To comply with financial regulations and prevent fraud, most apps will require identity verification. This might involve submitting a photo of your government-issued ID and a selfie, or answering security questions based on your credit history.

- Linking Financial Accounts: To monitor spending, set up automated payments, or report positive payment history, you’ll likely need to link your bank accounts or credit cards. Reputable apps use secure, encrypted connections, often through trusted third-party aggregators like Plaid or Yodlee, to protect your sensitive data. The app should clearly explain what data it accesses and how it’s used.

- Setting Up Credit-Building Products: If the app offers specific credit-building products, such as a secured credit card or a credit-builder loan, the application process for these will be integrated here. This often involves reviewing terms and conditions and providing any additional necessary information.

Tracking Progress and Understanding Credit Score Changes

Effective progress tracking is essential for motivation and for understanding the impact of your actions on your credit health. A good app will make this information transparent and easy to interpret.Methods for tracking progress and understanding credit score changes within an app include:

- Credit Score Visualization: Look for clear charts or graphs that display your credit score over time. This visual representation helps you see trends and the impact of your payment behavior.

- Key Credit Factors: The app should break down the factors influencing your credit score, such as payment history, credit utilization, length of credit history, credit mix, and new credit. Understanding these components helps you focus your efforts.

- Progress Indicators: Many apps offer visual cues, like progress bars or badges, to indicate how close you are to achieving specific credit-building milestones.

- Score Change Explanations: When your score changes, the app should provide a concise explanation of why. This might highlight a recent payment that was reported, a decrease in credit utilization, or a new inquiry.

For instance, an app might show a notification: “Your credit score increased by 15 points this month. This is primarily due to your consistent on-time payments on your reported credit accounts and a reduction in your overall credit utilization.”

Providing Clear and Actionable Feedback

The feedback an app provides is its primary mechanism for guiding users and reinforcing positive financial habits. This feedback should be more than just data; it needs to be informative and tell you what to do next.An app should provide clear and actionable feedback through:

- Timely Payment Reminders: Proactive alerts before payment due dates are crucial to avoid missed payments, which can negatively impact your credit score.

- Positive Reinforcement: When you make an on-time payment or achieve a credit-building goal, the app should offer positive affirmations and acknowledge your success. This can be in the form of congratulatory messages or visual rewards.

- Specific Recommendations: Instead of generic advice, the app should offer personalized suggestions based on your credit profile and activity. For example, it might recommend paying down a specific credit card to lower utilization or suggest a strategy for managing new credit applications.

- Explanation of Impact: When you take an action, such as paying more than the minimum on a credit card, the app should ideally provide an estimated impact on your credit score or timeline for improvement.

For example, if you’re nearing your credit limit on a card, the app might display a notification like: “Your credit utilization on Card X is at 85%. To improve your credit score, aim to reduce this to below 30%. Making an extra payment of $200 this week could significantly impact your utilization ratio.” This type of feedback is highly valuable as it directly informs the user on how to take control of their credit health.

Assessing Costs and Fee Structures

Understanding the financial implications of a fintech credit-building app is paramount before committing. While these apps offer valuable services, their fee structures can vary significantly, impacting the overall affordability and effectiveness of your credit-building journey. A transparent understanding of all associated costs will empower you to make an informed decision and avoid unexpected expenses.It’s essential to recognize that not all credit-building apps operate on the same pricing model.

Some may offer a free tier with limited features, while others require a monthly or annual subscription. Additionally, various transactional fees can apply, depending on the specific services you utilize within the app. Careful evaluation of these costs will help you determine which app aligns best with your budget and financial goals.

Types of Fees Associated with Credit-Building Apps

Credit-building apps often employ a range of fees to cover their operational costs and the services they provide. Being aware of these different fee types is crucial for a comprehensive cost assessment.

- Subscription Fees: Many apps charge a recurring fee, either monthly or annually, for access to their core credit-building features. This can range from a few dollars per month to a more substantial annual payment.

- Late Fees: If you miss a payment deadline for any credit-building products offered through the app (e.g., a rent reporting service or a secured loan), you may incur late fees. These fees are designed to penalize delayed payments.

- Origination Fees: For certain financial products facilitated by the app, such as a secured credit card or a small loan, an origination fee might be charged. This is typically a one-time fee paid at the inception of the product.

- Transaction Fees: Some apps may charge a small fee for specific transactions, such as processing a payment or transferring funds. While often minimal, these can add up over time.

- Reporting Fees: In cases where the app reports your payment history to credit bureaus, there might be a fee associated with this service, especially if it’s an optional add-on.

- Overdraft Fees: If you link a bank account to the app and incur overdrafts due to payments made through the app, your bank may charge overdraft fees. While not directly an app fee, it’s a potential consequence of using the app’s services.

Comparative Analysis of Fee Structures Across Different App Models

The fee structures of credit-building apps can be broadly categorized into a few common models, each with its own advantages and disadvantages. Understanding these models will help you compare different options effectively.

| App Model | Typical Fee Structure | Pros | Cons |

|---|---|---|---|

| Freemium | Basic features free, premium features require subscription. May include transaction fees. | Low barrier to entry, allows testing basic functionality. | Limited features in free tier, can become costly with premium upgrades. |

| Subscription-Based | Fixed monthly or annual fee for full access. | Predictable costs, all features generally available. | Requires upfront commitment, may be costly if not fully utilized. |

| Pay-Per-Service | Fees charged for specific services used (e.g., reporting, credit score monitoring). | Only pay for what you use, flexible for users with specific needs. | Costs can be unpredictable, may become expensive for heavy users. |

| Bundled Services | Fee includes a package of services, often with a linked financial product. | Can offer good value if all bundled services are needed. | May pay for services you don’t use, less flexibility. |

Potential Hidden Costs to Be Aware Of

Beyond the clearly stated fees, some credit-building apps may have less obvious costs that can impact your overall expenditure. Vigilance is key to avoiding these surprises.

- Interest Charges: If the app facilitates access to secured credit cards or loans, be mindful of the interest rates. High interest can significantly increase the cost of borrowing and impact your ability to pay down debt.

- Currency Conversion Fees: If the app operates internationally or deals with foreign currency transactions, be aware of potential currency conversion fees that may apply.

- Data Usage Costs: While not a direct app fee, using data-intensive features of an app can contribute to your mobile data plan costs, especially if you have a limited data allowance.

- Service Disruption Fees: In rare cases, some terms of service might include clauses for fees related to service disruptions or account inactivity, though this is less common for reputable apps.

Questions to Ask Regarding an App’s Pricing Before Committing

To ensure you have a complete understanding of the financial commitment, it’s advisable to ask specific questions about an app’s pricing structure.

- What is the total cost to use all the credit-building features I intend to utilize over a specific period (e.g., one year)?

- Are there any one-time setup or origination fees associated with the app or any linked financial products?

- What are the exact amounts and triggers for late fees, and are there grace periods?

- Does the app charge any fees for reporting my payment history to credit bureaus? If so, is this included in a subscription or a separate charge?

- Are there any transaction fees for making payments or transferring funds within the app?

- What are the interest rates on any credit products offered or facilitated by the app, and how are they calculated?

- Does the app offer different pricing tiers, and what are the specific features included in each tier?

- What is the policy on refunds or cancellations, and are there any fees associated with closing an account?

Understanding Data Security and Privacy

In today’s digital landscape, safeguarding your personal and financial information is paramount, especially when entrusting it to a fintech credit-building app. A reputable app will prioritize robust security measures and transparent privacy practices to protect your data. It’s crucial to understand what these measures entail and how you can actively participate in protecting your information.Reputable fintech credit-building apps employ a multi-layered approach to data security.

This includes advanced encryption methods to scramble your data, making it unreadable to unauthorized parties, and secure server infrastructure to house your information. Understanding these protocols will empower you to make informed decisions about which app to trust with your sensitive details.

Security Protocols and Encryption Methods

To ensure the confidentiality and integrity of your data, reputable fintech credit-building apps implement a range of sophisticated security protocols and encryption methods. These are the foundational elements that protect your information from breaches and unauthorized access.

- Encryption: This is the process of converting readable data into an unreadable format, known as ciphertext. For data in transit (when it’s being sent between your device and the app’s servers), Transport Layer Security (TLS) is commonly used. For data at rest (when it’s stored on the app’s servers), Advanced Encryption Standard (AES) is a widely adopted and highly secure standard.

- Multi-Factor Authentication (MFA): This adds an extra layer of security beyond just a password. It typically involves requiring two or more verification factors, such as something you know (password), something you have (a code sent to your phone), or something you are (biometric data like a fingerprint).

- Regular Security Audits and Penetration Testing: Reputable apps undergo frequent independent security audits and penetration tests. These are simulated cyberattacks designed to identify vulnerabilities in their systems before malicious actors can exploit them.

- Secure Coding Practices: Developers follow secure coding guidelines to minimize the introduction of security flaws during the app’s development.

- Access Controls: Strict access controls are in place to ensure that only authorized personnel can access sensitive data, and even then, only on a need-to-know basis.

User Best Practices for Data Protection

While apps implement strong security measures, your active participation is vital in maintaining the safety of your personal and financial data. Adopting good digital hygiene habits significantly reduces your risk of exposure.It is essential to be proactive and mindful of how you interact with any financial app. By following these best practices, you can create a more secure environment for your sensitive information.

- Use Strong, Unique Passwords: Avoid using easily guessable passwords or reusing the same password across multiple accounts. Consider using a password manager to generate and store complex, unique passwords for each service.

- Enable Multi-Factor Authentication (MFA): If the app offers MFA, always enable it. This is one of the most effective ways to prevent unauthorized access, even if your password is compromised.

- Be Wary of Phishing Attempts: Never click on suspicious links or provide personal information in response to unsolicited emails, texts, or calls that claim to be from the app. Always verify the source directly through the app’s official channels.

- Keep Your App and Device Updated: Software updates often include critical security patches. Ensure your app and the operating system on your device are always up-to-date.

- Use Secure Wi-Fi Networks: Avoid accessing your fintech app or entering sensitive information on public, unsecured Wi-Fi networks, as these are more vulnerable to interception.

- Regularly Review Account Activity: Periodically check your account statements and app activity for any unauthorized transactions or suspicious behavior. Report any discrepancies immediately.

Importance of Understanding an App’s Privacy Policy

An app’s privacy policy is a critical document that Artikels how your data is collected, used, stored, and protected. Taking the time to understand this policy is not just a formality; it’s a fundamental step in ensuring your privacy is respected and your data is handled responsibly.

“Your privacy is not an option, it’s a right. Understand how your data is being used to protect it.”

A well-written privacy policy should be clear, concise, and easily accessible. It should inform you about:

- The types of personal information the app collects.

- How this information is used to provide and improve their services, including credit building.

- Whether your data is shared with third parties, and if so, for what purposes and with whom.

- The security measures in place to protect your data.

- Your rights regarding your data, such as the right to access, correct, or delete it.

- How long your data is retained.

Failing to review the privacy policy can lead to unexpected data sharing or usage that you may not be comfortable with.

Data Collection and Usage for Credit Building

Fintech credit-building apps collect various types of data to assess your financial habits and report them to credit bureaus, which is the core mechanism for building your credit. Understanding what data is collected and how it’s utilized is essential for transparency and trust.The data collected by these apps is carefully chosen to provide a comprehensive picture of your financial behavior and to accurately reflect your creditworthiness.

| Type of Data Collected | How it’s Used for Credit Building | Examples |

|---|---|---|

| Rent and Utility Payments | Reporting consistent, on-time payments to credit bureaus can help establish a positive payment history, a key factor in credit scores. | Monthly rent payments, electricity bills, water bills, and internet service fees. |

| Subscription Service Payments | Similar to utilities, timely payments for services like streaming platforms or gym memberships can be reported. | Netflix, Spotify, Amazon Prime, gym memberships. |

| Banking Transaction Data (with consent) | Analyzing spending patterns and account balances can help the app understand your financial stability and ability to manage payments. This is often used to offer personalized advice or credit products. | Income deposits, spending habits, average account balance, overdraft history. |

| Personal Identification Information | Necessary for identity verification to comply with regulations and to link your credit-building activities to your unique identity. | Name, address, date of birth, social security number (SSN). |

| Credit Score Information (if available) | To provide a baseline and track progress, some apps may access your existing credit score (with your permission) to monitor improvements. | Your current FICO score or VantageScore. |

It is crucial that the app clearly states in its privacy policy and terms of service how this data will be used and if it will be shared with any third parties, such as credit bureaus. For instance, an app might state that it uses your rent payment history to report to Experian, Equifax, and TransUnion, thereby directly contributing to your credit file.

Considering Alternatives and Complementary Tools

While dedicated fintech credit-building apps offer a streamlined approach, it’s essential to explore all available avenues and understand how these apps fit into your broader financial strategy. Evaluating alternatives and complementary tools will ensure you make the most informed decision for your unique financial journey.

Alternative Credit-Building Methods

Beyond specialized apps, several established methods can effectively contribute to building or improving your credit score. These traditional approaches often involve direct interaction with financial institutions and can provide a solid foundation for credit health.

- Secured Credit Cards: These cards require a cash deposit, which typically becomes your credit limit. Responsible use, such as making timely payments, directly builds your credit history.

- Credit-Builder Loans: Offered by some credit unions and community banks, these loans involve you making payments on a loan that is held in a savings account until it’s fully repaid. The repayment history is then reported to credit bureaus.

- Authorized User Status: Becoming an authorized user on a credit card account held by someone with excellent credit can positively impact your score, provided the primary cardholder manages their account responsibly.

- Rent and Utility Reporting Services: Some services allow you to report on-time rent and utility payments to credit bureaus, which can be particularly beneficial if you lack other credit accounts.

Effectiveness Comparison: Apps vs. Traditional Products

The effectiveness of credit-building apps compared to traditional financial products like secured credit cards or credit-builder loans depends on individual circumstances and how diligently the chosen method is utilized.

Credit-building apps often provide a user-friendly interface and may automate savings or payments, making them accessible for individuals new to credit. They can be excellent for those who need guidance and a structured way to save and demonstrate responsible financial behavior. However, the impact on your credit score can vary significantly based on the app’s reporting practices and the specific credit products they utilize or mimic.

Secured credit cards and credit-builder loans, on the other hand, are direct financial products reported to credit bureaus. They are generally considered highly effective because they directly mirror traditional credit usage and repayment patterns that credit scoring models are designed to assess. For instance, a secured credit card, when used consistently and paid off monthly, directly demonstrates your ability to manage revolving credit, a key factor in credit scoring.

“The most reliable path to a strong credit score involves consistent, responsible management of traditional credit products over time.”

Integrating Credit-Building Apps with Other Personal Finance Tools

A credit-building app can function as a valuable component within a broader personal finance ecosystem. Its strengths lie in its focused approach to credit improvement, which can be complemented by other tools designed for budgeting, saving, and investing.

For example, if you use a budgeting app to track your income and expenses, you can allocate a specific portion of your budget towards the savings goal or payment required by your credit-building app. Similarly, if you have a savings account managed through a separate banking app, you can set up automatic transfers to fund your credit-building activities. This integration ensures that your credit-building efforts are aligned with your overall financial goals and cash flow management.

Circumstances Where Credit-Building Apps May Not Be Optimal

While beneficial for many, a credit-building app might not be the most suitable option in certain situations. Understanding these scenarios can help you avoid unnecessary costs or ineffective strategies.

- Individuals with Existing Credit History: If you already have a good to excellent credit score and established credit accounts, a credit-building app may offer limited additional benefit. You might be better off focusing on managing your existing credit responsibly or exploring premium credit cards with rewards.

- Those Needing Immediate Access to Credit: Credit-building apps are designed for gradual credit improvement. If you require immediate access to a credit line for emergencies or significant purchases, traditional credit products like personal loans or unsecured credit cards might be more appropriate, assuming you qualify.

- Individuals Seeking Complex Financial Products: Credit-building apps are typically specialized. If your financial needs extend beyond credit building to include investing, debt management, or complex loan applications, you may need to seek out more comprehensive financial platforms or services.

- Cost-Conscious Individuals Unwilling to Pay Fees: Some credit-building apps charge monthly or annual fees. If you are highly sensitive to fees and have access to free or low-cost traditional credit-building options, an app might not be the most economical choice.

Practical Steps for Integration into Your Financial Routine

Embarking on a credit-building journey with a fintech app is a significant step towards financial well-being. To maximize its effectiveness, integrating the app seamlessly into your existing financial habits is crucial. This section Artikels a practical approach to adopting and consistently utilizing a credit-building app to foster positive financial behaviors.Integrating a credit-building app effectively involves more than just downloading it; it requires a deliberate strategy to make it a natural part of your financial life.

This means establishing clear steps for selection, onboarding, and ongoing engagement, ensuring that the app’s features actively contribute to your credit-building goals without becoming an added burden.

Selecting and Onboarding with a Chosen App

The initial phase of adopting a credit-building app involves a structured selection and onboarding process. This ensures that you choose an app that aligns with your specific needs and that you set it up for success from the outset.A systematic approach to selection and onboarding can be broken down into the following steps:

- Revisit Your Needs Assessment: Before selecting, refer back to your identified credit-building goals and any specific features you prioritized during the evaluation phase.

- Download and Explore: Download the top 2-3 apps that best match your criteria. Take time to navigate their interfaces and understand their core functionalities.

- Review Onboarding Materials: Pay close attention to any tutorials, FAQs, or welcome guides provided by the app. These resources are designed to help you understand how to get started.

- Complete Profile Setup: Accurately fill out all required personal and financial information. This is essential for the app to function correctly and report your activities.

- Link Necessary Accounts: If the app requires linking bank accounts or other financial services, ensure you do so securely and understand what data is being accessed.

- Set Up Initial Credit-Building Activity: Whether it’s setting up a small, regular payment or choosing a subscription plan, initiate the primary credit-building mechanism as guided by the app.

- Confirm First Report: Understand when and how the app will report your activity to credit bureaus. Look for confirmation that your first report has been sent or is scheduled.

Integrating Credit-Building Activities into Your Financial Habits

Transforming credit-building app usage from a chore into a consistent habit requires strategic integration into your daily or weekly financial routine. This involves linking app activities with existing financial touchpoints.To embed credit-building into your regular financial life, consider the following strategies:

- Anchor to Existing Habits: Pair app usage with activities you already do regularly. For example, check your credit-building progress immediately after paying your rent or reviewing your bank statement.

- Automate Where Possible: Utilize any auto-payment or auto-deposit features offered by the app to ensure consistent activity without manual intervention.

- Schedule Reminders: Set up calendar alerts or phone notifications for specific tasks, such as making a manual payment, reviewing your credit score, or engaging with educational content.

- Visualize Progress: Regularly check the app’s dashboard to see your credit score improve or your payment history lengthen. Visual reinforcement can be a powerful motivator.

- Gamify Your Goals: Some apps offer rewards or progress tracking that can be used to create personal challenges or milestones to celebrate.

Strategies for Staying Motivated and Consistent

Maintaining motivation and consistency with a credit-building app is key to achieving long-term financial goals. The novelty of a new app can wear off, so proactive strategies are necessary to ensure continued engagement.Effective motivation and consistency strategies include:

- Set Clear, Achievable Milestones: Break down your larger credit-building goal into smaller, more manageable steps. Celebrating these smaller wins can maintain momentum. For instance, aiming for a 10-point credit score increase within three months, rather than an abstract “better credit.”

- Educate Yourself Continuously: Utilize any educational resources provided by the app or seek out additional information on credit management. Understanding

-why* you are doing something can increase commitment. - Seek Accountability: Share your goals with a trusted friend, family member, or financial advisor. Knowing someone else is aware of your progress can provide an extra layer of motivation.

- Review Your “Why”: Periodically remind yourself of the reasons you started building credit – perhaps to qualify for a mortgage, a better car loan, or simply for greater financial freedom.

- Be Patient and Persistent: Credit building is a marathon, not a sprint. Understand that progress may be gradual, and setbacks can happen. Focus on consistent effort over perfection.

Sample Daily/Weekly Schedule for Effective App Usage

A structured schedule helps ensure that credit-building activities become an ingrained part of your financial routine. This sample schedule can be adapted to fit your personal lifestyle and the specific features of your chosen app.Here is a sample schedule that integrates credit-building app usage: Daily Integration:

- Morning (5 minutes): Upon waking, quickly check your app’s dashboard for any immediate updates or to confirm that an automated payment has been processed. This reinforces the app’s presence in your daily financial overview.

Weekly Integration:

- Sunday Evening (15 minutes): Dedicate time to review your credit score progress for the week, read any new educational content provided by the app, and plan for any manual payments or specific actions needed in the coming week. This ensures you are proactive and informed.

- Mid-Week Check-in (5 minutes): Briefly log in to confirm that scheduled payments are on track and to acknowledge any positive progress. This quick touchpoint helps maintain engagement without being time-consuming.

Monthly Integration:

- End of Month (20 minutes): Conduct a more thorough review of your credit report (if the app offers this feature), analyze spending patterns that may affect your credit utilization, and adjust your strategy for the next month based on your progress and any new financial goals.

This structured approach transforms app usage from an optional task into a predictable and beneficial component of your financial management.

End of Discussion

In conclusion, navigating the world of fintech credit-building apps requires a thoughtful and informed approach. By diligently understanding your own financial needs, meticulously evaluating app features, scrutinizing costs and security, and considering all available options, you can confidently select a tool that genuinely supports your credit-building journey. This comprehensive evaluation process ensures that you invest your time and resources wisely, paving the way for improved creditworthiness and greater financial opportunities.