Embark on a journey to transform your financial future with “How to Make Building Credit a Positive Habit.” This guide is designed to demystify the world of credit, transforming it from a daunting concept into an empowering tool for achieving your financial aspirations. Prepare to uncover the secrets to not just managing, but mastering your credit.

We will delve into the very essence of credit building, exploring its foundational purpose, the key elements that shape your credit score, and the profound long-term advantages of cultivating a strong credit history. Furthermore, we’ll address common myths that may be hindering your progress and provide actionable steps to establish and maintain credit responsibly, setting you on a path to financial success.

Understanding the Foundation of Credit Building

Building credit is a fundamental aspect of financial health, acting as a key that unlocks access to various financial opportunities and services. It represents your reliability as a borrower, demonstrating to lenders your capacity to manage debt responsibly. A strong credit history is not merely about borrowing money; it’s about establishing trust and credibility in the financial marketplace, which can significantly impact your life in numerous positive ways.The process of building credit involves understanding how your financial behaviors are translated into a quantifiable measure of your creditworthiness.

This understanding empowers you to make informed decisions that foster a positive credit trajectory. It’s a continuous journey that, when approached with knowledge and discipline, leads to substantial long-term benefits.

The Fundamental Purpose of Building Credit

The primary purpose of building credit is to establish a financial track record that lenders and other institutions can use to assess your risk as a borrower or customer. This record serves as a proxy for your trustworthiness in financial dealings. By demonstrating a history of responsible borrowing and repayment, you signal to the financial world that you are a reliable entity capable of meeting your financial obligations.

This, in turn, facilitates access to essential financial products and services, often on more favorable terms.

Primary Components of a Credit Score

A credit score is a three-digit number that summarizes your credit history and is used by lenders to determine your creditworthiness. While specific algorithms vary among credit bureaus, several key factors consistently influence your score. Understanding these components is crucial for effective credit building.These factors are weighted differently, meaning some have a greater impact on your score than others. Focusing on the most influential aspects will yield the most significant improvements in your creditworthiness.

- Payment History (35%): This is the most critical factor. It reflects whether you pay your bills on time. Late payments, missed payments, defaults, and bankruptcies can severely damage your score.

- Amounts Owed (30%): This refers to the total amount of debt you carry across all your credit accounts. A high credit utilization ratio (the amount of credit you’re using compared to your total available credit) can negatively impact your score. Keeping this ratio low, ideally below 30%, is recommended.

- Length of Credit History (15%): The longer you have been managing credit responsibly, the more positive this factor becomes. It shows lenders a sustained pattern of good financial behavior.

- Credit Mix (10%): Having a variety of credit types, such as credit cards, installment loans (like mortgages or auto loans), can be beneficial. It demonstrates your ability to manage different forms of credit.

- New Credit (10%): Opening multiple new credit accounts in a short period can be seen as a sign of increased risk. Each hard inquiry from a credit application can slightly lower your score.

Long-Term Advantages of a Strong Credit History

A strong credit history is more than just a requirement for loans; it’s a powerful tool that offers a multitude of advantages throughout your life. These benefits extend beyond simple borrowing, impacting your ability to secure housing, obtain employment, and even save money.The sustained effort in maintaining good credit habits yields compounding returns over time, making your financial life smoother and more accessible.

- Easier Loan and Mortgage Approval: Lenders are more likely to approve applications for mortgages, auto loans, and personal loans for individuals with excellent credit scores.

- Lower Interest Rates: A good credit score often translates to lower interest rates on loans and credit cards, saving you significant amounts of money over the life of the loan. For example, a borrower with a score of 750 might secure a mortgage at 5% interest, while a borrower with a score of 650 might face an interest rate of 7%, resulting in thousands of dollars in extra payments over 30 years.

- Better Insurance Premiums: In many states, insurance companies use credit-based insurance scores to determine premiums for auto and homeowners insurance. A higher credit score can lead to lower insurance costs.

- Access to Premium Credit Cards: Premium credit cards often come with attractive rewards, travel perks, and cashback offers, which are typically reserved for individuals with good to excellent credit.

- Easier Rental Applications: Landlords frequently check credit reports to assess the reliability of potential tenants. A strong credit history can make it easier to rent an apartment or house.

- Potential for Lower Security Deposits: Utility companies and mobile phone providers may waive or reduce security deposits for customers with good credit.

- Employment Opportunities: Some employers, particularly in financial or sensitive positions, may review credit reports as part of the background check process.

Common Misconceptions About Credit Building

Despite the importance of credit, several widespread misconceptions can hinder effective credit building. Dispelling these myths is essential for developing a sound financial strategy.It is important to approach credit building with accurate information to avoid making decisions that could inadvertently harm your financial standing.

- “Checking your own credit score hurts your score.” This is false. Checking your own credit report or score for informational purposes (a “soft inquiry”) does not affect your credit score. Only when you apply for new credit and a lender pulls your report (a “hard inquiry”) does it have a minor, temporary impact.

- “Closing old credit cards will improve your score.” In most cases, closing an old credit card, especially one with a good payment history, can negatively impact your score. It reduces your average age of credit and can increase your credit utilization ratio if you carry balances on other cards.

- “You need to carry a balance to build credit.” It is not necessary to carry a balance and pay interest to build credit. Responsible use, including making on-time payments, is what matters most. In fact, carrying high balances can hurt your score due to increased credit utilization.

- “All debt is bad debt.” While excessive debt is detrimental, some forms of debt, when managed responsibly, are essential for building credit. For example, a mortgage or an auto loan, when paid on time, contributes positively to your credit history.

- “Credit scores are permanent.” Credit scores are dynamic and can change based on your financial behavior. Consistent responsible financial management can improve a low score over time, while neglect can cause a good score to decline.

Establishing Initial Credit Responsibly

Building credit is a foundational step towards financial well-being, and establishing it responsibly from the outset is crucial for long-term success. This section Artikels practical methods and tools to help you begin your credit-building journey with confidence and a solid understanding of how to manage it effectively.Understanding the various avenues available can empower you to choose the best starting point for your financial situation.

Whether you are new to credit or looking to rebuild, these strategies are designed to be accessible and beneficial.

Secured Credit Card Application Process

A secured credit card is an excellent tool for individuals seeking to establish or rebuild credit. It requires a cash deposit that typically serves as your credit limit, significantly reducing risk for the lender and making it easier to get approved.Here is a step-by-step guide to opening a secured credit card:

- Research and Compare: Look for secured credit cards from reputable banks or credit unions. Compare their annual fees, interest rates (APR), deposit requirements, and any other associated charges. Some cards may also offer rewards programs, which can be a nice bonus.

- Determine Deposit Amount: Decide how much you can comfortably afford to deposit. Your credit limit will usually be equal to this deposit. A higher deposit can lead to a higher credit limit, offering more flexibility, but it’s essential to choose an amount that aligns with your budget.

- Gather Necessary Information: You will typically need to provide personal information such as your name, address, date of birth, Social Security number, and income details.

- Complete the Application: Fill out the application form accurately and submit it. This can usually be done online through the lender’s website.

- Submit Your Deposit: Once your application is approved, you will be instructed on how to submit your security deposit. This is a critical step to activate your card.

- Receive and Activate Your Card: After your deposit is processed, your secured credit card will be mailed to you. Follow the instructions provided to activate it.

- Use Responsibly: Begin using the card for small, manageable purchases and ensure you pay your balance in full and on time each month.

Role of a Credit-Builder Loan

A credit-builder loan is a type of loan specifically designed to help individuals establish or improve their credit history. Unlike traditional loans where you receive the money upfront, with a credit-builder loan, the loan amount is held in a savings account by the lender and released to you only after you have made all the scheduled payments.The process works as follows:

- You apply for the loan and are approved for a specific amount.

- The lender places this amount into a locked savings account in your name.

- You make regular payments on the loan, just as you would with any other loan.

- These on-time payments are reported to the major credit bureaus (Equifax, Experian, and TransUnion).

- Once the loan term is complete and you have made all payments, the funds in the savings account are released to you.

This method ensures that you are consistently making payments, which is a primary factor in credit scoring, while also providing you with savings at the end of the loan term.

Benefits of Becoming an Authorized User

Becoming an authorized user on an existing credit card account can be a strategic way to build credit, especially if the primary account holder has a long, positive credit history. As an authorized user, you are added to someone else’s credit card account, and their payment history is reflected on your credit report.The advantages include:

- Leveraging Established Credit: You can benefit from the primary cardholder’s good credit habits, such as timely payments and a low credit utilization ratio.

- No Application Required: Typically, there is no credit check or application process for authorized users, making it an accessible option.

- Credit History Boost: Positive activity on the account can contribute to building or improving your credit score.

However, it is crucial to choose a primary cardholder who is financially responsible. Any negative activity on the account, such as late payments or high balances, can also negatively impact your credit. Open communication and trust are paramount when considering this option.

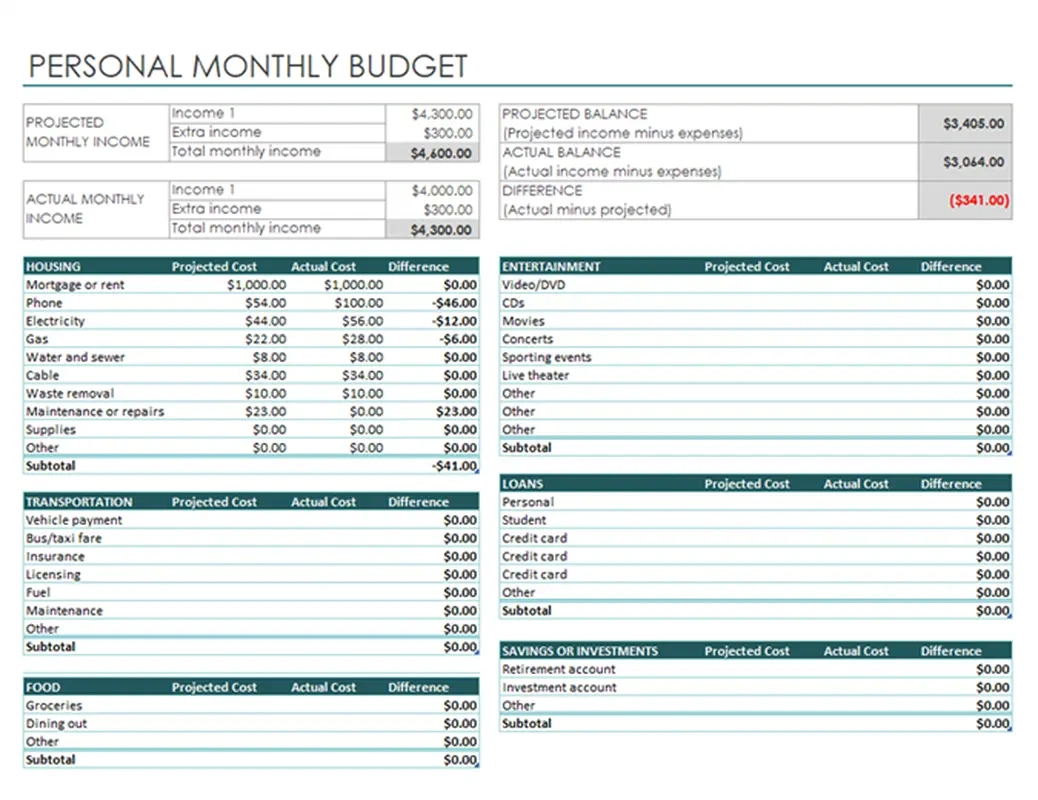

Budget for Managing Initial Credit Responsibly

Managing your credit responsibly from the start involves creating a clear budget that incorporates your credit card payments. This ensures you stay within your means and avoid accumulating debt.Here is a simple budget framework:

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Income | $XXXX | $XXXX | $0 |

| Essential Expenses (Rent/Mortgage, Utilities, Groceries) | $XXXX | $XXXX | $XXXX |

| Discretionary Spending (Entertainment, Dining Out) | $XXXX | $XXXX | $XXXX |

| Credit Card Payment (Minimum Payment) | $XX | $XX | $0 |

| Credit Card Payment (Targeted Full Payment) | $XXX | $XXX | $0 |

| Savings/Emergency Fund | $XXX | $XXX | $XXX |

| Total Expenses | $XXXX | $XXXX | $XXXX |

| Remaining Balance | $XXXX | $XXXX | $XXXX |

To manage initial credit responsibly, aim to pay more than the minimum payment whenever possible. This helps reduce the principal balance faster and minimizes interest charges.A key principle for responsible credit management is to treat your credit card as a tool, not as an extension of your income. Always ensure that the purchases you make can be covered by the cash you have available or will have available by the payment due date.

“The best way to predict the future is to create it.”Peter Drucker. This quote emphasizes the proactive nature required in financial planning, including credit management.

Cultivating Positive Credit Habits

Building a strong credit history is not a one-time event; it’s a continuous process that requires mindful attention and consistent effort. By integrating positive credit practices into your monthly routine, you can significantly enhance your financial well-being and achieve your long-term goals. This section will guide you through the essential habits that form the bedrock of a healthy credit profile.Establishing and maintaining good credit is akin to nurturing a valuable asset.

It requires regular engagement and a proactive approach to managing your financial responsibilities. The habits discussed below are designed to empower you with the knowledge and tools to make credit work for you, rather than against you.

Monthly Credit Report Review Routine

Regularly monitoring your credit reports is a crucial habit for maintaining credit health and identifying potential issues. This practice allows you to stay informed about your credit activity and ensure the accuracy of the information reported by lenders. Establishing a consistent schedule for this review can prevent surprises and enable timely action if discrepancies arise.To effectively incorporate this into your routine, consider the following steps:

- Set a recurring calendar reminder for the same day each month. This could be linked to a payday or another predictable financial event.

- Access your free credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) annually. You are entitled to one free report from each bureau every 12 months via AnnualCreditReport.com. While annual access is free, consider subscribing to a credit monitoring service if you wish to check more frequently, as many offer monthly access to your reports and scores.

- Carefully review each section of your credit report. Pay close attention to personal information, account details, credit inquiries, and public records.

- Verify that all personal information is accurate and up-to-date.

- Confirm that all listed accounts accurately reflect your borrowing history, including payment statuses, balances, and credit limits.

- Check for any unauthorized credit inquiries, which could indicate identity theft.

- If you find any inaccuracies or fraudulent activity, initiate a dispute with the credit bureau and the creditor involved immediately.

Consistent On-Time Payment Strategy

Making payments on time is the single most significant factor influencing your credit score. Lenders view timely payments as a strong indicator of your reliability and ability to manage debt responsibly. Developing a consistent strategy ensures that you never miss a due date, thereby protecting your credit score from unnecessary damage.To ensure you consistently make on-time payments, consider implementing these effective methods:

- Automate Payments: Set up automatic payments from your bank account for all your credit accounts. This is the most foolproof method to avoid late payments, as the funds are withdrawn automatically before the due date. Ensure you have sufficient funds in your account to cover these payments.

- Set Payment Reminders: If automation isn’t feasible or you prefer to review before payment, set up multiple reminders. Use calendar alerts, phone notifications, or even sticky notes to remind yourself a few days before the due date.

- Pay Early: Aim to make payments a few days before the actual due date. This provides a buffer in case of any unexpected issues, such as mail delays or bank processing times.

- Understand Billing Cycles: Be aware of the billing cycle for each of your credit accounts. Payments are typically due a certain number of days after the end of the billing cycle. Knowing these cycles helps in planning your payments effectively.

- Minimum Payment vs. Full Payment: While making at least the minimum payment on time will prevent late fees and negative marks on your credit report, it is always advisable to pay the full balance whenever possible to avoid interest charges. However, for the purpose of on-time payment, even the minimum is crucial.

Missing even one payment can have a substantial negative impact on your credit score, potentially dropping it by dozens of points. Repeated late payments can significantly hinder your ability to obtain future credit or loans at favorable terms.

Strategies for Maintaining Low Credit Utilization

Credit utilization refers to the amount of credit you are using compared to your total available credit. Keeping this ratio low is a critical habit that demonstrates responsible credit management and positively impacts your credit score. A high credit utilization ratio can signal to lenders that you may be overextended and are at a higher risk of default.Effective strategies to maintain a low credit utilization ratio include:

- Understand Your Ratio: Your credit utilization ratio is calculated by dividing the total balance of your revolving credit accounts by your total credit limit. For example, if you have a credit card with a $10,000 limit and a balance of $2,000, your utilization for that card is 20%.

- Aim for Below 30%: Financial experts and credit scoring models generally recommend keeping your credit utilization below 30% across all your credit accounts. Ideally, aiming for below 10% is even better for maximizing your credit score.

- Pay Down Balances Regularly: The most direct way to lower your utilization is to pay down your credit card balances. Make payments throughout the month, not just on the due date, to reduce the reported balance.

- Increase Credit Limits: If your spending habits remain consistent, requesting an increase in your credit limit from your credit card issuer can lower your utilization ratio, provided you don’t increase your spending. However, be cautious, as this may also tempt you to spend more.

- Spread Balances Across Cards: If you have multiple credit cards, try to distribute your spending across them rather than maxing out one card while others have zero balances. This helps maintain a lower overall utilization ratio.

- Avoid Closing Unused Credit Cards: Closing a credit card reduces your total available credit, which can increase your credit utilization ratio even if your spending remains the same. Keep older, unused cards open, especially if they have no annual fee, to maintain a higher credit limit.

Credit utilization is the second most important factor in determining your credit score, after payment history.

Impact of Responsible Credit Card Usage on Credit Health

Responsible credit card usage goes beyond simply making payments on time. It involves a mindful approach to spending, managing debt, and leveraging the benefits of credit cards without falling into debt traps. Consistently employing responsible practices significantly contributes to building a strong credit profile and enhancing your overall financial health.The positive impacts of responsible credit card usage include:

- Improved Credit Score: Consistent on-time payments and low credit utilization, both direct results of responsible usage, are key drivers of a higher credit score. A good score unlocks better interest rates on loans, easier approvals for credit, and even affects insurance premiums and rental applications.

- Access to Better Financial Products: A strong credit history built on responsible usage makes you a more attractive candidate for premium credit cards with rewards programs, lower interest rates, and better perks. It also makes it easier to qualify for mortgages, auto loans, and personal loans with favorable terms.

- Emergency Fund Supplement: While not a replacement for an emergency fund, a credit card can provide a financial safety net for unexpected expenses. However, it’s crucial to have a plan to pay off any emergency spending quickly to avoid accumulating high-interest debt.

- Building a Positive Financial Reputation: Responsible credit behavior establishes a track record that lenders and other financial institutions can rely on. This reputation can be invaluable when you need to borrow larger sums or seek specialized financial services.

- Rewards and Benefits: Many credit cards offer rewards such as cashback, travel points, or discounts. Responsible usage allows you to benefit from these perks without incurring additional costs or debt.

Conversely, irresponsible usage, such as overspending, missing payments, or carrying high balances, can lead to debt accumulation, damaged credit, and a host of financial challenges.

Plan for Avoiding Common Credit Pitfalls

Navigating the world of credit can be complex, and several common pitfalls can derail even the best intentions. Proactively creating a plan to avoid these traps is essential for maintaining good credit health and achieving financial stability. Understanding these pitfalls and developing strategies to circumvent them will safeguard your credit score and your financial future.A robust plan for avoiding common credit pitfalls should address the following:

- Overspending and Impulse Purchases: This is a leading cause of credit card debt.

- Strategy: Create a detailed budget and stick to it. Before making a purchase, especially a non-essential one, ask yourself if it aligns with your budget and financial goals. Implement a “24-hour rule” for non-essential purchases, giving yourself time to reconsider.

- Missing Payment Due Dates: Even one missed payment can significantly harm your credit score.

- Strategy: As discussed earlier, automate payments or set multiple reminders. Understand your billing cycles and ensure funds are available. If you anticipate a difficulty in making a payment, contact your creditor

-before* the due date to discuss potential arrangements.

- Strategy: As discussed earlier, automate payments or set multiple reminders. Understand your billing cycles and ensure funds are available. If you anticipate a difficulty in making a payment, contact your creditor

- Carrying High Balances (High Credit Utilization): This negatively impacts your credit score and incurs substantial interest charges.

- Strategy: Prioritize paying down balances, especially on high-interest cards. Aim to keep utilization below 30%, ideally below 10%.

- Opening Too Many Credit Accounts at Once: Each application results in a hard inquiry, which can slightly lower your score, and managing multiple new accounts can be overwhelming.

- Strategy: Apply for new credit only when necessary and spread out applications over time. Focus on building a solid history with a few responsible accounts first.

- Not Monitoring Credit Reports for Errors or Fraud: Inaccuracies or fraudulent activity can go unnoticed, damaging your credit.

- Strategy: Establish a routine for checking your credit reports at least annually, or more frequently if you use a credit monitoring service.

- Falling for “Credit Repair” Scams: These services often make unrealistic promises and charge high fees for services you can perform yourself.

- Strategy: Be wary of any company that guarantees to remove accurate negative information from your credit report or charges upfront fees. Legitimate credit repair involves addressing errors and managing debt responsibly.

- Ignoring Debt: Hoping debt will disappear is not a strategy and only leads to greater problems.

- Strategy: Face your debts head-on. Create a repayment plan, prioritize high-interest debts, and seek professional help from a non-profit credit counseling agency if needed.

By understanding these common pitfalls and proactively implementing these strategies, you can build a strong and resilient credit profile that supports your financial aspirations.

Leveraging Credit for Financial Growth

A well-managed credit history is more than just a record of your past borrowing behavior; it’s a powerful tool that can unlock significant financial opportunities and contribute to your overall wealth accumulation. By understanding and strategically utilizing credit, you can achieve your financial goals more efficiently and with greater ease. This section explores the multifaceted ways a strong credit profile can propel your financial growth.A good credit score acts as a financial passport, opening doors to a wider range of financial products and services, often with more favorable terms.

It signifies to lenders that you are a reliable borrower, capable of managing debt responsibly. This trust is fundamental to accessing the capital needed for major life purchases and investments.

Loan Approval Facilitation

Lenders, including banks and credit unions, rely heavily on credit scores to assess the risk associated with lending money. A higher credit score indicates a lower risk of default, making you a more attractive borrower. This translates directly into a higher likelihood of loan approval for various financial needs, from mortgages and auto loans to personal loans and business financing.When applying for a loan, your credit report provides a comprehensive overview of your credit history, including payment history, amounts owed, length of credit history, credit mix, and new credit.

A strong performance across these categories will present you as a responsible individual, reassuring lenders of your ability to repay the borrowed funds. This can be the difference between getting approved for a significant loan or facing rejection.

Rental Apartment Advantages

Beyond traditional lending, a strong credit profile is increasingly becoming a prerequisite for securing desirable rental accommodations. Landlords and property management companies often run credit checks on prospective tenants to gauge their financial reliability. A good credit score suggests that you are likely to pay rent on time and be a responsible tenant, reducing the landlord’s risk.This can provide a significant competitive edge in competitive rental markets.

It may allow you to:

- Secure an apartment more quickly, especially in high-demand areas.

- Potentially negotiate more favorable lease terms.

- Avoid the need for a co-signer or a larger security deposit.

In essence, your creditworthiness can directly influence your housing options and the ease with which you can establish a stable home.

Insurance Premium Impact

The influence of credit extends to the cost of various insurance policies, including auto and homeowners insurance. Many insurance companies use credit-based insurance scores as a factor in determining premiums. The logic behind this practice is that individuals with better credit histories tend to file fewer insurance claims, making them a lower risk for insurers.This correlation, while sometimes debated, is a recognized practice in the industry.

Consequently, a strong credit score can lead to demonstrably lower insurance costs. For example, studies have shown that individuals with excellent credit may pay significantly less for auto insurance compared to those with poor credit, even if they have similar driving records or home profiles. This represents a direct, ongoing financial saving.

Financial Benefits of Credit Use Over Cash

While the prudent use of cash is a cornerstone of good financial management, strategically employing credit can offer distinct financial advantages. Credit cards, when used responsibly and paid off in full each month, can provide benefits that cash simply cannot match.Consider the following benefits:

- Rewards Programs: Many credit cards offer rewards such as cashback, travel miles, or points that can be redeemed for valuable goods and services. Using credit for everyday purchases that you would make with cash allows you to accumulate these rewards, effectively giving you a discount on your spending. For instance, if you spend $1,000 per month on groceries and gas, and your card offers 2% cashback, you could earn $240 in cashback annually, which is essentially free money.

- Purchase Protection and Extended Warranties: Some credit cards offer built-in protections for purchases, such as extended warranties on electronics or protection against damage or theft for a certain period after purchase. These benefits can save you money on repairs or replacements.

- Building Credit History: As previously discussed, the responsible use of credit cards is fundamental to building and improving your credit score, which in turn opens up opportunities for better loan terms and other financial benefits.

- Fraud Protection: Credit card companies typically offer robust fraud protection. If your card is compromised, your liability for unauthorized charges is usually limited, and the credit card company will investigate and resolve the issue, protecting your immediate funds.

It is crucial to emphasize that these benefits are realized only when credit is used judiciously. Carrying a balance and incurring interest charges will negate these advantages and lead to increased costs. The key is to treat credit as a convenient payment tool and to always pay off the balance in full and on time.

Advanced Credit Management Techniques

Once you’ve established a solid foundation for building credit, it’s time to explore advanced strategies to further optimize your credit profile and leverage it for greater financial well-being. These techniques involve proactive management, strategic utilization, and a long-term perspective on your credit journey.

Credit Report Error Dispute Process

Errors on credit reports can negatively impact your credit score and your ability to access credit. It’s crucial to know how to identify and rectify these inaccuracies promptly. The process involves several key steps to ensure your credit report accurately reflects your financial history.To dispute an error on your credit report, follow these steps:

- Obtain Your Credit Reports: Regularly request free copies of your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Review them carefully for any discrepancies.

- Identify the Error: Pinpoint the specific information that is incorrect, such as incorrect personal details, accounts you don’t recognize, inaccurate payment history, or incorrect credit limits.

- Gather Supporting Documentation: Collect any evidence that supports your claim, such as billing statements, canceled checks, court records, or correspondence with the creditor.

- Contact the Credit Bureau: You can dispute errors online, by mail, or by phone directly with the credit bureau reporting the inaccuracy. Most bureaus have dedicated dispute sections on their websites. When writing, be specific and include copies of your documentation.

- Contact the Furnisher of Information: In addition to contacting the credit bureau, you should also contact the company that provided the incorrect information (the “furnisher”) to request a correction.

- Follow Up: Credit bureaus are typically required to investigate your dispute within 30 days. You will receive a written response detailing the outcome of their investigation. If the error is corrected, ensure it is updated on all three credit reports.

Strategic Credit Limit Increases

Increasing your credit limits can positively impact your credit utilization ratio, a key factor in credit scoring. This is achieved by increasing the amount of available credit without increasing your actual spending.Methods for strategically increasing credit limits include:

- Demonstrate Responsible Usage: Consistently making on-time payments and keeping balances low on your existing credit cards is the most effective way to show lenders you are a reliable borrower.

- Request an Increase: After a period of responsible use (typically 6-12 months), you can proactively request a credit limit increase from your credit card issuer. This can often be done online or by calling customer service. Be prepared to provide updated income information.

- Avoid Frequent Applications: Applying for multiple credit limit increases in a short period can lead to hard inquiries on your credit report, which can temporarily lower your score. Space out your requests.

- Consider Balance Transfer Offers: Sometimes, a balance transfer offer can come with a higher credit limit. However, be mindful of fees and interest rates associated with such offers.

A higher credit limit, when managed responsibly, can lower your credit utilization ratio. For example, if you have a credit card with a $1,000 balance and a $2,000 limit, your utilization is 50%. If your limit increases to $4,000, your utilization drops to 25%, which is generally more favorable for your credit score.

Implications of Closing Old Credit Accounts

The decision to close old credit accounts should be approached with careful consideration, as it can have a notable impact on your credit profile.The implications of closing old credit accounts include:

- Impact on Credit Utilization Ratio: Closing an account reduces your total available credit. If you carry balances on other cards, this can increase your credit utilization ratio, potentially lowering your score.

- Effect on Average Age of Accounts: Older, well-managed accounts contribute positively to the average age of your credit history. Closing an old account can reduce this average, which may negatively affect your score.

- Loss of Payment History: If the old account was in good standing, closing it means losing the positive payment history associated with it.

- Potential for Fees: Some credit cards have annual fees. If you are no longer using a card and are being charged a fee, closing it might seem logical. However, weigh this against the potential credit score impact.

It is generally advisable to keep older, well-managed credit accounts open, especially if they do not have an annual fee, as they contribute positively to your credit history length and utilization.

Credit Mix Importance

A credit mix refers to the variety of credit accounts you have, such as credit cards, installment loans (like mortgages or auto loans), and personal loans. Lenders view a diverse credit mix as a sign of responsible credit management across different types of credit.The importance of a credit mix is that it demonstrates your ability to handle various forms of debt.

A well-rounded credit history that includes both revolving credit (credit cards) and installment credit (loans with fixed payments) can signal to lenders that you are a capable borrower. While not as heavily weighted as payment history or credit utilization, a healthy credit mix can contribute positively to your overall credit score.

Long-Term Responsible Credit Usage Strategy

Developing a long-term strategy for using credit responsibly ensures that your credit continues to be a valuable asset throughout your financial life. This involves consistent habits and forward-thinking planning.A strategy for using credit responsibly over many years includes:

- Consistent On-Time Payments: This is the cornerstone of good credit. Automate payments where possible to avoid missing due dates.

- Maintain Low Credit Utilization: Aim to keep your credit utilization ratio below 30%, and ideally below 10%, on all your credit cards.

- Regularly Monitor Credit Reports: Continue to check your credit reports annually for accuracy and to stay informed about your credit health.

- Strategic Use of New Credit: When opening new accounts, do so thoughtfully. Consider the impact on your credit mix and average age of accounts. Avoid opening too many accounts in a short period.

- Review Credit Card Benefits: Periodically review the rewards, benefits, and interest rates of your credit cards. Consider consolidating or closing accounts that no longer serve your financial goals, but do so strategically, as discussed previously.

- Utilize Credit for Major Goals: Over the long term, responsible credit use can facilitate major life events such as purchasing a home, a vehicle, or funding education.

By adhering to these principles consistently, you build a strong and resilient credit profile that supports your financial aspirations over decades.

Practical Tools and Resources for Credit Building

Navigating the world of credit can feel complex, but a wealth of digital and educational resources are available to empower your credit-building journey. These tools are designed to simplify monitoring, enhance understanding, and provide structured methods for managing your credit effectively. By leveraging these resources, you can transform abstract credit concepts into tangible, actionable steps toward financial well-being.The key to successful credit building lies in consistent monitoring and informed decision-making.

Fortunately, numerous applications and websites offer real-time insights into your credit reports and scores, while reputable financial education platforms provide the knowledge base needed to make sound financial choices. Furthermore, practical tools for tracking your financial activities and seeking expert advice can solidify your progress.

Credit Monitoring Applications and Websites

Staying informed about your credit health is paramount. Credit monitoring services offer a convenient way to track changes to your credit report, receive alerts for significant activity, and understand the factors influencing your credit score. This proactive approach helps you identify potential errors, detect fraudulent activity, and gauge the impact of your financial habits.Here are some highly-regarded platforms that offer credit monitoring and related tools:

- Credit Karma: Provides free access to credit scores from TransUnion and Equifax, along with personalized insights and recommendations. It also offers tools for tracking credit card offers and budgeting.

- Credit Sesame: Offers free credit scores and monitoring, along with personalized recommendations for credit cards and loans that may improve your score.

- Experian: As one of the three major credit bureaus, Experian offers its own credit monitoring services, including free access to your Experian FICO Score and a detailed look at your credit report.

- MyFICO: This platform, directly from FICO, offers more in-depth analysis of your FICO Scores, including different score versions and detailed explanations of what impacts them. While some services require a fee, it provides unparalleled insight into your scores.

- AnnualCreditReport.com: This is the official, government-mandated website where you can obtain free copies of your credit reports from Equifax, Experian, and TransUnion once every 12 months. It’s crucial for reviewing your reports for accuracy.

Reputable Financial Education Resources

A strong understanding of credit principles is the bedrock of responsible financial management. Accessing reliable educational content can demystify credit, lending, and personal finance, enabling you to make informed decisions that align with your financial goals. These resources often cover topics ranging from the basics of credit reports to strategies for debt management and wealth building.Explore these trusted sources for comprehensive financial education:

- Consumer Financial Protection Bureau (CFPB): The CFPB offers a wealth of free resources, guides, and tools on various financial topics, including credit building, managing debt, and understanding financial products. Their website is a government-backed authority on consumer finance.

- National Foundation for Credit Counseling (NFCC): This non-profit organization provides access to accredited credit counselors who can offer personalized advice and educational materials on budgeting, debt management, and credit repair.

- Investopedia: A widely respected online resource for financial news, education, and market analysis. Their extensive library of articles and tutorials covers a broad spectrum of financial concepts, including detailed explanations of credit.

- Khan Academy (Personal Finance Section): Khan Academy offers free, accessible courses on a variety of subjects, including a robust personal finance section that covers topics like credit scores, debt, and saving.

- Your Bank or Credit Union: Many financial institutions provide educational resources, workshops, or online tools to help their customers understand and improve their financial literacy, including credit management.

Template for Tracking Credit-Related Expenses and Payments

Consistent and timely payments are the most significant factors in building a positive credit history. A structured approach to tracking your credit obligations ensures that no payment is missed and helps you visualize your spending patterns relative to your credit limits. This template serves as a practical tool to maintain control and foster good financial habits.Consider using a simple spreadsheet or a dedicated notebook to track the following information for each of your credit accounts:

| Credit Account Name | Credit Limit | Current Balance | Minimum Payment Due | Due Date | Payment Amount Made | Date Paid | Payment Status (Paid/Pending) | Notes (e.g., Auto-pay enabled, made extra payment) |

|---|---|---|---|---|---|---|---|---|

| [e.g., Visa Platinum] | [$5,000] | [$1,200] | [$25] | [MM/DD/YYYY] | [$50] | [MM/DD/YYYY] | [Paid] | [Made extra payment to reduce balance] |

| [e.g., Mastercard Rewards] | [$10,000] | [$3,500] | [$50] | [MM/DD/YYYY] | [$50] | [MM/DD/YYYY] | [Paid] | [Auto-pay set up] |

| [e.g., Auto Loan] | [N/A] | [$15,000] | [$300] | [MM/DD/YYYY] | [$300] | [MM/DD/YYYY] | [Paid] | [On time] |

Regularly updating this tracker will provide a clear overview of your credit usage and payment history, reinforcing responsible behavior.

Seeking Professional Guidance for Credit Concerns

While many credit-related issues can be managed independently, there are times when professional assistance is invaluable. Navigating complex credit disputes, understanding the implications of significant financial events, or developing a comprehensive strategy for credit repair may benefit from the expertise of a qualified professional.When seeking guidance, consider the following avenues:

- Non-Profit Credit Counseling Agencies: Organizations accredited by the NFCC or similar bodies offer confidential and affordable counseling services. They can help you create a budget, negotiate with creditors, and develop a debt management plan. Be sure to verify their accreditation and understand their fee structure.

- Certified Financial Planners (CFPs): For broader financial planning that includes credit management as a component, a CFP can provide holistic advice. They can help integrate your credit strategy with your overall investment, retirement, and savings goals.

- Credit Repair Specialists (with caution): While some credit repair companies can be legitimate and helpful, the industry is also prone to scams. If you choose to work with a credit repair specialist, thoroughly research their reputation, check for accreditation, and understand exactly what services they offer and what their fees are. It’s often advisable to start with non-profit agencies or government resources before engaging paid services.

- Legal Aid Societies or Consumer Attorneys: In cases of significant credit report errors, identity theft, or legal disputes with creditors, consulting with a legal professional or a consumer protection attorney may be necessary.

It is important to approach any paid service with due diligence, ensuring they are reputable and have your best financial interests at heart.

Summary

By consistently applying the strategies discussed, you will find that building and maintaining excellent credit becomes an integrated, positive aspect of your financial life. This proactive approach not only opens doors to better loan terms and rental opportunities but also empowers you with greater financial flexibility and peace of mind. Embrace these practices, and watch your financial well-being flourish.