With How to Understand the Credit Impact of Co-signing a Loan at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a journey into the intricate world of shared financial responsibility. Understanding the nuances of co-signing is crucial, as it extends beyond simply helping a friend or family member secure a loan; it involves a deep dive into how your own financial health can be significantly influenced by another person’s borrowing habits.

This guide will illuminate the fundamental role of a co-signer, detailing the direct impact on credit scores, the responsibilities involved, and the common loan types where such arrangements are prevalent. We will explore how every payment, or missed payment, on a co-signed loan is meticulously recorded, affecting both borrowers’ credit reports and how these accounts are evaluated by scoring models.

Furthermore, we’ll uncover potential complications, risks, and essential strategies for managing this delicate financial partnership, ensuring you are well-equipped to navigate the complexities and protect your creditworthiness.

The Basics of Co-signing and Credit

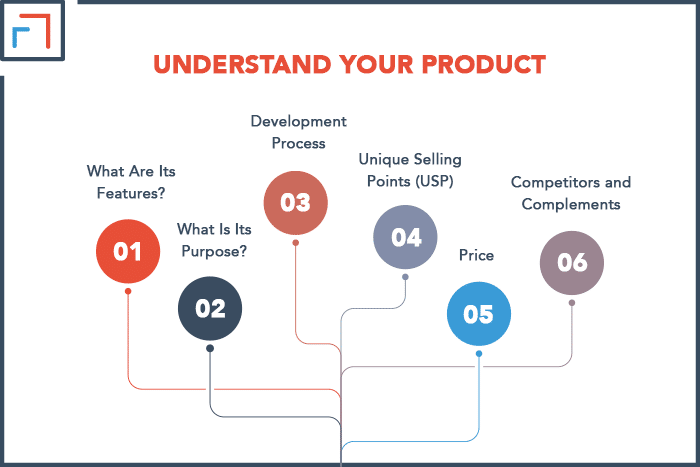

Co-signing a loan is a significant commitment that involves lending your creditworthiness to help someone else secure financing. While it can be a benevolent act, it carries substantial implications for your financial standing, particularly your credit score. Understanding these impacts is crucial before agreeing to co-sign. This section will Artikel the fundamental principles of co-signing and its direct connection to credit.When you co-sign a loan, you are essentially becoming a co-borrower.

This means you are equally responsible for the loan’s repayment, alongside the primary borrower. Lenders view co-signers as a form of insurance; if the primary borrower defaults, the lender can pursue the co-signer for the outstanding debt. This shared responsibility is the bedrock of why co-signing has such a profound effect on your credit.

The Co-signer’s Role in a Loan Agreement

The fundamental role of a co-signer is to provide additional assurance to the lender that the loan will be repaid. This is particularly important when the primary borrower has limited credit history, a low credit score, or insufficient income to qualify for the loan on their own. By co-signing, you are vouching for the borrower’s ability and willingness to meet their financial obligations.

Direct Credit Impact on the Primary Borrower

A co-signer’s involvement directly benefits the primary borrower by increasing their chances of loan approval and potentially securing more favorable terms, such as a lower interest rate. The lender will factor in the co-signer’s credit history and financial stability when assessing the overall risk of the loan. This can lead to a higher approved loan amount or a better interest rate than the primary borrower could have obtained independently.

Typical Responsibilities and Legal Implications for a Co-signer

The responsibilities of a co-signer extend beyond merely signing the loan documents. You are legally obligated to repay the entire loan if the primary borrower fails to do so. This includes not only the principal and interest but also any late fees, collection costs, or legal fees incurred due to default.Key responsibilities and implications include:

- Full Liability: You are as responsible for the debt as the primary borrower.

- Payment Obligation: If the primary borrower misses a payment, the lender can demand payment from you immediately.

- Impact on Credit: Every payment made or missed on the loan will appear on your credit report.

- Legal Action: In case of default, lenders can sue both the primary borrower and the co-signer to recover the debt.

- Collateral: If the loan is secured by collateral, the co-signer may also be liable for the seizure of that collateral.

Common Loan Types Where Co-signing is Prevalent

Co-signing is a common practice across various types of loans, especially when the primary applicant needs assistance to qualify.The most prevalent loan types include:

- Auto Loans: Often used when a young driver or someone with limited credit history needs a vehicle.

- Student Loans: Particularly private student loans, where a parent or guardian may co-sign to help a student obtain financing for their education.

- Personal Loans: Used for various purposes, such as consolidating debt or covering unexpected expenses.

- Mortgages: While less common due to the significant financial commitment, a co-signer might be involved if the primary applicant’s income or credit is insufficient.

- Rental Agreements: Some landlords require a co-signer for tenants with no rental history or a low credit score.

Direct Credit Score Influence

When you co-sign a loan, the agreement isn’t just a favor; it’s a financial commitment that directly affects your creditworthiness. This means the loan’s performance, whether positive or negative, will be reflected on your credit report just as it is for the primary borrower. Understanding this direct impact is crucial for managing your financial health.The way a co-signed loan appears on credit reports is identical to how any other loan or credit account would be listed.

It includes the lender’s name, the loan amount, the account number, the date it was opened, and the current balance. Crucially, it also features the payment history. This shared reporting ensures that both parties are held accountable for the loan’s terms.

Credit Report Appearance of Co-signed Loans

A co-signed loan will be listed on both the primary borrower’s and the co-signer’s credit reports. The report will clearly indicate that you are a co-signer on the account. This visibility means that every payment made, or missed, will be recorded and contribute to the credit history of both individuals. This transparency is a key reason why co-signing carries significant credit implications.

Impact of On-Time Payments

Making timely payments on a co-signed loan is one of the most beneficial actions you can take for your credit score. When both the primary borrower and the co-signer consistently pay on time, this positive behavior is reported to the credit bureaus. This demonstrates to future lenders that you are a responsible borrower who meets their financial obligations. Consistent on-time payments can help to:

- Increase your credit score over time.

- Improve your credit utilization ratio if the loan is a revolving credit line.

- Build a strong credit history, making it easier to qualify for future loans or credit cards.

Consequences of Late or Missed Payments

The flip side of on-time payments is the severe damage that late or missed payments can inflict on your credit score. As a co-signer, you are equally responsible for the debt. If the primary borrower misses a payment, it will appear on your credit report as a delinquency. This negative mark can significantly lower your credit score and have lasting repercussions.

The consequences include:

- A substantial drop in your credit score, potentially by dozens of points for each late payment.

- Difficulty obtaining future credit, as lenders view late payments as a sign of higher risk.

- Higher interest rates on future loans, reflecting the increased risk perceived by lenders.

- Potential legal action from the lender if the loan becomes severely delinquent, which can further damage your credit and financial standing.

It’s important to note that even a single 30-day late payment can have a noticeable negative impact.

Effect on Credit Utilization Ratio

The credit utilization ratio, which is the amount of credit you are using compared to your total available credit, is a critical factor in credit scoring. When you co-sign a loan, the outstanding balance of that loan is typically included in the calculation of your credit utilization ratio. This is particularly true for revolving credit lines like personal loans or credit cards where you might have access to a certain limit.

Credit Utilization Ratio = (Total Balances on Revolving Credit) / (Total Credit Limits on Revolving Credit)

For example, if you have a credit card with a $10,000 limit and a $2,000 balance, your utilization is 20%. If you co-sign a personal loan with a $15,000 balance, and this balance is factored into your utilization, your total debt could significantly increase your utilization ratio. A higher credit utilization ratio can negatively impact your credit score, even if all payments are made on time.

Lenders generally prefer a utilization ratio below 30%.

Understanding Loan History and Reporting

When you co-sign a loan, it’s crucial to understand how this financial commitment is reflected in your credit history. This section will detail the reporting mechanisms, the information captured, and the longevity of co-signed loans on your credit report, as well as how different scoring models perceive these arrangements.

Payment History Reporting for Co-signed Loans

The payment history of a co-signed loan is reported to all major credit bureaus (Experian, Equifax, and TransUnion) by the lender. This means that every payment, whether made on time, late, or missed, directly impacts the credit scores of both the primary borrower and the co-signer. The lender typically reports the account under both individuals’ Social Security numbers, ensuring transparency and accountability.

This unified reporting emphasizes that both parties share equal responsibility for the loan’s performance.

Information Included in Credit Reports for Co-signed Accounts

A credit report provides a comprehensive overview of an individual’s credit activity. For co-signed accounts, the following information is generally included:

- Account Name: The name of the lender and the type of loan (e.g., “XYZ Bank Auto Loan”).

- Account Number: A unique identifier for the loan.

- Co-signer Status: An indication that you are a co-signer on the account. This is a critical piece of information for lenders assessing your creditworthiness.

- Loan Amount: The original principal amount of the loan.

- Current Balance: The outstanding amount owed on the loan.

- Payment History: A detailed record of past payments, including dates and amounts, and whether payments were made on time, late, or missed. This is often presented as a series of codes representing payment status for each billing cycle.

- Date Opened: When the loan was initially established.

- Maturity Date: The date when the loan is scheduled to be fully repaid.

- Status: Whether the account is open, closed, or in default.

This detailed reporting ensures that any activity related to the co-signed loan is accurately reflected, providing a clear picture of your financial obligations.

Duration of Co-signed Loans on Credit Reports

A co-signed loan, like any other credit account, remains on your credit report for a significant period. Typically, closed accounts can stay on your report for up to 10 years from the date they were last reported as active or paid off. For active co-signed loans, the account will remain visible on your credit report for as long as the loan is outstanding and being reported by the lender.

Even after the loan is fully repaid and closed, its payment history will continue to influence your credit score for the duration it remains on your report. This long-term reporting highlights the importance of ensuring timely payments throughout the life of the loan.

Credit Scoring Model Weighting of Co-signed Accounts

Different credit scoring models may interpret co-signed accounts with varying degrees of emphasis. While most modern scoring models, such as FICO and VantageScore, aim to provide a holistic view of credit risk, the presence of co-signed accounts can be a factor.

Modern credit scoring models generally treat co-signed accounts similarly to any other debt obligation, focusing on the payment history and utilization. However, the exact weighting can vary.

Here’s a general comparison:

- FICO Score: FICO scores are widely used and consider payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%), and new credit (10%). A co-signed loan contributes to “amounts owed” and “payment history.” If the loan is managed responsibly by the primary borrower, it can be neutral or even beneficial by demonstrating your ability to manage debt.

However, late payments or high balances will negatively impact your score.

- VantageScore: VantageScore also emphasizes payment history, credit utilization, credit age, total credit balances, and available credit. Similar to FICO, VantageScore will view the co-signed loan as part of your overall debt. Responsible repayment strengthens your credit profile, while delinquency or default will harm it.

It’s important to note that while the direct influence might be similar across models, the specific algorithms and their sensitivity to certain factors can differ. The key takeaway is that the performance of the co-signed loan is a direct reflection on your credit report and, consequently, your credit score, regardless of the specific scoring model used.

Potential Credit Complications and Risks

While co-signing a loan can be a generous act to help someone, it’s crucial to be aware of the potential downsides that can significantly impact your financial well-being and credit history. Understanding these risks is the first step in making an informed decision.When you co-sign, you are essentially putting your own creditworthiness on the line for the primary borrower. This means that any issues with the loan repayment can directly and negatively affect your credit score, even if you aren’t the one making the payments.

It’s a commitment that carries substantial responsibility.

Scenarios Leading to Decreased Co-signer Creditworthiness

Several situations can arise where a co-signed loan negatively impacts your credit score. These often stem from the primary borrower’s inability to meet their financial obligations.

- Late Payments: If the primary borrower misses even a single payment, it will be reported to the credit bureaus as late, affecting both their credit score and yours. This is because the loan is listed on both your credit reports.

- Missed Payments: Similar to late payments, entirely missed payments are a serious red flag for lenders and will significantly lower your credit score.

- High Credit Utilization on the Loan: If the co-signed loan has a large outstanding balance, it can increase your overall credit utilization ratio, especially if you have limited other credit. This can make you appear riskier to future lenders.

- Default on the Loan: This is the most severe consequence, where the primary borrower completely stops making payments. This will result in significant damage to both your credit scores.

Implications of Loan Default on Co-signer Credit

A default on a co-signed loan is a serious event with far-reaching consequences for the co-signer’s credit. It signals to all future lenders that you have a history of being associated with a defaulted debt, regardless of your personal payment behavior on other accounts.

- Significant Credit Score Drop: A default can cause your credit score to plummet by tens or even hundreds of points, making it difficult to qualify for new credit.

- Public Record of Default: In some cases, a defaulted loan may lead to collections or even legal action, which can appear on your credit report as a public record, further damaging your creditworthiness.

- Difficulty Obtaining Future Loans: Lenders view a history of default as a high-risk indicator, making it challenging to secure mortgages, car loans, or even credit cards in the future.

- Negative Impact on Other Accounts: While the default is on the co-signed loan, the negative mark can create a ripple effect, potentially impacting the approval odds or terms of other credit accounts you hold.

Liability for the Entire Loan Amount

One of the most critical aspects of co-signing is understanding that you are equally responsible for the debt. This means that if the primary borrower fails to make payments, the lender can pursue you for the full outstanding balance.

“As a co-signer, you are legally obligated to repay the entire loan amount if the primary borrower defaults, including any accrued interest, fees, and collection costs.”

This liability extends to the entire life of the loan. For instance, if a $20,000 loan is co-signed and the primary borrower stops paying after making only a few payments, the lender has the right to demand the remaining $18,000 (plus any associated charges) from you. This can lead to significant financial strain and potential legal battles.

Challenges in Future Credit Applications

The presence of a co-signed loan, especially one with payment issues or a default, can create significant hurdles when you try to obtain credit for yourself. Lenders will consider the co-signed debt as part of your overall debt obligations.

- Reduced Borrowing Capacity: When you apply for a new loan, lenders will factor in the outstanding balance of the co-signed loan when calculating your debt-to-income ratio. This can reduce the amount you can borrow for your own needs, such as a mortgage or car loan.

- Higher Interest Rates: If you are approved for credit, you may be offered higher interest rates due to the perceived increased risk associated with your credit history, which now includes the co-signed debt.

- Loan Denials: In severe cases, particularly if the co-signed loan is in default or has a history of late payments, your applications for new credit may be outright denied.

- Increased Scrutiny: Lenders may conduct more thorough reviews of your financial situation and credit history when they see a co-signed loan on your report, potentially delaying the approval process for your own applications.

Strategies for Managing Co-signed Loan Credit Impact

Co-signing a loan introduces a significant shared responsibility that can impact your creditworthiness. Proactive management and clear communication are key to mitigating potential negative consequences. This section Artikels essential strategies to effectively navigate the credit implications of being a co-signer.Being a co-signer means you are equally responsible for the loan, and this responsibility is reflected on your credit report. Therefore, understanding how to monitor this activity and maintain open lines of communication with the primary borrower is crucial for safeguarding your financial health.

Credit Report Monitoring for Co-signed Loan Activity

Regularly reviewing your credit report is paramount to staying informed about the status of any co-signed loans. This allows you to identify any discrepancies, missed payments, or other issues that could affect your credit score.To effectively monitor your credit report for co-signed loan activity, consider the following steps:

- Obtain copies of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to a free credit report from each bureau annually through AnnualCreditReport.com.

- Scrutinize each report for the presence of the co-signed loan. Verify that the loan details, including the lender, loan amount, and payment history, are accurately reported.

- Pay close attention to the payment status of the co-signed loan. Any late payments, defaults, or missed payments by the primary borrower will be reflected on your credit report and can significantly lower your credit score.

- Look for any changes in the loan status or terms that you were not expecting. This could indicate a problem with the loan or the primary borrower’s management of it.

- Set up credit monitoring services. Many financial institutions and credit bureaus offer services that alert you to significant changes on your credit report, including new accounts or delinquencies on existing ones.

Communication Strategy with the Primary Borrower

A robust communication strategy with the primary borrower is fundamental to ensuring the co-signed loan is managed responsibly and payments are made on time. Establishing clear expectations and maintaining open dialogue can prevent misunderstandings and potential credit damage.Develop a communication plan that includes:

- An initial discussion before signing the loan to establish clear expectations regarding payment responsibilities, due dates, and how financial difficulties will be handled.

- Agree on a regular check-in schedule, perhaps monthly, to discuss the loan’s status and confirm that payments have been made. This can be done via text, email, or a brief phone call.

- Encourage the primary borrower to provide you with advance notice if they anticipate any difficulty in making a payment. This allows you time to either make the payment yourself or discuss alternative solutions.

- Keep communication channels open and accessible. Ensure the primary borrower feels comfortable discussing any financial concerns they may have related to the loan.

Process and Potential Credit Implications of Removal as a Co-signer

Being removed as a co-signer from a loan is a process that requires the lender’s approval and can have significant credit implications. It is not always a straightforward procedure and depends heavily on the lender’s policies and the loan agreement.The process for removal typically involves:

- Contacting the lender to inquire about their specific procedure for co-signer release. This usually requires the primary borrower to re-qualify for the loan on their own, demonstrating sufficient income and creditworthiness.

- The primary borrower will likely need to submit a new loan application, and the lender will assess their ability to assume the full responsibility of the loan.

- If the primary borrower is approved, the lender will formally release you as a co-signer. This will result in the loan being removed from your credit report as an active obligation.

The potential credit implications of removal are generally positive if the loan has been managed well. However, if the primary borrower fails to qualify for removal, or if the loan has a history of late payments, it may remain on your report. If the primary borrower defaults after you are removed, and the lender cannot recover the full amount, there could be implications depending on the specific release agreement.

It is crucial to understand that until you are formally released by the lender, you remain fully liable for the loan.

Setting Financial Boundaries and Expectations Before Co-signing

Before agreeing to co-sign any loan, it is essential to establish firm financial boundaries and clear expectations with the primary borrower. This proactive approach helps prevent future conflicts and protects your own financial well-being.Consider the following when setting boundaries and expectations:

- Payment Responsibility: Clearly define who is primarily responsible for making the payments. While you are a co-signer, the expectation should be that the primary borrower will handle all payments.

- Payment Due Dates: Ensure the primary borrower understands the exact due dates for each payment and the grace period, if any.

- Financial Contingencies: Discuss what will happen if the primary borrower experiences a financial hardship, such as job loss or a medical emergency. Will you be expected to step in immediately, or will there be a discussion period?

- Loan Purpose and Amount: Understand the exact purpose of the loan and the total amount being borrowed. Ensure you are comfortable with these details.

- Duration of Co-signing: If possible, discuss a timeframe for when you might be able to be removed as a co-signer, such as after a certain period of consistent, on-time payments by the primary borrower.

- Your Own Financial Goals: Be honest about how co-signing might affect your ability to achieve your own financial goals, such as saving for a down payment or securing your own loan.

It is also wise to have a written agreement, even if informal, that Artikels these expectations. This document can serve as a reference point and help avoid misunderstandings down the line. Remember, co-signing is a significant commitment, and approaching it with clear boundaries and open communication is the most responsible path.

Credit Reporting Discrepancies and Resolution

It’s crucial for co-signers to actively monitor their credit reports for any inaccuracies related to a co-signed loan. Errors can occur, and if left unaddressed, they can negatively impact your creditworthiness. Understanding the process for identifying and resolving these discrepancies is a vital part of managing the credit implications of co-signing.When you discover an error on your credit report concerning a co-signed loan, taking prompt and systematic action is key.

This involves knowing who to contact, what information to provide, and how to follow up effectively to ensure the correction is made.

Steps for Identifying and Reporting Credit Report Inaccuracies

If you notice any information on your credit report that you believe is incorrect or does not accurately reflect your financial obligations for a co-signed loan, it’s important to act swiftly. The first step is to obtain copies of your credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. Federal law grants you the right to a free credit report from each bureau annually.Once you have your reports, carefully review the section detailing your credit accounts.

Look for any discrepancies, such as incorrect payment statuses, balances that don’t match your records, or accounts you don’t recognize. If you find an error, gather all relevant documentation that supports your claim.

Disputing Incorrect Information with Credit Bureaus and Lenders

The process of disputing an inaccuracy involves direct communication with both the credit bureaus and the lender who reported the information. It’s often beneficial to dispute with both simultaneously, as each has a role in the correction process.To dispute with a credit bureau, you can typically do so online through their respective websites, by mail, or sometimes by phone. You will need to provide specific details about the error and your supporting documentation.

The credit bureau will then investigate the claim, which usually involves contacting the furnisher of the information (the lender).Simultaneously, or if the credit bureau dispute doesn’t yield results, you should contact the lender directly. Clearly explain the discrepancy and provide them with the same supporting documentation. Lenders are required to investigate disputes and report any corrections to the credit bureaus.

Best Practices for Gathering Documentation to Support a Dispute

Effective documentation is the cornerstone of a successful credit report dispute. The stronger your evidence, the more likely your claim will be validated and resolved in your favor. Aim to collect a comprehensive set of documents that clearly illustrate the inaccuracy.

- Loan Agreement: A copy of the original loan agreement that clearly Artikels the terms, responsibilities, and any specific clauses related to co-signing.

- Payment Records: Statements, cancelled checks, or online transaction histories that prove your payment history or demonstrate payments made by the primary borrower that were incorrectly reported.

- Correspondence: Any written communication (emails, letters) with the lender or primary borrower regarding the loan, payment arrangements, or issues with the account.

- Account Statements: Recent and past statements from the lender that show the correct balance, payment status, or other details that contradict the information on your credit report.

- Proof of Identity: Ensure your personal identification documents are up-to-date, as sometimes discrepancies can arise from identity verification issues.

Organizing a Process for Following Up on Credit Report Disputes

Persistence and organized follow-up are essential to ensure your credit report dispute is resolved satisfactorily. The credit bureaus and lenders have specific timeframes for investigating and responding to disputes, but it’s important to stay engaged.

- Keep Records of Communication: Log every interaction you have regarding the dispute. This includes dates, times, names of representatives spoken to, and a summary of the conversation.

- Note Dispute Reference Numbers: When you file a dispute, you’ll often receive a reference number. Keep this number handy for all subsequent communications.

- Track Deadlines: Be aware of the typical investigation timelines. Credit bureaus generally have 30 days (or 45 days for initial reports) to investigate. Lenders typically have a similar timeframe.

- Request Updates: If you haven’t heard back by the expected deadline, proactively contact the credit bureau or lender to request an update on the status of your dispute.

- Escalate if Necessary: If the initial investigation does not resolve the issue, or if you receive an unsatisfactory response, consider escalating the dispute. This might involve writing a formal letter to the credit bureau’s dispute department or speaking with a supervisor at the lender.

- Consider Consumer Protection Agencies: If all else fails, you may consider filing a complaint with consumer protection agencies like the Consumer Financial Protection Bureau (CFPB) or your state’s Attorney General’s office.

“Thorough documentation and diligent follow-up are the most effective tools a co-signer has when addressing credit reporting discrepancies.”

Conclusion

In essence, understanding the credit impact of co-signing a loan is not merely an informational exercise but a vital step in safeguarding your financial future. By grasping the mechanics of credit reporting, potential risks, and proactive management strategies, you can make informed decisions and maintain a healthy credit profile, even when lending your name to support another’s financial aspirations. This comprehensive overview empowers you to approach co-signing with clarity and confidence, ensuring a responsible and well-managed financial commitment.