Understanding your credit score is a crucial step towards achieving financial well-being, and fortunately, accessing this vital information doesn’t have to cost a penny. This guide delves into the importance of credit scores, the factors that shape them, and most importantly, the various avenues available for you to check your credit score without any financial obligation. We aim to demystify the process, making it accessible and straightforward for everyone.

Embark on a journey to unlock the secrets of your creditworthiness. We will explore reputable sources, practical methods, and what to look for in your credit report, empowering you with the knowledge to confidently monitor and manage your financial health. From understanding the nuances of your score to discovering strategies for improvement, this comprehensive overview is designed to be your ultimate resource.

Understanding Credit Scores and Why They Matter

Your credit score is a three-digit number that lenders use to assess your creditworthiness. It’s a snapshot of your financial behavior and plays a crucial role in many aspects of your financial life. Understanding what it represents and why it’s important is the first step towards building a strong financial future.A credit score is a numerical representation of your credit risk, indicating how likely you are to repay borrowed money.

It’s calculated based on your credit history, which includes information from credit bureaus. This score is a vital tool for financial institutions, helping them make informed decisions about extending credit.

The Fundamental Concept of a Credit Score

At its core, a credit score is a statistical prediction of how likely you are to repay a loan. It’s a summary of your past borrowing and repayment habits, distilled into a single number. Lenders use this number to gauge the risk associated with lending you money, whether it’s for a mortgage, a car loan, a credit card, or even renting an apartment.

A higher score generally indicates lower risk, making it easier and cheaper to borrow money.

The Importance of a Good Credit Score for Financial Well-being

A strong credit score is more than just a number; it’s a key enabler of financial opportunities and savings. It can significantly impact your ability to achieve major life goals, such as homeownership or starting a business. Lenders offer better interest rates and more favorable terms to individuals with good credit, meaning you’ll pay less over the life of a loan.

Beyond loans, landlords often check credit scores before approving rental applications, and some employers may review them as part of the hiring process, particularly for positions involving financial responsibility.

Typical Factors That Influence a Credit Score

Several key factors contribute to the calculation of your credit score. These elements are tracked by credit bureaus and are weighted differently in the scoring models. Understanding these components allows you to focus your efforts on the areas that will have the most positive impact on your score.The primary factors influencing your credit score are:

- Payment History: This is the most critical factor. Making payments on time, every time, is paramount. Late payments, defaults, and bankruptcies can severely damage your score.

- Credit Utilization Ratio: This refers to the amount of credit you’re using compared to your total available credit. Keeping this ratio low, ideally below 30%, demonstrates responsible credit management.

- Length of Credit History: The longer you’ve had credit accounts open and managed them responsibly, the more positive impact it generally has on your score.

- Credit Mix: Having a variety of credit types (e.g., credit cards, installment loans like mortgages or car loans) can be beneficial, as it shows you can manage different forms of credit responsibly.

- New Credit: Opening multiple new credit accounts in a short period can signal increased risk and may temporarily lower your score.

Different Types of Credit Scores Available

While the concept of a credit score is singular, there isn’t just one score that lenders use. Various scoring models exist, developed by different companies, and each may produce a slightly different score. The most common types are based on the FICO® Score and the VantageScore models.FICO® Scores are widely used by lenders and are categorized into industry-specific versions (e.g., FICO® Score for mortgages, auto loans, and credit cards).

The FICO® Score ranges from 300 to 850.VantageScore is another popular credit scoring model, also ranging from 300 to 850. It was developed collaboratively by the three major credit bureaus.It’s important to note that while these models are similar in their fundamental approach to assessing credit risk, the exact algorithms and weighting of factors can differ, leading to variations in your reported scores.

Identifying Free Credit Score Sources

Accessing your credit score without incurring fees is entirely achievable, thanks to a variety of reputable providers. Many financial institutions and specialized services understand the importance of credit score awareness for consumers and offer complimentary access. This section will guide you through the various avenues available to find and utilize these free resources.Understanding where to look and what to expect from these free services is key to making informed financial decisions.

By leveraging these options, you can regularly monitor your credit health without any financial commitment.

Reputable Financial Institutions Offering Free Credit Scores

Many banks and credit unions now provide their customers with free access to their credit scores as a value-added service. This is often integrated directly into their online banking portals or mobile applications, making it convenient to check your score alongside your other financial accounts. These institutions typically partner with major credit bureaus or credit scoring companies to deliver this information.The following are examples of types of financial institutions that commonly offer free credit score access:

- Major national banks

- Regional banks

- Credit unions

- Online-only banks

When exploring your bank’s website or app, look for sections labeled “Credit Score,” “Credit Center,” or similar. Often, you’ll need to opt-in to view your score.

Credit Monitoring Services with Free Score Checks

Beyond traditional financial institutions, several credit monitoring services specialize in providing credit reports and scores. Many of these services offer a free tier or a free trial period that includes access to your credit score. These services can be particularly useful for those who want more detailed insights into their credit history and ongoing monitoring for any changes.Examples of credit monitoring services that frequently offer free credit score access include:

- Credit Karma: Provides free access to TransUnion and Equifax credit scores and reports, updated weekly.

- Credit Sesame: Offers a free credit score from Experian, updated monthly, along with personalized recommendations.

- Certain services offered by the major credit bureaus themselves (Experian, Equifax, TransUnion) may offer limited free access to scores or reports under specific conditions.

It is important to note that while these services offer free score checks, they often generate revenue through partnerships and may present offers for credit cards or loans based on your credit profile.

Finding Free Credit Score Options Through Existing Banking Relationships

Your current banking relationship can be a surprisingly direct route to accessing your credit score for free. Most modern banks aim to provide a comprehensive suite of financial tools to their customers, and credit score monitoring is increasingly a part of that offering. The process typically involves a few simple steps within your existing online banking platform.To find free credit score options through your bank:

- Log in to your online banking portal or mobile application.

- Navigate to the account summary or financial tools section.

- Look for a prominent link or tab related to credit scores, credit health, or credit monitoring.

- Follow the prompts to view your score. You may need to agree to terms and conditions.

Many banks utilize the VantageScore model, which is a FICO alternative, for their free score offerings. This provides a good general overview of your credit standing.

Comparison of Different Free Credit Score Providers

When choosing a free credit score provider, it’s beneficial to understand their features, the scoring model they use, and the frequency of updates. While many offer a valuable service, some may provide more comprehensive insights or a more up-to-date score than others.Here is a comparison of common free credit score providers:

| Provider | Credit Bureaus Used | Scoring Model | Update Frequency | Additional Features |

|---|---|---|---|---|

| Credit Karma | TransUnion, Equifax | VantageScore 3.0 | Weekly | Free credit reports, personalized recommendations, financial tools. |

| Credit Sesame | Experian | VantageScore 3.0 | Monthly | Free credit reports, personalized insights, identity theft protection alerts (basic). |

| Bank-Provided Scores (Varies by institution) | Often Experian or TransUnion | VantageScore or FICO (specific model varies) | Monthly to weekly | Integrated with banking, convenience. |

It is important to remember that different providers may use different scoring models, leading to slight variations in the score you see. This is normal, as each model weighs factors differently. The most crucial aspect is the trend of your score over time.

Methods for Obtaining Your Credit Score Without Payment

Fortunately, obtaining your credit score for free is more accessible than ever. Several reputable avenues exist that allow you to monitor your credit health without incurring any costs. Understanding these methods empowers you to stay informed about your financial standing and make informed decisions.This section will guide you through the most common and effective ways to access your credit score without needing to pay for a service.

We will cover direct access through credit bureaus, the utility of budgeting applications, the convenience of online financial platforms, and the benefits offered by your credit card issuers.

Accessing Your Credit Score Directly from Major Credit Bureaus

The three major credit bureaus in the United States – Equifax, Experian, and TransUnion – are the primary holders of your credit information. While they offer paid credit monitoring services, they also provide options for obtaining your credit score for free. This is often done through their respective websites or via the annual credit report you are entitled to by law.The process for signing up for a free credit score from a major credit bureau typically involves the following steps:

- Visit the official website of the credit bureau you wish to check (e.g., Equifax, Experian, TransUnion).

- Navigate to their “Free Credit Score” or “Free Credit Report” section.

- You will likely be prompted to create an account. This usually requires providing personal information such as your name, address, date of birth, and Social Security number to verify your identity.

- Some bureaus may offer a free score as part of a trial for their credit monitoring services. Be sure to read the terms and conditions carefully to understand if this is a permanent free offering or a trial that requires cancellation to avoid charges.

- Once your identity is verified, you will be able to view your credit score, often accompanied by a detailed credit report.

It’s important to note that the specific score you receive might be a FICO score or a VantageScore, and the version may vary. Some bureaus may update your score monthly, while others might provide it less frequently.

Utilizing Budgeting Apps for Credit Score Access

Budgeting applications have evolved beyond simple expense tracking to become comprehensive personal finance management tools. Many of these apps have integrated features that allow users to view their credit scores directly within the application, often for free. This integration offers a convenient way to keep tabs on your credit health alongside your overall financial picture.The steps involved in using a budgeting app to access your credit score are generally straightforward:

- Download and install a reputable budgeting app from your device’s app store (e.g., Credit Karma, Mint, Personal Capital, PocketGuard).

- Sign up for an account with the app, which usually involves providing your email address and creating a password.

- To link your financial accounts and enable credit score tracking, you will need to provide additional personal information for identity verification, similar to what you would provide to a credit bureau. This may include your address, date of birth, and the last four digits of your Social Security number.

- Once your identity is confirmed and your accounts are linked, navigate to the credit score section within the app.

- The app will then display your credit score, often along with insights into the factors influencing it and recommendations for improvement.

These apps typically refresh your credit score periodically, providing you with updated information without requiring you to actively seek it out.

Leveraging Online Financial Platforms for Complimentary Credit Score Retrieval

Beyond dedicated budgeting apps, a wide array of online financial platforms now offer free credit score access as part of their services. These platforms aim to provide a holistic view of your financial health, and a credit score is a crucial component of that assessment.Here’s how you can leverage these online financial platforms for complimentary credit score retrieval:

- Identify a reputable online financial platform that offers free credit score services. Examples include many online banks, investment platforms, and financial wellness websites.

- Create an account on the platform. This process will involve providing your contact information and potentially answering security questions.

- For identity verification and to access your credit score, you will likely need to link your bank accounts or other financial products. This allows the platform to gather the necessary data.

- Once your identity is verified and your accounts are connected, locate the credit score section within the platform’s dashboard.

- Your credit score will be displayed, often with accompanying details about its components and suggestions for improvement.

These platforms often provide credit scores updated monthly, allowing for consistent monitoring.

Accessing Credit Scores Through Credit Card Issuer Programs

Many credit card issuers understand the importance of credit health for their cardholders and have integrated free credit score access into their online portals and mobile applications. This is a convenient perk for existing customers, allowing them to check their score without needing to sign up for a separate service.Here are the steps for accessing credit scores through credit card issuer programs:

- Log in to your online account or the mobile app provided by your credit card issuer.

- Look for a section dedicated to credit score monitoring, often labeled as “Credit Score,” “Credit Insights,” or “Free Credit Score.”

- If this is your first time accessing it, you may need to agree to terms and conditions and undergo a brief identity verification process. This typically involves confirming some personal details.

- Once verified, your credit score will be displayed within the portal or app.

The credit score provided by credit card issuers is usually updated monthly and may be a VantageScore or a FICO score. It’s a valuable tool for cardholders to understand how their spending and payment habits are impacting their credit.

What to Look For in a Free Credit Score Report

Understanding what you’re looking at is crucial when reviewing your free credit score report. While a free offering might not provide every single detail of a premium report, it will typically give you the essential components needed to assess your credit health. This section will guide you through the key elements and how to interpret them.A free credit score report provides a snapshot of your creditworthiness.

It’s designed to be accessible and informative, allowing you to understand the factors influencing your score and identify potential areas for improvement. Familiarizing yourself with these components empowers you to make informed decisions about managing your credit.

Key Components of a Credit Score Report

A typical free credit score report will present several critical pieces of information that contribute to your overall creditworthiness. These components are designed to give you a clear picture of your credit history and how it’s being evaluated.The information presented in a credit score report can be broadly categorized into the following key areas:

- Credit Score: This is the numerical representation of your creditworthiness, usually ranging from 300 to 850. A higher score indicates a lower risk to lenders.

- Credit Utilization: This refers to the amount of credit you are using compared to your total available credit. Keeping this ratio low is generally beneficial.

- Payment History: This section details whether you have made your payments on time. Late payments can significantly impact your score.

- Length of Credit History: The longer you have managed credit responsibly, the more positive this can be for your score.

- Credit Mix: Having a variety of credit types (e.g., credit cards, installment loans) can be viewed favorably, but is a less significant factor than payment history.

- New Credit: This tracks recent credit inquiries and new accounts opened. Opening too many accounts in a short period can lower your score.

Interpreting the Different Sections of a Credit Report

Each section of your credit report tells a story about your financial habits. Understanding how to read and interpret these sections allows you to identify strengths and weaknesses in your credit profile. This knowledge is fundamental to taking proactive steps to improve your credit standing.The interpretation of each section is vital for understanding your credit health:

- Personal Information: This includes your name, address, Social Security number, and employment details. Ensure this information is accurate, as errors can lead to identity theft or incorrect credit reporting.

- Credit Accounts: This is a detailed listing of all your credit accounts, including credit cards, loans, and mortgages. For each account, you’ll see the lender, account number (often partially masked), balance, credit limit, and payment status. Pay close attention to the payment history for each account.

- Public Records: This section includes information like bankruptcies, liens, and judgments. These are serious negative marks that significantly impact your credit score.

- Credit Inquiries: This lists who has recently requested to see your credit report. “Hard inquiries” (when you apply for credit) can slightly lower your score, while “soft inquiries” (like checking your own score) do not.

Information Typically Included in a Free Credit Score Offering

Free credit score services aim to provide you with the most impactful information without overwhelming you. While the exact details may vary, they generally focus on the components that most directly influence your score. This allows for a quick and effective assessment of your credit standing.The information commonly found in a free credit score offering includes:

- Your FICO Score or VantageScore, along with an explanation of what that score means.

- A breakdown of the factors influencing your score, often presented as “factors that most affect your score.”

- A summary of your credit utilization ratio.

- Indicators of whether your payment history is positive or negative.

- Insights into the length of your credit history.

- Information about recent credit inquiries.

Differentiating Between a Credit Score and a Full Credit Report

It’s essential to understand that a credit score is a single number, while a credit report is a comprehensive document containing all the details that contribute to that score. Free services often provide the score upfront, but accessing the full report requires a separate step or a more detailed look within the platform.The distinction is crucial for a complete understanding of your credit health:

- Credit Score: This is a numerical summary, like a grade, indicating your credit risk. It’s a quick indicator but doesn’t provide the underlying reasons for the score.

- Full Credit Report: This is the detailed document that lenders use to make credit decisions. It contains a complete history of your credit accounts, payment history, public records, and inquiries. It’s the raw data from which your credit score is calculated.

Think of it this way: your credit score is the headline, while the credit report is the entire article that explains the headline. While a free score is a great starting point, reviewing your full credit report is necessary for identifying specific issues and taking targeted action.

Understanding the Information Presented in Your Score

Once you’ve obtained your free credit score, the next crucial step is to understand what the numbers and accompanying information truly mean. This section will guide you through interpreting your score, analyzing its contributing factors, understanding common fluctuations, and identifying potential errors within your report.

Credit Score Ranges and Their Meaning

Credit scores are typically presented on a numerical scale, with higher numbers indicating a better credit history and lower risk to lenders. While specific ranges can vary slightly between scoring models, a general understanding of these tiers is essential for evaluating your financial health.A common FICO score range is from 300 to

850. Here’s a breakdown of what these ranges generally signify

- Exceptional (800-850): Scores in this range indicate an excellent credit history. You are considered a very low risk to lenders, often qualifying for the best interest rates and terms on loans and credit cards.

- Very Good (740-799): This range signifies a strong credit history. You are likely to be approved for most credit products with favorable terms.

- Good (670-739): Scores in this range suggest a decent credit history. You will likely be approved for credit, though perhaps not always with the most competitive rates.

- Fair (580-669): This range indicates that you have some credit issues or a limited credit history. Obtaining credit may be more challenging, and interest rates might be higher.

- Poor (300-579): Scores in this range suggest significant credit problems. Lenders may view you as a high risk, making it difficult to get approved for new credit, and if approved, terms will likely be unfavorable.

Analyzing the Factors Contributing to Your Score

Your credit score is not a random number; it’s a reflection of your credit behavior. Understanding the key factors that influence your score empowers you to make informed decisions and improve your financial standing. Credit scoring models weigh several components, with varying degrees of impact.The primary factors influencing your credit score are:

- Payment History (35%): This is the most significant factor. Making on-time payments for all your credit obligations is paramount. Late payments, defaults, and bankruptcies can severely damage your score.

- Amounts Owed (30%): This refers to the total amount of debt you carry across all your credit accounts, particularly your credit utilization ratio (the amount of credit you’re using compared to your total available credit). Keeping credit utilization low, ideally below 30%, is beneficial.

- Length of Credit History (15%): The longer you have managed credit responsibly, the more positive it is for your score. This includes the age of your oldest account, the age of your newest account, and the average age of all your accounts.

- Credit Mix (10%): Having a variety of credit types, such as credit cards, installment loans (like mortgages or auto loans), and student loans, can positively impact your score, provided you manage them responsibly.

- New Credit (10%): Opening multiple new credit accounts in a short period can signal higher risk. While opening new credit is sometimes necessary, doing so judiciously is important.

It’s important to note that these percentages are approximate and can vary slightly depending on the specific credit scoring model used.

Common Reasons for Score Fluctuations

Credit scores are not static; they can change over time due to various financial activities and events. Understanding these common reasons for fluctuation helps you anticipate changes and maintain a stable or improving score.Several factors can lead to changes in your credit score:

- Late Payments: Even a single late payment can cause a noticeable drop in your score. The severity of the impact depends on how late the payment was and your score before the delinquency.

- High Credit Utilization: If you significantly increase the balance on your credit cards, especially if it pushes your utilization ratio above 30%, your score can decrease.

- New Credit Applications: Applying for several new credit accounts within a short timeframe can lead to multiple hard inquiries, which can temporarily lower your score.

- Closing Old Accounts: While it might seem counterintuitive, closing an older credit card account can sometimes lower your score by reducing your average credit history length and potentially increasing your credit utilization if you carry balances on other cards.

- Errors on Your Credit Report: Inaccurate information, such as incorrect late payment markers or accounts that do not belong to you, can negatively impact your score.

- New Delinquencies or Collections: Having new accounts sent to collections or experiencing new defaults will significantly lower your score.

Identifying Potential Errors or Discrepancies

While credit scoring models are sophisticated, errors can occur on your credit report. These inaccuracies can unfairly lower your score, potentially hindering your ability to obtain credit or secure favorable terms. Regularly reviewing your free credit report is crucial for identifying and rectifying these mistakes.When reviewing your credit report, pay close attention to the following:

- Personal Information: Verify that your name, address, Social Security number, and date of birth are accurate. Incorrect personal details can sometimes lead to confusion with other individuals’ credit files.

- Account Information: Check that all the credit accounts listed are indeed yours. Ensure that account numbers, balances, and credit limits are correct.

- Payment History: Scrutinize the payment status of each account. Look for any reported late payments, defaults, or collection accounts that you do not recognize or that are incorrect.

- Inquiries: Review the list of recent inquiries. While legitimate inquiries from lenders when you apply for credit are expected, be wary of any inquiries you don’t recognize.

- Public Records: Ensure there are no incorrect public records, such as bankruptcies or tax liens, listed on your report.

If you discover any errors, it is essential to dispute them with the credit bureau that provided the report. Most credit bureaus have a clear process for filing disputes online, by mail, or by phone.

Strategies for Improving Your Credit Score Over Time

Building a strong credit score is a marathon, not a sprint. While checking your score for free provides valuable insight, actively working on your credit habits is crucial for long-term financial health. This section Artikels actionable strategies to enhance your creditworthiness, making it easier to access loans, secure better interest rates, and achieve your financial goals.Improving your credit score involves consistent effort and understanding the key factors that influence it.

By implementing specific practices, you can systematically address areas that may be holding your score back and build a positive credit trajectory.

Credit Utilization Management

Credit utilization, the ratio of your credit card balances to your credit limits, is a significant factor in your credit score. Keeping this ratio low demonstrates responsible credit usage.A step-by-step plan to improve credit utilization involves:

- Monitor Your Balances Regularly: Keep a close eye on your credit card balances throughout the month, not just at the statement closing date.

- Pay Down Balances Strategically: Aim to pay down your credit card balances as much as possible. Ideally, keep your utilization below 30% on each card and overall. Even better is to keep it below 10%.

- Make Multiple Payments: If possible, make smaller payments throughout the billing cycle. This can help reduce your reported balance by the statement closing date, even if you haven’t paid the full amount.

- Request Credit Limit Increases: Periodically, consider requesting a credit limit increase on your existing credit cards. If approved, this will automatically lower your utilization ratio, assuming your spending remains the same. Be cautious not to increase spending simply because your limit has increased.

- Avoid Maxing Out Cards: Never max out your credit cards. This signals financial distress and significantly harms your credit score.

Establishing a Positive Payment History

Your payment history is the most critical component of your credit score, accounting for approximately 35% of the FICO score. Consistently making on-time payments is paramount.To establish a positive payment history, focus on these strategies:

- Pay All Bills On Time: This includes credit cards, loans, mortgages, and even utility bills if they are reported to credit bureaus. Set up automatic payments or calendar reminders to ensure you never miss a due date.

- Catch Up on Delinquent Accounts: If you have any past-due accounts, make it a priority to bring them current as quickly as possible. The longer an account remains delinquent, the more it will negatively impact your score.

- Keep Old Accounts Open: Even if you no longer use a credit card, keeping older accounts open and in good standing can benefit your credit history length, which is another factor in your score.

Managing and Reducing Existing Debt

High levels of debt can significantly lower your credit score. Effectively managing and reducing this debt is a key strategy for improvement.Methods for managing and reducing existing debt include:

- Debt Snowball Method: This popular strategy involves paying off your smallest debts first while making minimum payments on your larger debts. Once the smallest debt is paid off, you roll that payment amount into the next smallest debt, creating a snowball effect. This method provides psychological wins that can keep you motivated.

- Debt Avalanche Method: This approach prioritizes paying off debts with the highest interest rates first, while making minimum payments on others. Mathematically, this method saves you the most money on interest over time.

- Balance Transfers: Consider transferring high-interest credit card balances to a card with a 0% introductory APR. Be mindful of balance transfer fees and the APR after the introductory period ends.

- Debt Consolidation: This involves combining multiple debts into a single new loan, often with a lower interest rate. This can simplify payments and potentially reduce the overall interest paid.

For example, imagine you have three credit cards with balances of $2,000, $3,000, and $5,000, with interest rates of 18%, 22%, and 25% respectively. Using the debt avalanche method, you would focus all extra payments on the $5,000 card first, then the $3,000 card, and finally the $2,000 card.

Responsible Credit Management Practices

Beyond specific actions, adopting general responsible credit management practices is fundamental for long-term credit health. These habits ensure that your credit score not only improves but also remains stable.A guide to responsible credit management practices includes:

- Limit New Credit Applications: Applying for multiple credit accounts in a short period can lead to numerous hard inquiries, which can temporarily lower your credit score. Apply for new credit only when you truly need it.

- Review Your Credit Reports Regularly: Obtain your free credit reports annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Check for any errors or fraudulent activity and dispute them immediately.

- Understand the Impact of Credit Inquiries: There are two types of credit inquiries: soft and hard. Soft inquiries, such as checking your own credit score or pre-approved offers, do not affect your score. Hard inquiries, which occur when you apply for new credit, can slightly lower your score.

- Build a Credit History with Secured Credit Cards or Credit-Builder Loans: If you have limited or no credit history, these tools can help you establish a positive track record. A secured credit card requires a cash deposit as collateral, and a credit-builder loan holds the loan amount in an account until it’s fully repaid.

- Avoid Co-signing Loans for Others: While it may seem helpful, co-signing a loan means you are responsible for the debt if the primary borrower defaults. This can negatively impact your credit if payments are missed.

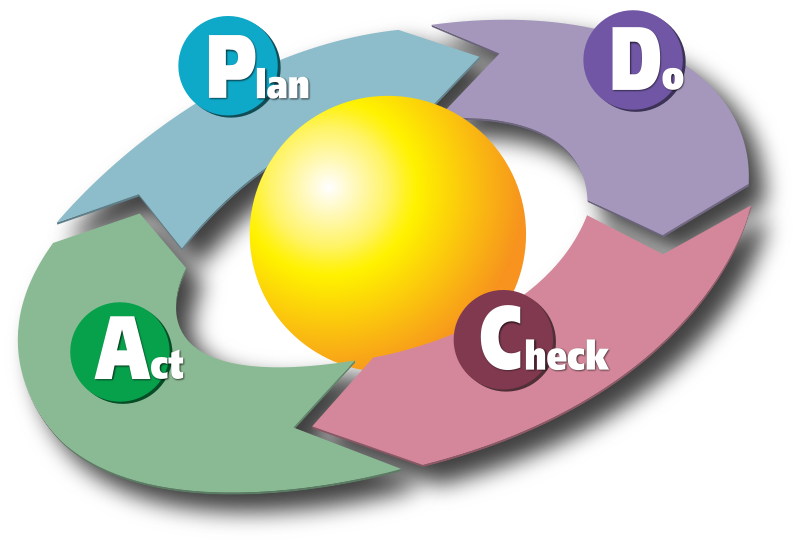

A crucial principle in credit management is:

“Consistency in timely payments and responsible utilization are the cornerstones of a strong credit score.”

Frequently Asked Questions About Free Credit Scores

Understanding your credit score is crucial for your financial well-being, and it’s natural to have questions. This section addresses some of the most common inquiries about obtaining and interpreting your credit score for free, aiming to provide clear and helpful answers.

Accuracy of Free Credit Scores

Many consumers wonder if the credit scores they access for free are as accurate as those they might pay for. It’s important to understand that most free credit score services provide FICO Scores or VantageScores, which are the same scoring models used by lenders. The primary difference often lies in the specific version of the score being provided and the credit bureau it’s pulled from.

While a free score can give you a very good indication of your creditworthiness, it may not always be the exact score a lender pulls for a specific loan application. However, for general monitoring and understanding your credit health, free scores are highly reliable.

Frequency of Free Score Updates

The frequency with which your free credit score is updated can vary depending on the service provider. Some services update your score monthly, while others may offer weekly or even daily updates. The key factor influencing these updates is the reporting cycle of the credit bureaus to the score providers. Lenders typically report your account activity to the credit bureaus once a month.

Therefore, significant changes to your credit report, which would affect your score, are generally reflected in your free score updates as they become available from the bureaus.

Impact of Checking Your Score on Credit Value

Checking your own credit score is known as a “soft inquiry” and does not impact your credit score in any way. This is because these checks are for informational purposes and do not represent an application for new credit. In contrast, a “hard inquiry” occurs when a lender checks your credit as part of a loan application process, and these can have a minor, temporary negative effect on your score.

Therefore, you can check your credit score as often as you like without concern for damaging your creditworthiness.

Consumer Rights Regarding Credit Information

Consumers have significant legal rights concerning their credit information, primarily governed by the Fair Credit Reporting Act (FCRA) in the United States. These rights include:

- The right to access your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) for free, once every 12 months, at AnnualCreditReport.com.

- The right to dispute any inaccurate or incomplete information on your credit report. The credit bureaus are required to investigate these disputes.

- The right to be notified if your credit information is used against you in a decision (e.g., denial of credit, insurance, or employment).

- The right to know who has accessed your credit report.

These rights are in place to ensure fairness and accuracy in the credit reporting system.

Visualizing Credit Score Data

Understanding your credit score is crucial, and visualizing its components can make this complex information more accessible and actionable. By seeing how different factors contribute to your score and how it changes over time, you can better strategize for financial health. This section will explore various ways to visualize your credit score data, offering clarity and insight.

Conceptual Credit Score Breakdown

A credit score is not a single, monolithic number but rather a reflection of your creditworthiness, determined by several key factors. Understanding the weight of each component helps in prioritizing financial behaviors that positively impact your score.Here is a conceptual representation of the typical percentage contributions of major factors to a credit score:

- Payment History: Approximately 35%

- Amounts Owed (Credit Utilization): Approximately 30%

- Length of Credit History: Approximately 15%

- Credit Mix: Approximately 10%

- New Credit: Approximately 10%

This breakdown highlights that consistently making on-time payments and keeping credit utilization low are the most impactful actions for maintaining or improving a strong credit score.

Credit Score Calculation Analogy

To better grasp how these factors combine, consider a balance scale metaphor. Each factor represents a weight that either adds to or subtracts from your overall creditworthiness.Imagine a balance scale where the goal is to keep the “good credit” side as heavy as possible.

- Payment History: A consistent record of on-time payments acts as a heavy, steady weight on the good credit side. Late payments, however, would be like removing significant weight, tilting the scale unfavorably.

- Amounts Owed (Credit Utilization): Keeping your credit card balances low relative to their limits is like maintaining a balanced load. High utilization, meaning you owe a large percentage of your available credit, is like adding an excessive, unstable weight that can tip the scale.

- Length of Credit History: A longer history of responsible credit use is a foundational weight that provides stability to the good credit side.

- Credit Mix: Having a variety of credit types (e.g., credit cards, installment loans) can add moderate weight, showing you can manage different forms of credit.

- New Credit: Opening many new accounts in a short period is like adding too many small, potentially wobbly weights, which can destabilize the balance.

The ideal scenario is a well-balanced scale, heavily weighted on the side of responsible credit management.

Impact of Late Payments: A Timeline Scenario

Late payments are one of the most damaging events for a credit score. Visualizing this impact over time clearly demonstrates the long-term consequences.Consider a scenario where an individual misses a credit card payment:

Month 1: A payment is due on the 15th. The payment is not made. The credit card company typically reports a delinquency 30 days after the due date. The credit score may see an initial drop.

Month 2: The payment is still not made. The account is now 60 days past due. The credit score experiences a more significant decline. The late payment is reported to credit bureaus.

Month 3: The payment remains unpaid. The account is 90 days past due. This is considered a severe delinquency, leading to a substantial drop in the credit score. The account may be sent to collections.

Month 6: The account may be charged off by the lender, meaning they have written it off as a loss. This has a severe negative impact on the credit score.

Year 1: The negative marks, including the late payment and potential charge-off, continue to weigh down the credit score. It can take years for the impact to diminish.

Year 7: Most negative information, including late payments, typically falls off a credit report after seven years. However, the score may have begun to recover prior to this point if responsible credit behavior was resumed.

This timeline illustrates that a single missed payment can have cascading negative effects that persist for years, emphasizing the importance of timely payments.

Credit Score Trends Over Time

Monitoring your credit score’s movement over months and years provides valuable insights into the effectiveness of your financial strategies. A line graph is an excellent tool for visualizing these trends.Imagine a hypothetical line graph showing a credit score over a 24-month period:

- X-axis: Time (in months)

- Y-axis: Credit Score (e.g., from 300 to 850)

The line on the graph might show the following hypothetical trajectory:

- Months 1-6: The score starts at 680. The individual begins consistently paying all bills on time and reduces credit card balances. The line shows a gradual upward trend, reaching 710 by month 6.

- Months 7-12: A minor setback occurs. The individual experiences an unexpected expense and carries a higher balance on a credit card for a couple of months, slightly increasing credit utilization. The line shows a slight dip to 700, then a recovery to 725 as the balance is paid down again.

- Months 13-18: The individual opens a new credit card to take advantage of a rewards program. This causes a small, temporary dip in the score due to the hard inquiry and reduced average age of accounts, bringing it to 720. However, responsible use of the new card leads to a steady climb to 745 by month 18.

- Months 19-24: The individual continues to manage credit responsibly, maintaining low utilization and a perfect payment history. The line shows a strong, consistent upward trend, reaching 760 by month 24.

This visualization clearly shows how positive actions lead to score improvement and how minor setbacks can be overcome with continued good financial habits. It provides a clear narrative of financial progress.

Summary

In conclusion, taking control of your financial future begins with understanding your credit score, and the good news is that this essential insight is readily available for free. By leveraging the various resources and methods Artikeld, you can gain clarity on your credit standing, identify areas for improvement, and proactively manage your financial health. Empower yourself with this knowledge and pave the way for a more secure and prosperous financial journey.