Embarking on the journey to establish or improve your creditworthiness can feel like navigating a complex landscape. Fortunately, understanding the fundamentals of store credit cards offers a clear and accessible pathway for many individuals. This guide is designed to provide you with comprehensive insights into leveraging these specialized cards effectively.

We will explore how store credit cards function, their distinct advantages and potential disadvantages compared to general-purpose credit cards, and the crucial steps involved in their application and responsible usage. By delving into these aspects, you’ll be well-equipped to make informed decisions that contribute positively to your financial future.

Understanding the Basics of Store Credit Cards for Credit Building

Store credit cards, often referred to as retail or co-branded cards, are a valuable tool for individuals looking to establish or rebuild their credit history. These cards are typically issued by a bank or financial institution in partnership with a specific retailer. Their primary purpose is to encourage customer loyalty and provide a convenient payment option for purchases made at that particular store or a select group of affiliated merchants.

For those new to credit or with limited credit experience, understanding their fundamental nature is the first step toward responsible credit management.While they share similarities with general-purpose credit cards, store credit cards have distinct characteristics. General-purpose cards, such as those branded with Visa, Mastercard, American Express, or Discover, can be used at a wide array of merchants worldwide. In contrast, store credit cards are primarily intended for use within the issuing retailer’s ecosystem.

This can mean they are only accepted at that specific store, or they might be accepted at a small network of related brands. This limited acceptance is a key differentiator, influencing how and where they can be utilized.The primary benefit of using a store credit card to establish a credit history lies in their accessibility. Often, these cards have less stringent approval requirements compared to traditional credit cards, making them a more attainable option for individuals with no credit or a low credit score.

By making small, timely payments on a store credit card, users can demonstrate responsible credit behavior to credit bureaus, which is crucial for building a positive credit report. This positive activity is then reflected in their credit score, opening doors to more significant credit opportunities in the future.However, it is essential to be aware of the potential drawbacks and risks associated with store credit cards.

One significant concern is their typically higher Annual Percentage Rates (APRs). If balances are carried over from month to month, the interest charges can accumulate rapidly, potentially leading to a cycle of debt. Additionally, the limited acceptance can be a disadvantage if a user wishes to build credit through everyday spending across various categories. It is crucial to approach store credit cards with a clear understanding of their terms and a commitment to responsible usage, focusing on paying off balances in full each month to avoid accumulating high-interest debt.

Purpose of Store Credit Cards

The fundamental purpose of store credit cards is to foster customer loyalty and provide a dedicated payment method for purchases made with a particular retailer. By offering a branded credit card, retailers aim to increase sales and encourage repeat business. These cards often come with exclusive perks and discounts, incentivizing customers to choose that store for their shopping needs.

Distinction from General-Purpose Credit Cards

Store credit cards differ from general-purpose credit cards primarily in their network of acceptance.

- Acceptance: General-purpose cards (e.g., Visa, Mastercard) are widely accepted globally at millions of merchants. Store credit cards are typically limited to the issuing retailer and its affiliated brands.

- Rewards and Benefits: While both can offer rewards, store card benefits are usually tailored to the retailer, such as discounts on store merchandise or exclusive access to sales. General-purpose cards may offer broader rewards like travel miles or cashback on various spending categories.

- Approval Criteria: Store credit cards often have more lenient approval requirements, making them a more accessible option for individuals with limited or no credit history.

Benefits for Establishing Credit History

Utilizing a store credit card can offer several advantages for individuals aiming to build or improve their credit profile.

- Accessibility: They are often easier to qualify for than traditional credit cards, serving as an entry point for credit building.

- Credit Reporting: Responsible use, including on-time payments, is reported to credit bureaus, contributing positively to a credit score.

- Building Credit Habits: They provide an opportunity to practice managing credit, making payments, and understanding credit utilization in a controlled environment.

Potential Drawbacks and Risks

Despite their benefits, store credit cards carry certain risks that consumers should consider.

- High APRs: Store credit cards often have significantly higher interest rates compared to general-purpose credit cards. If balances are not paid in full each month, the accumulated interest can become substantial. For instance, a store card with a 29.99% APR can quickly increase the cost of purchases if carried over.

- Limited Utility: Their restricted acceptance means they cannot be used for all your spending needs, limiting their effectiveness in building a diverse credit history across various spending categories.

- Encouragement of Overspending: The allure of immediate discounts and rewards can sometimes encourage impulse purchases, leading to debt accumulation if not managed carefully.

- Potential for Multiple Small Credit Lines: Opening several store cards to build credit can result in multiple small credit lines, which might not be as beneficial as one or two larger, well-managed general-purpose cards.

Eligibility and Application Process for Store Credit Cards

Securing a store credit card is often a straightforward process designed to be accessible, especially for those new to credit. Understanding the typical requirements and the steps involved will help you navigate the application smoothly and increase your chances of approval. This section Artikels what you can expect when applying for a store credit card.The eligibility criteria for store credit cards are generally less stringent than those for traditional credit cards, making them a popular choice for individuals looking to establish or rebuild their credit history.

However, certain basic requirements must be met.

Typical Eligibility Requirements

To be considered for a store credit card, applicants usually need to meet a set of common criteria. These are designed to assess your ability to manage credit responsibly.

- Age: Applicants must typically be at least 18 years old, or the age of majority in their state, to enter into a credit agreement.

- Residency: You generally need to be a legal resident of the country where the store operates and have a valid U.S. mailing address. Some issuers may have specific requirements regarding the length of residency.

- Income: While not always a strict requirement for all store cards, having a verifiable source of income is often preferred. This demonstrates your ability to make payments. Some cards may have a minimum income threshold, though this is less common for entry-level store cards.

- Credit History: For individuals aiming to build credit, a limited or no credit history is often acceptable. However, if you have a history of missed payments or defaults, it may impact your eligibility. Some cards are specifically designed for those with fair or poor credit.

- Identification: A valid government-issued photo identification, such as a driver’s license or passport, is usually required to verify your identity.

Steps in the Application Process

Applying for a store credit card is typically a quick and convenient process, often initiated at the point of sale. The steps are designed for ease of use.

- Initiate the Application: The process usually begins when you express interest in a store credit card, often at the checkout counter or through the store’s website. A sales associate or an online form will guide you through the initial steps.

- Complete the Application Form: You will be asked to fill out an application form, either on paper or digitally. This form collects the necessary personal and financial information.

- Provide Personal Information: Be prepared to share specific details about yourself. This information is crucial for the issuer to assess your creditworthiness and verify your identity.

- Submit the Application: Once the form is completed, you submit it for review. For in-store applications, this is often done immediately. Online applications are submitted electronically.

- Receive a Decision: Many store credit card applications receive an instant decision, especially if applied for in-store. You will be notified whether your application has been approved, denied, or requires further review.

- Card Activation: If approved, you will receive your card in the mail within a specified timeframe. You will then need to activate it before you can begin using it.

Commonly Requested Personal Information

The application for a store credit card requires you to provide certain personal details to help the issuer make an informed decision. This information is standard for most credit applications.

- Full Name: Your legal first, middle, and last name.

- Address: Your current residential address, including street, city, state, and ZIP code. Some issuers may also ask for previous addresses if you have moved recently.

- Date of Birth: This is used to verify your age and for identity confirmation.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): This is a crucial piece of information for credit checks and identity verification.

- Phone Number: A primary contact number where you can be reached.

- Email Address: A valid email address for communication and notifications.

- Employment Information: This may include your employer’s name, your job title, and how long you have been employed there. This helps assess your income stability.

- Income Information: You will likely be asked about your annual income, including sources of income such as salary, wages, or other earnings. You may be asked to provide an estimate if you are self-employed or have multiple income streams.

Guidance for Application Denial

Receiving a denial for a store credit card application can be disappointing, but it is not the end of your credit-building journey. Understanding the reasons for denial and taking appropriate steps can help you improve your chances for future approvals.

- Review the Denial Reason: If your application is denied, the issuer is required by law to send you an adverse action notice. This notice will explain the specific reasons for the denial, such as insufficient credit history, too many recent credit inquiries, or a high debt-to-income ratio. Carefully review this notice to understand the factors that led to the decision.

- Check Your Credit Report: A denial can sometimes be due to errors on your credit report. Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Review it for any inaccuracies and dispute them if found.

- Address the Underlying Issues: Once you understand the reasons for denial, focus on addressing them. For example, if your credit history is limited, consider secured credit cards or credit-builder loans. If you have too many inquiries, wait a few months before applying for new credit.

- Consider Different Cards: Not all store credit cards have the same approval criteria. If you were denied by one store, research other retailers that might have more lenient requirements or cards specifically designed for individuals with limited credit.

- Reapply Strategically: After taking steps to improve your financial profile, you can consider reapplying for a store credit card. It is advisable to wait a reasonable period, typically 6-12 months, before reapplying to allow time for any improvements to reflect on your credit report and to avoid appearing as a persistent applicant.

Responsible Usage for Effective Credit Building

Successfully obtaining a store credit card is just the first step toward building credit. The true power of this tool lies in how you use it. Responsible usage is paramount to ensure your efforts translate into a positive impact on your credit score. This section will guide you through the essential practices for managing your store credit card effectively to build a strong credit foundation.This involves a mindful approach to spending and repayment, focusing on habits that credit bureaus look favorably upon.

By understanding and implementing these strategies, you can maximize the benefits of your store credit card while minimizing potential pitfalls.

Timely Payment Strategy

Making on-time payments is the single most important factor in building a good credit score. Even one late payment can significantly damage your credit history. To ensure you never miss a due date, a proactive strategy is essential.Here are several methods to design a robust timely payment strategy:

- Automate Payments: Set up automatic payments from your bank account for at least the minimum payment due. This is the most foolproof way to ensure you never miss a deadline.

- Calendar Reminders: Utilize your smartphone or a physical calendar to set multiple reminders a few days before the due date.

- Payment Scheduling: If you prefer to make payments manually, schedule them immediately after you receive your statement or a few days after your payday.

- Direct Deposit: If possible, align your payment due date with your payday to ensure funds are readily available.

- Budgeting: Integrate your credit card payments into your monthly budget. Knowing exactly when and how much you need to pay makes it easier to stay on track.

Credit Utilization Ratio Impact

The credit utilization ratio (CUR) is a critical component of your credit score, often accounting for a significant portion of its calculation. It measures the amount of credit you are using compared to your total available credit. A lower utilization ratio generally indicates to lenders that you are not over-reliant on credit and can manage your debt responsibly.

Credit Utilization Ratio = (Total Credit Used / Total Credit Available) – 100

A high credit utilization ratio can signal to lenders that you might be experiencing financial distress, which can negatively impact your credit score. Lenders view individuals with high utilization as higher risk, potentially making it harder to get approved for future credit or loans.

Methods for Keeping Credit Utilization Low

Maintaining a low credit utilization ratio is crucial for effective credit building. Even with a store credit card that might have a lower credit limit, managing this ratio diligently is key.Here are effective methods to keep your credit utilization low:

- Pay Down Balances Before the Statement Date: Instead of waiting for the due date, make payments throughout the billing cycle. If you make a large purchase, pay it off before your statement closing date to prevent it from being reported to the credit bureaus.

- Make Multiple Payments: If you use your card frequently, consider making several small payments throughout the month rather than one large payment at the end. This keeps the reported balance lower.

- Increase Credit Limit (with caution): While not always feasible with store cards, if you have other credit cards, requesting a credit limit increase can lower your overall utilization. However, do this only if you are confident you can manage the increased credit responsibly.

- Use Sparingly: The most straightforward method is to use your store credit card only for small, planned purchases that you can afford to pay off quickly.

- Avoid Maxing Out the Card: Never approach your credit limit. Aim to keep your balance well below 30% of your credit limit, and ideally below 10%, for the best impact on your credit score.

Monitoring Credit Reports for Accuracy

Regularly reviewing your credit reports is an essential part of responsible credit management. These reports detail your credit history, including all your credit accounts, payment history, and credit inquiries. Ensuring the information is accurate helps protect you from identity theft and allows you to catch any errors that could negatively affect your credit score.It is important to understand the contents of your credit report and how they contribute to your credit score.

By diligently monitoring these reports, you can maintain control over your financial identity and ensure your credit-building efforts are accurately reflected.Here are the key aspects of monitoring your credit reports:

- Obtain Free Credit Reports: You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. You can request these reports through AnnualCreditReport.com.

- Review for Errors: Carefully examine each report for any inaccuracies, such as incorrect personal information, accounts you do not recognize, or incorrect payment statuses.

- Dispute Inaccuracies: If you find any errors, immediately contact the credit bureau that issued the report and the creditor that reported the information to dispute the inaccuracies. The bureaus have procedures for investigating and correcting errors.

- Check for Unauthorized Activity: Look for any signs of identity theft, such as new accounts opened in your name that you did not authorize or inquiries you do not recognize.

- Understand the Impact of Inquiries: Note any hard inquiries, which occur when a lender checks your credit for a new credit application. While some inquiries are necessary, too many in a short period can slightly lower your score.

Maximizing Rewards and Benefits While Building Credit

While the primary goal of a store credit card when starting to build credit is to establish a positive payment history, it’s also wise to leverage the associated rewards and benefits. This strategic approach can make your credit-building journey more rewarding and cost-effective, provided you remain disciplined with your spending. By understanding and planning how to use these perks, you can enhance the value you receive from your card.A well-thought-out plan ensures that you are not overspending just to earn rewards.

Instead, you are strategically benefiting from purchases you would have made anyway. This section will guide you through organizing your approach to rewards, understanding their value, comparing different reward structures, and effectively redeeming them without falling into debt.

Organizing a Plan to Leverage Store-Specific Discounts and Rewards

To effectively maximize the benefits of your store credit card, it’s essential to create a structured plan that aligns with your shopping habits and financial goals. This involves understanding the specific types of rewards offered by your card and identifying opportunities to use them strategically.A proactive approach to rewards management can significantly enhance the value you derive from your credit card.

It transforms a simple payment tool into a source of savings and added value.

- Understand Your Card’s Reward Program: Thoroughly read the terms and conditions of your store credit card to understand the types of rewards offered. This could include points, cashback, discounts, or exclusive access to sales.

- Align Rewards with Your Spending Habits: If your card offers higher rewards for specific categories (e.g., groceries, gas, or specific store purchases), prioritize using it for those expenses. This amplifies the rewards you earn on your regular spending.

- Track Special Promotions and Bonus Offers: Many store credit cards offer bonus points or special discounts during specific periods or for particular product categories. Keep an eye on these opportunities and plan your purchases accordingly. For instance, a store might offer double points on all purchases during a holiday sale, or a specific percentage off if you use your store card.

- Set Reward Earning Goals: Define what you aim to achieve with your rewards. This could be saving up for a specific item, offsetting a portion of your annual expenses, or achieving a certain cashback amount. Having a goal provides motivation and direction.

- Integrate with Store Loyalty Programs: If the store credit card is linked to a broader store loyalty program, ensure you are enrolled in both. This often leads to stacked benefits, where you earn rewards from both the card and the loyalty program simultaneously.

Calculating the Value of Accumulated Rewards

Understanding the monetary value of your accumulated rewards is crucial for assessing the true benefit of your store credit card. This calculation allows you to quantify your savings and make informed decisions about redemption.Quantifying rewards helps you see the tangible financial advantage of using your card responsibly. It moves beyond the abstract idea of “earning points” to a concrete understanding of your savings.The value of rewards can be calculated differently depending on the reward type.

Here are common methods:

- Points-Based Systems: For points, the value is typically expressed as a certain amount of currency per point. For example, if 1,000 points can be redeemed for $10 in store credit, then each point is worth $0.01 ($10 / 1,000 points). If points can be redeemed for merchandise, you might need to compare the retail price of an item with the point cost to determine its value.

- Cashback: Cashback is usually straightforward. A percentage of your spending is returned to you as cash or statement credit. If you earn 2% cashback and spend $500, your cashback is $10 (500

– 0.02). - Statement Credits or Discounts: These are directly applied to your bill. If you have a $20 statement credit, its value is simply $20. A 15% discount on a $100 purchase using your card is a $15 saving.

To calculate the total value of your accumulated rewards, sum the calculated value of all your redeemed or redeemable rewards. For instance, if you have 5,000 points worth $0.01 each, and $50 in accumulated cashback, your total reward value is ($5,000 \times \$0.01) + \$50 = \$50 + \$50 = \$100$.

The true value of rewards is realized when they are redeemed for items or services that you would have purchased anyway, or when they offer significant savings on desired purchases.

Comparing Different Types of Store Credit Card Rewards Programs

Store credit cards offer a variety of rewards programs, each with its own structure and potential benefits. Understanding these differences will help you choose a card that best aligns with your spending patterns and maximize your returns.Each reward program is designed to incentivize spending within a particular ecosystem. Comparing them allows you to select the one that offers the most practical and valuable benefits for your lifestyle.

- Points Programs: These are very common. You earn a set number of points for every dollar spent, often with bonus points for spending at the affiliated store or on specific product categories. The redemption value of points can vary, so it’s important to understand how points translate into discounts or merchandise. Some programs offer tiered redemption options, where more points might yield a slightly better value for certain redemptions.

- Cashback Programs: These are often simpler to understand. You receive a percentage of your spending back as cash or statement credit. Some store cards offer a flat cashback rate on all purchases, while others might provide higher cashback percentages for purchases made at the store. For example, a card might offer 3% cashback on store purchases and 1% on everything else.

- Discount Programs: Instead of earning points or cashback, some cards offer immediate discounts on purchases made at the store. This could be a fixed percentage off every purchase or specific promotional discounts. For instance, you might receive 10% off all your purchases at the store for the first year.

- Exclusive Perks and Benefits: Beyond direct monetary rewards, many store cards offer non-monetary benefits. These can include free shipping on online orders, extended return periods, early access to sales, birthday rewards, or complimentary services. While harder to assign a direct dollar value, these can significantly enhance the shopping experience and save you time and hassle.

When comparing, consider which type of reward aligns best with your shopping habits. If you frequently shop at a particular store, a points or discount program specific to that store might be highly beneficial. If you prefer flexibility, a cashback program might be more appealing, especially if it can be used anywhere.

Redeeming Rewards Effectively Without Incurring Debt

The most significant aspect of maximizing rewards is ensuring that their redemption does not lead to increased debt. Effective redemption means using your earned benefits wisely, without letting them encourage overspending.The goal is to let rewards work for you as savings, not to let the pursuit of rewards lead to financial strain. Responsible redemption is key to the credit-building process.

- Prioritize Essential Purchases: When redeeming rewards, focus on items or services you genuinely need or would have purchased regardless of the reward. This ensures you are saving money on existing expenses rather than buying something new just to use a reward. For example, if you have accumulated $50 in cashback, use it to pay down your next statement balance or purchase necessary household items.

- Avoid Impulse Buys Driven by Rewards: Be wary of purchasing items solely because you have enough rewards to cover them. If the item is not something you need or planned for, acquiring it might lead to unnecessary spending that outweighs the value of the reward.

- Understand Redemption Thresholds: Many rewards programs have minimum redemption amounts. Be aware of these thresholds and plan your spending to reach them efficiently without rushing or overspending. For example, if you need 1,000 points for a $10 reward, and you currently have 800, resist the urge to make an unnecessary purchase just to reach the threshold. Wait for a planned purchase.

- Choose Redemptions Wisely: Sometimes, rewards can be redeemed in different ways (e.g., statement credit, gift card, merchandise). Evaluate which redemption option offers the best value for your situation. A statement credit directly reduces your balance, which is often the most financially prudent choice when building credit.

- Treat Rewards as Savings: Mentally, consider your accumulated rewards as a savings account. Only “withdraw” from it when it makes financial sense and contributes to your overall savings goals or reduces your existing expenses.

For example, imagine you’ve earned enough points for a $50 gift card to your favorite clothing store. If you were already planning to buy a new outfit that costs $50, using the gift card is a perfect, debt-free redemption. However, if you were not planning any clothing purchases, buying an item you don’t need with the gift card could lead to spending money you wouldn’t have otherwise spent, potentially negating the benefit if it leads to carrying a balance on your card.

Moving Beyond Store Credit Cards for Broader Credit Growth

While store credit cards are an excellent starting point for building credit, they are often just the first step. As your credit history grows and you demonstrate responsible financial behavior, it becomes beneficial to explore general-purpose credit cards. These cards typically offer broader acceptance, more robust rewards programs, and can contribute more significantly to a well-rounded credit profile. Transitioning allows you to leverage your established history to access a wider range of financial tools and opportunities.

Timing Your Transition to General-Purpose Credit Cards

The decision to move beyond a store credit card should be based on several factors, primarily your demonstrated creditworthiness and financial goals. After consistently using your store card responsibly for at least 6-12 months, making on-time payments, and keeping your credit utilization low, you’ll be in a strong position to apply for other credit products. This period allows you to build a positive payment history, which is the most critical factor in credit scoring.

Furthermore, consider your spending habits; if you find yourself using your store card for purchases that could be better rewarded or are not accepted everywhere, it’s a clear sign that a general-purpose card would be more advantageous.

Strategies for Applying for General-Purpose Credit Cards

Once you’ve established a solid foundation with a store credit card, applying for a general-purpose card requires a strategic approach. The key is to target cards that align with your credit profile and spending habits, thereby increasing your chances of approval and ensuring the card provides tangible benefits.

- Review Your Credit Report: Before applying, obtain a copy of your credit report from the major credit bureaus (Equifax, Experian, and TransUnion). This will provide a clear picture of your current credit standing and highlight any potential errors that need to be corrected.

- Research Suitable Cards: Look for “unsecured” credit cards designed for individuals with limited credit history or those looking to rebuild their credit. Many reputable issuers offer such cards, often with lower credit limits initially. Consider cards with no annual fees and reasonable interest rates.

- Pre-qualification Tools: Many credit card issuers provide pre-qualification tools on their websites. These tools allow you to check your likelihood of approval without a hard inquiry on your credit report, helping you avoid unnecessary applications.

- Focus on One Application at a Time: To avoid multiple hard inquiries in a short period, which can negatively impact your credit score, apply for only one general-purpose credit card at a time.

- Highlight Your Store Card History: When filling out applications, you can often indicate your existing credit accounts. Your positive history with the store credit card will be a significant factor for the new issuer.

Influence of Store Card History on Other Credit Products

A well-managed store credit card serves as a valuable reference point for lenders considering your application for other credit products, such as general-purpose credit cards, auto loans, or even mortgages. This positive history demonstrates your ability to handle credit responsibly.

A consistent record of on-time payments and low credit utilization on a store card signals to new lenders that you are a reliable borrower.

This can lead to a higher likelihood of approval for new credit lines and potentially more favorable terms, such as lower interest rates and higher credit limits, compared to someone with no credit history at all.

Developing a Long-Term Credit Score Improvement Plan

Building credit is an ongoing process, and moving beyond initial store card usage is a crucial part of a comprehensive long-term strategy. The goal is to cultivate a diverse credit portfolio and maintain impeccable financial habits.

- Continue Responsible Usage: Consistently make all payments on time for all your credit accounts, including your store card and any new general-purpose cards.

- Manage Credit Utilization: Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total available credit) below 30%, and ideally below 10%, across all your accounts.

- Diversify Your Credit Mix: As your credit history matures, consider adding other types of credit, such as a small installment loan (e.g., a secured personal loan or a credit-builder loan) if appropriate for your financial situation. A mix of revolving credit (credit cards) and installment credit can positively impact your score.

- Monitor Your Credit Regularly: Continue to check your credit reports annually for accuracy and to track your progress. Many credit card issuers also offer free credit score monitoring services.

- Avoid Unnecessary Credit Applications: Only apply for credit when you genuinely need it. Each application can result in a hard inquiry, which can temporarily lower your score.

- Build a Longer Credit History: The longer you’ve had credit accounts open and in good standing, the better it is for your credit score. Avoid closing old, unused credit accounts, especially if they have no annual fee, as this can reduce your average account age and increase your overall credit utilization.

Understanding Key Credit Card Terms and Concepts

Navigating the world of credit cards involves understanding specific terminology that dictates how your card functions and impacts your financial health. For store credit cards, grasping these concepts is crucial for effective credit building and avoiding potential pitfalls. This section will demystify the essential terms you’ll encounter.Understanding these terms empowers you to make informed decisions about your store credit card, ensuring you leverage its benefits for credit building while managing your finances responsibly.

Annual Percentage Rate (APR)

The Annual Percentage Rate, or APR, represents the yearly cost of borrowing money on your credit card. It’s expressed as a percentage and includes not only the interest rate but also certain fees associated with the loan. For store credit cards, the APR is a particularly important figure because it directly influences how much you’ll pay in interest if you carry a balance from month to month.

Store card APRs can often be higher than those on general-purpose credit cards, making it essential to pay off your balance in full each billing cycle to avoid accumulating significant interest charges.

APR is the true cost of borrowing, including interest and fees, over a year.

Credit Limits

Your credit limit is the maximum amount of money you can borrow on a particular credit card. For store credit cards, these limits are often lower than those on other types of credit cards, especially when you are first starting to build credit. The credit limit is determined by the issuer based on several factors, including your credit history, income, and the specific store’s policies.

A higher credit limit can offer more purchasing power, but it also means a greater potential for debt if not managed carefully. Conversely, a lower limit can be beneficial for new credit users as it makes it easier to manage spending and avoid maxing out the card, which can negatively impact your credit score.

Minimum Payments

The minimum payment is the smallest amount you are required to pay each billing cycle to keep your account in good standing. While paying only the minimum might seem like a way to manage cash flow, it’s generally not a financially sound strategy for building credit effectively. When you make only the minimum payment, a large portion of it typically goes towards interest charges, with very little applied to the principal balance.

This can lead to a prolonged debt cycle, significantly increasing the total amount you repay over time and hindering your progress in building a strong credit history.It is highly recommended to pay more than the minimum payment whenever possible. Aiming to pay the full statement balance each month is the most effective way to avoid interest charges and accelerate your debt repayment.

Common Fees Associated with Store Credit Cards

Store credit cards, while offering specific benefits, can also come with various fees that add to the overall cost of using the card. Being aware of these fees is crucial for making informed financial decisions and avoiding unexpected charges.Here are some common fees associated with store credit cards:

- Annual Fee: Some store cards may charge an annual fee for the privilege of using the card. This is less common with entry-level store cards but can be found on premium versions.

- Late Payment Fee: If you fail to make at least the minimum payment by the due date, you will likely incur a late payment fee. This fee can be a fixed amount or a percentage of the overdue balance.

- Over-Limit Fee: If you spend beyond your credit limit, you may be charged an over-limit fee. Many issuers now require explicit opt-in for this feature, but it’s important to be aware of the possibility.

- Returned Payment Fee: This fee is charged if your payment to the credit card company is returned due to insufficient funds or other reasons.

- Foreign Transaction Fee: While less common for store cards that are primarily used domestically, some may charge a fee for purchases made in a foreign currency or processed outside your home country.

Visualizing the Credit Building Journey with Store Cards

Embarking on the path to building credit can feel like a long and abstract process. However, by understanding how responsible use of a store credit card contributes to your financial health, you can visualize this journey and stay motivated. This section will illuminate the positive impact of consistent, good credit habits, demonstrating tangible progress over time.The journey of building credit is akin to cultivating a garden; it requires consistent effort, patience, and the right tools.

A store credit card, when used wisely, acts as a foundational tool, allowing you to nurture your credit profile from its nascent stages into a robust and reliable financial asset. We will explore how this journey unfolds, from initial steps to achieving a strong credit standing.

Credit Score Progression Over Time

Responsible usage of a store credit card can lead to a noticeable and positive trajectory in your credit score. This progression is not instantaneous but rather a gradual build-up based on consistent positive financial behaviors. The visual representation below illustrates this development.Imagine a graph where the horizontal axis represents time (in months or years) and the vertical axis represents your credit score.

- Starting Point (Month 0-3): With no credit history, your score might be considered “thin” or non-existent. After opening a store card and making a small, planned purchase, and paying it off immediately, the score might show a slight increase or remain stable as the account is established.

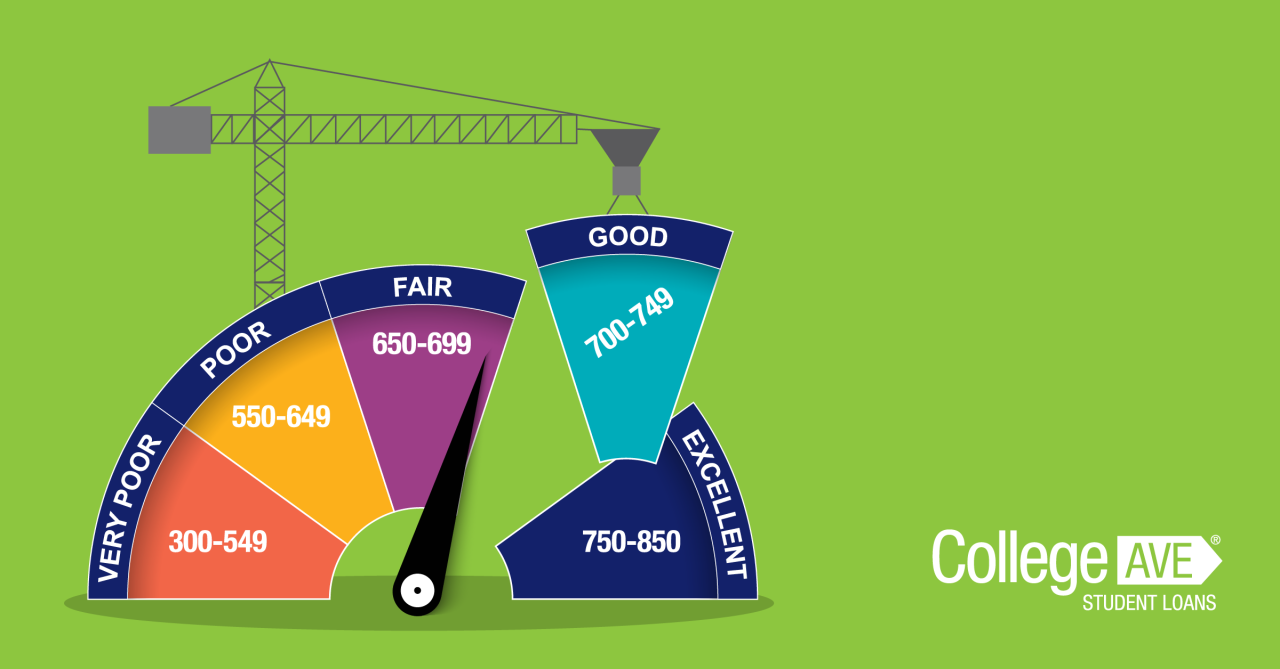

- Early Stages (Month 3-12): Consistently using the card for small purchases and paying the balance in full before the due date will begin to establish a positive payment history. This is a critical factor in credit scoring. Your score will likely show a steady, upward trend, moving from a “fair” or “average” range.

- Mid-Journey (Year 1-3): As you continue to manage the store card responsibly, keeping your credit utilization low (ideally below 30%), and always paying on time, your credit score will continue to climb. You might see your score enter the “good” or even “very good” categories. This demonstrates to lenders that you are a reliable borrower.

- Established Credit (Year 3+): With a solid history of on-time payments and low utilization on your store card, your credit score will become more robust. This foundation can then be leveraged to apply for other types of credit, such as a general-purpose credit card or even a car loan, further enhancing your credit profile.

The visual impact is a curve that starts low and gradually ascends, becoming steeper as positive behaviors are consistently applied over an extended period.

Hypothetical Scenario: From No Credit to a Healthy Profile

Let’s consider the journey of Alex, a young adult who is new to managing finances and has no prior credit history. Alex decides to open a store credit card at their favorite clothing retailer to help build credit.

- Month 1: Alex opens the store card. They make a small purchase of a $50 sweater and immediately pay the full amount online. This establishes the account and shows initial activity.

- Month 2-6: Alex uses the card for a few more small clothing purchases, totaling around $75-$100 per month. Crucially, they set up automatic payments to ensure the full balance is paid on time each month, well before the due date. Their credit utilization remains very low (around 10-20% of the available credit).

- Month 7-12: Alex continues their disciplined approach. Their credit report now shows a consistent payment history of 12 months. The store card issuer reports this positive activity to the credit bureaus. Alex’s credit score, which was initially unestablished, starts to appear and gradually increases. They might see their score reach the mid-600s.

- Year 2: Alex has now managed the store card for two years with perfect on-time payments and low utilization. They decide to apply for a general-purpose rewards credit card. Because of their established positive history with the store card, their application is approved with a reasonable credit limit. Their credit score has now moved into the “good” range, potentially in the high 600s or low 700s.

- Year 3 and beyond: With both the store card and the general-purpose card being managed responsibly, Alex’s credit profile continues to strengthen. They maintain low credit utilization across both cards and continue to pay all bills on time. Their credit score is now in the “very good” to “excellent” range, opening doors for more significant financial opportunities like a mortgage or a favorable car loan.

This scenario highlights how a single, well-managed store credit card can serve as a stepping stone to a much broader and healthier credit profile.

A User’s Successful Credit Building Narrative

Sarah was determined to improve her financial future. Having made some early financial missteps in her early twenties, she found herself with a poor credit score, making it difficult to rent an apartment or secure favorable loan terms. She decided to start with a store credit card from a popular electronics retailer, seeing it as a manageable way to rebuild her credit.Sarah approached her store card with a clear strategy: treat it like a debit card.

She set a strict budget for herself, ensuring she would only use the card for purchases she could comfortably afford to pay off in full. For the first year, she used the card for small, planned purchases like phone accessories or a new book, always paying the balance within a week of making the purchase, well before the statement due date.

This strategy ensured her credit utilization was always at 0% when the statement closed, a highly favorable factor for credit scoring.After about 18 months of consistent, responsible usage, Sarah noticed a significant improvement in her credit score. Her score had climbed from the low 500s to the mid-600s. Encouraged, she decided to apply for a secured credit card from a major bank, a product designed for individuals looking to build or rebuild credit.

Her application was approved, and she was able to transition from relying solely on the store card to managing two credit accounts responsibly.By the end of the third year, Sarah’s credit score had reached the high 700s. She was now able to qualify for a competitive interest rate on a car loan and secured a lease on a new apartment without needing a co-signer.

Her journey, initiated with a simple store credit card, demonstrates the power of discipline and consistent positive financial behavior in transforming one’s creditworthiness.

Closure

In essence, a store credit card can serve as a powerful stepping stone in your credit-building journey. By understanding its unique characteristics, diligently managing your account, and strategically leveraging its benefits, you can cultivate a positive credit history. This foundation not only opens doors to further financial opportunities but also empowers you with greater control over your financial well-being, paving the way for broader credit growth and long-term financial success.