Beginning with How to Use the Debt Snowball Method to Improve Your Credit, this guide offers a comprehensive exploration of a powerful strategy designed to not only tackle outstanding debts but also significantly enhance your financial standing. We will delve into the psychological advantages that fuel motivation and the practical, step-by-step processes required for successful implementation, ensuring you gain a clear roadmap to financial freedom.

This journey will illuminate the direct correlation between diligent debt repayment and the improvement of your credit score. You’ll discover how strategic debt reduction, particularly by lowering credit utilization ratios and maintaining consistent on-time payments, builds a robust credit history. Furthermore, we will explore how the decreasing balances of your debts are reported to credit bureaus, actively contributing to a more favorable credit profile.

Understanding the Debt Snowball Method

The debt snowball method is a popular debt reduction strategy that focuses on paying off debts from smallest to largest, regardless of interest rates. This approach leverages psychological momentum to keep individuals motivated and committed to their financial goals. By celebrating small victories along the way, the debt snowball method aims to build confidence and a sense of progress, making the journey to becoming debt-free feel more achievable.The core principle of the debt snowball method is to create a powerful sense of accomplishment.

Instead of tackling the most financially “optimal” debt first, which might be the one with the highest interest rate (known as the debt avalanche method), the snowball method prioritizes debts based on their outstanding balance. This strategy is designed to provide frequent wins, which are crucial for maintaining motivation over the long term.

The Core Principle of the Debt Snowball Method

The fundamental concept behind the debt snowball method is to gain early psychological wins by eliminating smaller debts first. You organize all your debts by their balance, from the smallest to the largest. You then make minimum payments on all debts except for the smallest one. On that smallest debt, you throw every extra dollar you can find at it.

Once the smallest debt is paid off, you take the money you were paying on that debt (the minimum payment plus any extra you were adding) and add it to the minimum payment of the next smallest debt. This creates a “snowball” effect, where the amount you’re paying towards each subsequent debt grows larger over time.

Psychological Benefits of the Debt Snowball Method

The debt snowball method is particularly effective due to its inherent psychological benefits. The rapid elimination of smaller debts provides tangible, frequent successes that can significantly boost an individual’s morale and motivation. Seeing debts disappear quickly can create a sense of control and progress, which is vital for staying on track with a long-term financial plan. This method taps into the human desire for reward and recognition, making the often arduous process of debt repayment feel more manageable and less overwhelming.For instance, imagine someone with three debts: $500, $1,500, and $5,000.

By focusing on the $500 debt first and aggressively paying it off, they can achieve debt freedom in a shorter timeframe compared to tackling the $5,000 debt. This quick win can be a powerful motivator to continue with the next debt.

Step-by-Step Procedure for Implementing the Debt Snowball Method

Implementing the debt snowball method involves a structured approach to ensure clarity and efficiency. It begins with a comprehensive understanding of all outstanding debts and a commitment to allocating extra funds towards repayment. The process is designed to be straightforward, allowing individuals to focus on execution rather than complex calculations.The steps are as follows:

- List all your debts: Gather information on all your outstanding debts, including credit cards, personal loans, car loans, and any other forms of consumer debt. Note the creditor, the current balance, and the minimum monthly payment for each.

- Order debts by balance: Arrange your debts from the smallest balance to the largest balance. The interest rate is not a primary factor in this ordering.

- Pay minimums on all but the smallest: Make only the minimum required payment on all debts except for the one with the smallest balance.

- Attack the smallest debt: Allocate any additional funds you can afford towards the debt with the smallest balance. This includes any extra money from your budget, windfalls like tax refunds or bonuses, or money saved from cutting expenses.

- Snowball the payments: Once the smallest debt is completely paid off, take the total amount you were paying on that debt (minimum payment plus any extra) and add it to the minimum payment of the next smallest debt.

- Repeat the process: Continue this process, rolling the payment amount from each debt you eliminate into the payment of the next debt in line, until all your debts are paid off.

Identifying and Prioritizing Debts for the Snowball

The process of identifying and prioritizing debts is a critical first step in the debt snowball method. It requires a thorough inventory of all financial obligations to ensure no debt is overlooked. The prioritization is based solely on the outstanding balance, making it a simple yet effective ranking system.To effectively identify and prioritize your debts for the snowball, consider the following:

- Debt Inventory: Create a comprehensive list of all your debts. For each debt, record the name of the creditor, the current outstanding balance, the minimum monthly payment, and the interest rate (APR). While the interest rate is not used for prioritization in the snowball method, it’s good financial practice to be aware of it.

- Balance Ordering: Arrange your debts in ascending order based on their current outstanding balance. The debt with the lowest balance should be at the top of your list, and the debt with the highest balance at the bottom.

- Identifying “Extra” Funds: Determine how much extra money you can realistically allocate towards debt repayment each month. This might involve reviewing your budget, cutting discretionary spending, or finding additional income sources. Even small amounts can make a difference in accelerating the payoff of smaller debts.

- Focus on the Smallest: Once your debts are ordered, focus all your extra payment efforts on the debt with the absolute smallest balance. Continue making only the minimum payments on all other debts.

This systematic approach ensures that you are systematically working through your debts, building momentum with each payoff.

Connecting Debt Snowball to Credit Improvement

The Debt Snowball method, while primarily a debt reduction strategy, offers significant and direct benefits to your credit score. By systematically paying down your debts, you actively influence the key factors that credit bureaus consider when calculating your creditworthiness. This process not only frees you from financial burdens but also builds a foundation for a healthier financial future.The direct impact of paying off debt on your credit score is multifaceted.

As you eliminate debts, you improve several critical components of your credit report, leading to a more favorable overall credit profile. This strategic approach ensures that your efforts to manage debt directly translate into tangible credit score gains.

Direct Impact of Debt Payoff on Credit Scores

Paying off debt directly impacts your credit score by reducing the amount of credit you owe, which is a primary determinant of your creditworthiness. As balances decrease, your credit utilization ratio improves, and consistent on-time payments solidify your reputation as a reliable borrower. This systematic reduction in outstanding debt signals to lenders and credit bureaus that you are managing your financial obligations responsibly.

Reducing Credit Utilization Ratios

Credit utilization ratio, often referred to as your credit utilization rate, is the amount of credit you are currently using compared to your total available credit. This metric significantly influences your credit score, with lower utilization generally leading to higher scores. The Debt Snowball method directly addresses this by reducing your overall debt balances, thereby lowering your utilization ratio. For instance, if you have a credit card with a $1,000 limit and a $500 balance, your utilization is 50%.

As you pay down this balance using the snowball method, say to $250, your utilization drops to 25%, which is viewed much more favorably by credit scoring models.

Lowering credit utilization below 30% is generally recommended, with scores often improving further as it approaches 10%.

Consistent On-Time Payments

One of the most crucial elements of a strong credit history is making payments on time. The Debt Snowball method encourages this behavior by focusing on paying off smaller debts first. As you make progress and pay off these smaller debts, you experience early wins, which can boost your motivation to continue making all your payments on time. Each on-time payment is a positive mark on your credit report, demonstrating reliability to lenders.

Conversely, late payments can severely damage your credit score and remain on your report for years. The discipline fostered by the snowball method reinforces positive payment habits.

Reporting of Decreasing Debt Balances to Credit Bureaus

Credit bureaus receive information from lenders about your credit accounts on a regular basis, typically monthly. As you implement the Debt Snowball method and pay down your balances, these reductions are reported to the credit bureaus. For example, if you have a loan with a reported balance of $5,000 at the beginning of a month, and you make a significant payment that reduces the balance to $4,500 by the end of the month, this lower balance will be reflected in your credit report for the next reporting cycle.

This ongoing reporting of decreasing debt demonstrates positive account management and contributes to an improving credit profile over time.

| Debt Type | Initial Balance | Payment After 1 Month | Reported Balance |

|---|---|---|---|

| Credit Card A | $1,200 | $300 | $900 |

| Personal Loan B | $3,500 | $500 | $3,000 |

| Student Loan C | $10,000 | $200 | $9,800 |

This table illustrates how balances are reported after a month of payments, showing a clear reduction that positively impacts credit metrics.

Practical Steps for Debt Snowball Implementation

Embarking on the debt snowball journey requires a clear plan and consistent execution. This method, while simple in principle, benefits greatly from structured organization and dedicated tracking to maintain momentum and motivation. By breaking down the process into actionable steps, individuals can systematically tackle their debts and witness tangible progress.The following sections will guide you through setting up your debt snowball, from organizing your debts to budgeting effectively and adapting to financial changes.

These practical tools are designed to empower you to take control of your financial future.

Organizing a Sample Debt Snowball Plan

To illustrate the debt snowball method, let’s consider a hypothetical individual, Sarah, who is determined to become debt-free. Sarah has the following debts:

- Credit Card A: $2,500 balance at 18% APR

- Personal Loan B: $7,000 balance at 9% APR

- Student Loan C: $15,000 balance at 5% APR

- Car Loan D: $10,000 balance at 4% APR

Sarah’s total minimum monthly payments amount to $300. She has committed to paying an extra $200 per month towards her debts, bringing her total monthly debt repayment to $500. Following the debt snowball method, Sarah will prioritize paying off her smallest debt first, regardless of interest rate.Her snowball plan will be structured as follows:

- Smallest Debt First: Sarah will focus her extra $200 payment on Credit Card A ($2,500). Her total payment to Credit Card A will be its minimum payment plus the $200 extra.

- Minimum Payments on Others: She will continue to make only the minimum payments on Personal Loan B, Student Loan C, and Car Loan D.

- Snowball Effect: Once Credit Card A is paid off, the entire amount she was paying towards it (minimum payment + $200) will be added to the minimum payment of the next smallest debt, Personal Loan B. This larger payment accelerates the payoff of the subsequent debts.

- Iteration: This process continues, with the snowball of payments growing larger as each debt is eliminated, until all debts are cleared.

Designing a Printable Worksheet to Track Debt Payments and Progress

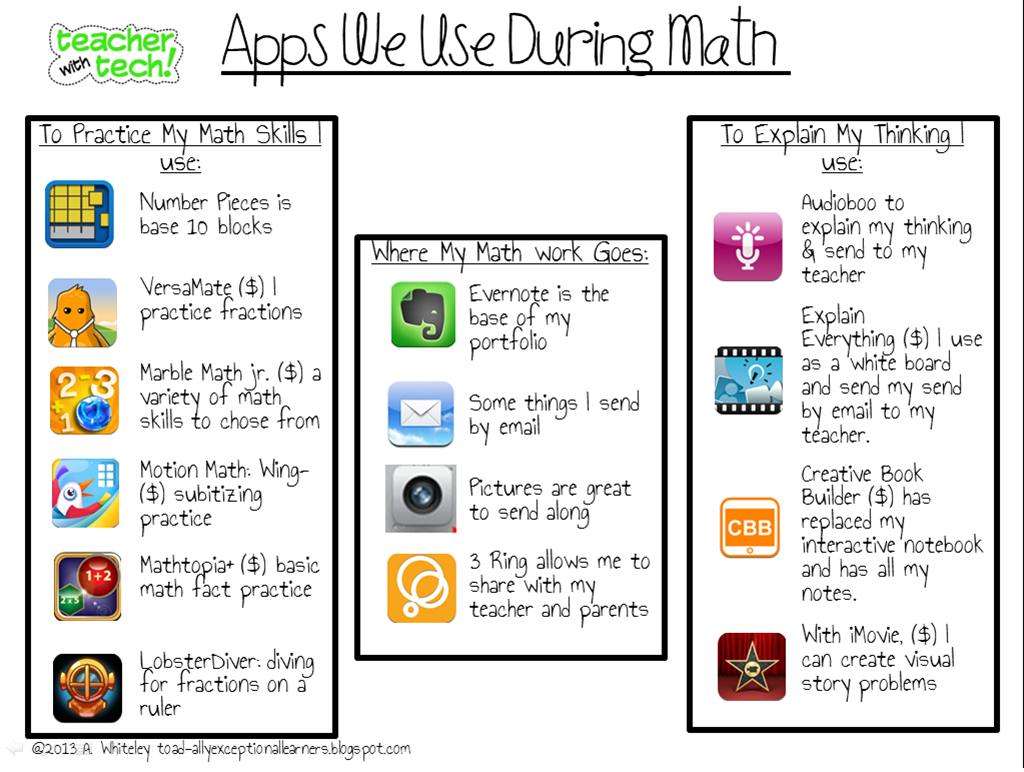

A visual tracker is an invaluable tool for staying motivated and organized. A printable worksheet allows you to see your progress at a glance, reinforcing your commitment to the debt snowball method.Here is a design for a printable debt snowball tracker:

Debt Snowball Tracker

| Debt Name | Starting Balance | Current Balance | Minimum Payment | Extra Payment | Total Payment This Month | Date Paid | Status (Paid/Remaining) |

|---|---|---|---|---|---|---|---|

| Credit Card A | $2,500 | [Input Current Balance] | [Input Minimum Payment] | [Input Extra Payment] | [Input Total Payment] | [Input Date] | [Paid/Remaining] |

| Personal Loan B | $7,000 | [Input Current Balance] | [Input Minimum Payment] | $0 (until previous debt paid) | [Input Total Payment] | [Input Date] | [Paid/Remaining] |

| Student Loan C | $15,000 | [Input Current Balance] | [Input Minimum Payment] | $0 (until previous debt paid) | [Input Total Payment] | [Input Date] | [Paid/Remaining] |

| Car Loan D | $10,000 | [Input Current Balance] | [Input Minimum Payment] | $0 (until previous debt paid) | [Input Total Payment] | [Input Date] | [Paid/Remaining] |

Summary Section:

- Total Debt Paid This Month: [Sum of Total Payments]

- Total Debt Remaining: [Sum of Current Balances]

- Number of Debts Paid Off: [Count of Paid Debts]

This worksheet can be printed monthly, and the current balances updated after each payment. This visual representation of progress can be highly motivating.

Creating a Template for a Budget that Allocates Extra Funds Towards Debt Repayment

A successful debt snowball requires a budget that prioritizes debt repayment. This involves identifying areas where expenses can be reduced to free up funds for extra payments. A clear budget template helps in allocating these resources effectively.Here is a sample budget template focused on debt repayment:

Monthly Budget for Debt Snowball

Income:

- Net Salary: $[Amount]

- Other Income: $[Amount]

- Total Income: $[Total Income]

Expenses:

- Housing (Rent/Mortgage, Utilities): $[Amount]

- Transportation (Car Payment, Gas, Insurance): $[Amount]

- Food (Groceries, Dining Out): $[Amount]

- Debt Minimum Payments: $[Sum of Minimum Payments]

- Personal Care: $[Amount]

- Entertainment: $[Amount]

- Miscellaneous: $[Amount]

- Total Expenses: $[Total Expenses]

Debt Snowball Allocation:

- Extra Payment Towards Debt: $[Amount – e.g., $200]

Remaining Funds:

- Total Income – Total Expenses – Extra Payment = $[Remaining Funds]

This template helps visualize where money is going and identify potential savings. The goal is to minimize the “Expenses” category as much as possible to maximize the “Extra Payment Towards Debt” amount. For instance, reducing dining out or entertainment costs can directly translate into more funds for debt payoff.

Demonstrating How to Handle Unexpected Income or Windfalls within the Snowball Method

Unexpected income, such as a tax refund, bonus, or gift, can significantly accelerate your debt snowball progress. The most effective way to utilize these windfalls is to apply them directly to your smallest outstanding debt.Consider Sarah again. If she receives a $1,000 tax refund while she is still aggressively paying off Credit Card A ($2,500 balance), she should apply the entire $1,000 to Credit Card A.

Applying unexpected income directly to the smallest debt on your snowball accelerates its payoff and increases the snowball’s momentum sooner.

This immediate application has a dual benefit:

- It drastically reduces the balance of the smallest debt, leading to its quicker elimination.

- Once that debt is paid off, the extra payment amount (including the portion of the windfall that was applied) is then added to the next debt, making the snowball larger and faster.

For example, if Sarah’s $1,000 windfall was applied to Credit Card A, and she had already paid off $500 of it, the new balance would be $1,000. This means Credit Card A would be paid off much sooner. The full amount she was paying towards Credit Card A, now including the portion of the windfall, would then be directed towards Personal Loan B, further speeding up her debt-free journey.

This strategic use of unexpected funds is a powerful way to supercharge the debt snowball method.

Common Challenges and Solutions in Debt Snowball

Embarking on the debt snowball journey is a commendable step towards financial freedom, but like any significant endeavor, it can present its share of hurdles. Understanding these potential challenges and having a robust set of solutions at your disposal will significantly increase your chances of success and help you maintain momentum throughout the process. This section will equip you with strategies to navigate common obstacles, negotiate effectively with creditors, and adapt your plan as life circumstances evolve.

Strategies for Staying Motivated

Sustaining motivation is crucial for the long haul of debt repayment. The debt snowball method, with its focus on small wins, is inherently motivating, but dips in enthusiasm are natural. Developing a proactive approach to maintaining your drive will ensure you stay on track.Here are several effective strategies to keep your motivation high:

- Celebrate Small Victories: Acknowledge and reward yourself each time you pay off a debt, no matter how small. This reinforces the positive progress you are making.

- Visualize Your Goal: Regularly remind yourself of the freedom and financial security that becoming debt-free will bring. Create a vision board or write down your goals to keep them top of mind.

- Track Your Progress Visually: Use charts, graphs, or a physical representation of your snowball to see how far you’ve come and how much further you need to go. Seeing the snowball grow can be incredibly encouraging.

- Find an Accountability Partner: Share your goals with a trusted friend, family member, or join an online community. Knowing someone is cheering you on or that you need to report your progress can be a powerful motivator.

- Educate Yourself Continuously: Continue learning about personal finance and debt management. The more you understand, the more empowered you will feel, which fuels motivation.

- Focus on the “Why”: Revisit the reasons you started this journey. Was it to buy a home, travel, reduce stress, or provide a better future for your family? Keeping your core motivation in focus is key.

Potential Pitfalls Derailing Debt Snowball Progress

While the debt snowball method is effective, certain pitfalls can easily derail your progress if not anticipated and addressed. Being aware of these common traps allows you to prepare and steer clear of them.Common pitfalls include:

- Lifestyle Inflation: As you start making extra payments, it can be tempting to increase your spending or take on new debt, negating your efforts.

- Discouragement from Slow Progress: If you have large debts, it can take time to see the initial debts paid off, leading to frustration.

- Unexpected Expenses: Without an emergency fund, a sudden car repair or medical bill can force you to pause or even reverse your debt repayment efforts.

- Lack of a Budget: Not having a clear understanding of where your money is going makes it difficult to identify funds for extra debt payments.

- Giving Up Too Soon: The debt snowball requires discipline and persistence. Quitting before significant progress is made means you miss out on the long-term benefits.

Negotiating with Creditors

When facing significant debt, proactive communication with your creditors can often lead to more manageable repayment terms. While not all creditors are willing to negotiate, it’s a worthwhile avenue to explore before reaching a crisis point.Tips for negotiating with creditors:

- Be Prepared: Before contacting your creditors, gather all relevant account information, including balances, interest rates, and payment history. Understand your financial situation thoroughly.

- Be Honest and Polite: Explain your situation clearly and honestly. A polite and respectful demeanor can go a long way in fostering a positive interaction.

- Focus on Your Desire to Pay: Emphasize that you are committed to repaying your debt and are seeking a mutually agreeable solution.

- Propose a Specific Solution: Instead of just stating you can’t pay, suggest a specific plan. This could include a lower interest rate, a reduced monthly payment, or a temporary deferment.

- Ask About Hardship Programs: Many lenders have hardship programs designed for individuals facing financial difficulties. Inquire about these options.

- Get Everything in Writing: Once an agreement is reached, ensure all terms are documented in writing by the creditor before you make any changes to your payments.

Adjusting the Debt Snowball Method for Income or Expense Changes

Life is dynamic, and your income or expenses may change significantly during your debt repayment journey. The beauty of the debt snowball method lies in its adaptability. Being prepared to adjust your plan ensures you can continue making progress even when circumstances shift.When your income increases, you have a wonderful opportunity to accelerate your debt payoff.

- Allocate Increased Income to the Snowball: The most straightforward approach is to add any extra income directly to your debt snowball payments. This could be a raise, a bonus, or income from a side hustle.

- Re-evaluate Your Budget: Even with increased income, it’s wise to review your budget to ensure your spending hasn’t crept up. Prioritize debt repayment over discretionary spending.

- Consider a “Mini-Snowball” for Bonuses: If you receive a bonus, consider using a portion of it to pay off a small debt entirely, providing a significant motivational boost.

Conversely, if your expenses increase or your income decreases, you may need to adjust your snowball strategy to remain sustainable.

- Temporarily Reduce Extra Payments: If faced with unexpected significant expenses or a loss of income, it may be necessary to temporarily reduce the extra amount you are paying towards your debts. Focus on making at least the minimum payments on all debts to avoid late fees and negative credit impacts.

- Re-examine Your Budget for Cuts: Scrutinize your budget for areas where expenses can be reduced. This might involve cutting back on non-essential spending, finding cheaper alternatives, or delaying certain financial goals.

- Build or Replenish an Emergency Fund: If your reduced income or increased expenses have depleted your emergency fund, prioritize rebuilding it to at least a small amount. This will prevent future unexpected costs from derailing your debt snowball efforts.

- Communicate with Creditors: As mentioned earlier, if you anticipate difficulty making payments, proactively contact your creditors to discuss potential temporary adjustments or hardship options.

- Reassess Your Snowball Order: In extreme situations, you might need to temporarily pause aggressive snowball payments to cover essential living expenses. Once your financial situation stabilizes, you can resume and potentially even increase your snowball payments.

Advanced Strategies for Accelerating Debt Snowball and Credit Repair

While the core Debt Snowball method is highly effective, incorporating advanced strategies can significantly expedite your debt repayment journey and simultaneously boost your creditworthiness. These techniques focus on optimizing your repayment strategy, leveraging financial tools, and proactively managing your financial health.

Debt Snowball vs. Debt Avalanche for Repayment Speed

Understanding the nuances between the Debt Snowball and Debt Avalanche methods is crucial for selecting the most efficient path to debt freedom, particularly when speed is a priority. Both methods aim to eliminate debt, but their prioritization differs, leading to varied psychological and financial outcomes.The Debt Snowball method prioritizes paying off debts from smallest balance to largest, regardless of interest rate.

This approach provides psychological wins as smaller debts are eliminated quickly, which can be highly motivating.The Debt Avalanche method, conversely, prioritizes paying off debts with the highest interest rate first, while making minimum payments on others. This strategy is mathematically superior in terms of minimizing the total interest paid over time and therefore, can lead to faster overall debt repayment if strictly adhered to.For accelerating debt repayment speed, the Debt Avalanche method typically results in paying off debt faster and saving more money on interest.

However, the motivational aspect of the Debt Snowball can be a powerful driver for individuals who need to see progress to stay engaged. The ideal approach for some may even involve a hybrid strategy, or sticking with the Debt Snowball if that’s what keeps them motivated.

Leveraging Balance Transfers to Accelerate Debt Payoff

Balance transfers can be a powerful tool to accelerate debt payoff, especially when combined with the Debt Snowball method, by reducing or eliminating interest charges on existing debts. This strategy involves moving high-interest debt from one or more credit cards to a new card that offers a promotional 0% Annual Percentage Rate (APR) for a set period.When considering a balance transfer, it is important to:

- Understand the promotional period: Know exactly how long the 0% APR will last.

- Factor in balance transfer fees: Most cards charge a fee, typically 3-5% of the transferred amount.

- Have a plan for repayment: Aim to pay off the entire transferred balance before the promotional period ends to avoid high interest rates.

- Check the post-promotional APR: Be aware of the regular interest rate that will apply after the introductory period.

For example, if you have a credit card with a $5,000 balance at 20% APR and a $3,000 balance at 18% APR, and you transfer them to a card with a 0% introductory APR for 15 months with a 3% balance transfer fee. The fee would be $240 (3% of $8,000). However, during those 15 months, you would save potentially thousands of dollars in interest, allowing more of your payments to go directly towards the principal.

This can significantly accelerate your debt snowball by freeing up funds that would otherwise be lost to interest.

Methods for Increasing Income to Free Up More Funds for Debt Reduction

Increasing your income is a direct and highly effective way to accelerate debt reduction. By bringing in more money, you can allocate a larger portion of your budget towards debt payments, thereby shortening the repayment timeline.Here are several methods to consider for increasing your income:

- Side Hustles: Engage in freelance work, consulting, delivery services, or any skill-based service that can be performed in your spare time. Platforms like Upwork, Fiverr, or DoorDash can provide opportunities.

- Selling Unused Items: Declutter your home and sell items you no longer need on platforms like eBay, Facebook Marketplace, or Poshmark.

- Negotiating a Raise: If you are employed, prepare a strong case for a salary increase based on your performance, contributions, and market research.

- Part-Time Job: Consider taking on a part-time job in addition to your primary employment, especially if it offers flexible hours.

- Monetizing Hobbies: Turn a passion or hobby into a source of income, such as selling crafts, teaching music lessons, or offering photography services.

For instance, consistently earning an extra $500 per month through a side hustle, and dedicating that entire amount to your debt snowball, can shave months or even years off your repayment plan, depending on the total debt amount.

Monitoring Credit Reports for Accuracy and Areas for Improvement

Regularly monitoring your credit reports is a critical component of credit repair, going beyond just debt payoff. It ensures the accuracy of the information being reported and identifies opportunities to enhance your credit score.Here’s how to effectively monitor your credit reports:

- Obtain Free Credit Reports: You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com. It’s advisable to stagger these requests throughout the year to monitor your credit continuously.

- Review for Errors: Carefully examine each report for any inaccuracies, such as incorrect personal information, accounts you don’t recognize, or incorrect payment history.

- Dispute Inaccuracies: If you find errors, dispute them immediately with the credit bureau and the creditor involved. This process is crucial for correcting misinformation that could be negatively impacting your score.

- Identify Areas for Improvement: Beyond just debt reduction, look for opportunities to improve your credit utilization ratio, ensure on-time payments are reflected, and check for any negative items that are nearing their reporting limit.

For example, discovering an erroneous late payment mark on your report and successfully disputing it can lead to a significant increase in your credit score. Similarly, as you pay down debts, monitor your credit utilization ratio on your remaining credit cards. Keeping this ratio below 30% is generally recommended for a healthy credit score.

Visualizing Debt Snowball Progress and Credit Impact

Witnessing the tangible results of your debt reduction efforts is a powerful motivator. The debt snowball method, when visualized, transforms abstract financial goals into a clear, upward trajectory of financial well-being and improved creditworthiness. This section will guide you through understanding and tracking your progress, making the journey to financial freedom both clearer and more rewarding.The beauty of the debt snowball lies in its momentum.

As you consistently apply the method, you’ll not only see your debts shrink but also observe a positive ripple effect on your credit score. This visual feedback loop is crucial for maintaining discipline and celebrating milestones along the way.

Debt Reduction Over Time Narrative

Imagine a cascading waterfall. At the top, you have the full weight of your outstanding debts. As you begin the debt snowball, each small payment is like a droplet adding to a stream. Initially, the stream is small, but as you gain momentum, paying off the smallest debts first and rolling that payment into the next, the stream grows into a powerful river.

This river steadily erodes the base of the waterfall, representing your total debt, until eventually, the entire waterfall has diminished into a gentle flow. This visual progression highlights how consistent, albeit initially small, efforts can lead to significant debt reduction over time.

Chart Elements for Debt Decrease and Credit Score Rise

A comprehensive chart illustrating the debt snowball method’s impact would effectively merge two key metrics: total debt reduction and credit score improvement. The horizontal axis would represent time, perhaps in months or quarters, showing the progression of your financial journey. The vertical axis would have two distinct scales. One scale would track the total outstanding debt, starting at its highest point and visibly decreasing over time, ideally represented by a downward-sloping line or bar graph.

The second scale would track your credit score, starting at its initial point and showing a corresponding upward trend as debt is paid down, represented by an upward-sloping line or bar graph. Key milestones, such as the complete elimination of a specific debt or a significant jump in credit score, would be clearly marked.

The Compounding Effect of Small Debt Payments

The compounding effect in the debt snowball method can be understood through the analogy of rolling a snowball down a hill. When you start, the snowball is small, and it picks up only a little snow with each rotation. However, as it rolls, it gathers more snow, becoming larger and heavier. This larger snowball then picks up even more snow with each subsequent rotation, accelerating its growth.

Similarly, in the debt snowball, the payment applied to the smallest debt is the initial small rotation. Once that debt is paid off, the entire payment amount, including the extra amount you were paying, is rolled over to the next smallest debt. This combined payment is like the larger snowball, allowing you to tackle the next debt faster and with greater force, leading to a quicker overall payoff.

Illustrative Scenarios: Before and After Credit Profiles

To truly grasp the transformative power of the debt snowball, consider these illustrative scenarios:

Scenario 1: Sarah, the Young Professional

Before Debt Snowball:

Total Debt

$25,000 (Student loans: $15,000, Credit card 1: $5,000, Credit card 2: $5,000)

Credit Score

620

Monthly Debt Payment Budget

$500

Credit Utilization

High on both credit cards.

Credit Mix

Primarily credit cards and one installment loan (student loan).Sarah felt overwhelmed by her debt. She was making minimum payments, and her credit score was stagnant, hindering her ability to get a better car loan. She decided to implement the debt snowball, targeting her smallest debt (Credit Card 2 for $5,000) first, while making minimum payments on others. After 18 Months of Debt Snowball:

Total Debt Remaining

$12,000 (Student loans: $15,000 – partially paid, Credit card 1: $0, Credit card 2: $0)

Credit Score

710

Credit Utilization

Significantly reduced.

Credit Mix

Improved due to paying off a credit card.By focusing on her smallest debts first, Sarah paid off Credit Card 2 in 10 months, then rolled that payment into Credit Card 1, paying it off in the subsequent 8 months. This accelerated payoff, combined with reduced credit utilization, led to a substantial credit score increase, opening doors for better financial opportunities.

Scenario 2: Mark and Emily, the Young Family

Before Debt Snowball:

Total Debt

$40,000 (Car loan: $15,000, Personal loan: $10,000, Credit card 1: $8,000, Credit card 2: $7,000)

Credit Score

650

Monthly Debt Payment Budget

$800

Credit Utilization

Moderate to high on credit cards.

Credit Mix

Installment loans and credit cards.Mark and Emily wanted to buy a home but were held back by their debt and credit score. They decided to tackle their debts using the snowball method, prioritizing the smallest balance first (Credit Card 2 for $7,000). After 24 Months of Debt Snowball:

Total Debt Remaining

$22,000 (Car loan: $15,000 – partially paid, Personal loan: $0, Credit card 1: $0, Credit card 2: $0)

Credit Score

730

Credit Utilization

Significantly reduced.

Credit Mix

Improved.After paying off Credit Card 2 in 12 months, they rolled that payment into Credit Card 1, clearing it in the next 12 months. The combined effect of eliminating two credit cards, reducing overall debt, and improving credit utilization dramatically boosted their creditworthiness, bringing them closer to their homeownership goal.

Closure

Embarking on the debt snowball journey is more than just a financial strategy; it’s a transformative path toward improved creditworthiness and lasting financial well-being. By diligently applying these principles, staying motivated through common challenges, and even exploring advanced acceleration techniques, you are actively shaping a brighter financial future. Witnessing your debt diminish and your credit score rise is a testament to your commitment and a powerful motivator for continued success.